Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

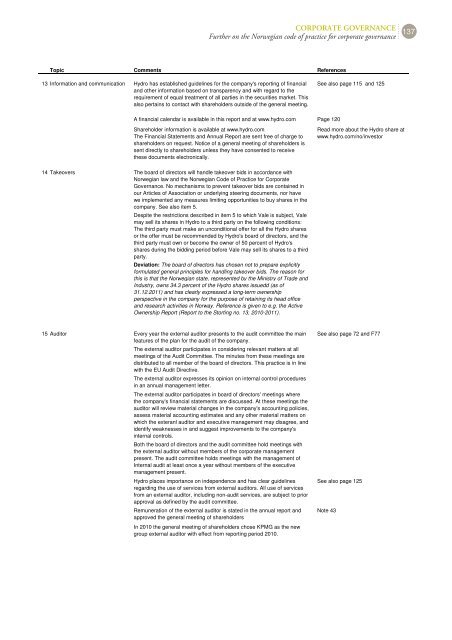

Topic Comments References<br />

13 Information and communication <strong>Hydro</strong> has established guidelines for the company's reporting of financial<br />

and other information based on transparency and with regard to the<br />

requirement of equal treatment of all parties in the securities market. This<br />

also pertains to contact with shareholders outside of the general meeting.<br />

A financial calendar is available in this report and at www.hydro.com Page 120<br />

Shareholder information is available at www.hydro.com<br />

The Financial Statements and <strong>Annual</strong> <strong>Report</strong> are sent free of charge to<br />

shareholders on request. Notice of a general meeting of shareholders is<br />

sent directly to shareholders unless they have consented to receive<br />

these documents electronically.<br />

14 Takeovers The board of directors will handle takeover bids in accordance with<br />

Norwegian law and the Norwegian Code of Practice for Corporate<br />

Governance. No mechanisms to prevent takeover bids are contained in<br />

our Articles of Association or underlying steering documents, nor have<br />

we implemented any measures limiting opportunities to buy shares in the<br />

company. See also item 5.<br />

Despite the restrictions described in item 5 to which Vale is subject, Vale<br />

may sell its shares in <strong>Hydro</strong> to a third party on the following conditions:<br />

The third party must make an unconditional offer for all the <strong>Hydro</strong> shares<br />

or the offer must be recommended by <strong>Hydro</strong>'s board of directors, and the<br />

third party must own or become the owner of 50 percent of <strong>Hydro</strong>'s<br />

shares during the bidding period before Vale may sell its shares to a third<br />

party.<br />

Deviation: The board of directors has chosen not to prepare explicitly<br />

formulated general principles for handling takeover bids. The reason for<br />

this is that the Norwegian state, represented by the Ministry of Trade and<br />

Industry, owns 34.3 percent of the <strong>Hydro</strong> shares issuedd (as of<br />

31.12.2011) and has clearly expressed a long-term ownership<br />

perspective in the company for the purpose of retaining its head office<br />

and research activities in Norway. Reference is given to e.g. the Active<br />

Ownership <strong>Report</strong> (<strong>Report</strong> to the Storting no. 13, 2010-2011).<br />

15 Auditor Every year the external auditor presents to the audit committee the main<br />

features of the plan for the audit of the company.<br />

CORPORATE GOVERNANCE<br />

Further on the Norwegian code of practice for corporate governance 137<br />

The external auditor participates in considering relevant matters at all<br />

meetings of the Audit Committee. The minutes from these meetings are<br />

distributed to all member of the board of directors. This practice is in line<br />

with the EU Audit Directive.<br />

The external auditor expresses its opinion on internal control procedures<br />

in an annual management letter.<br />

The external auditor participates in board of directors' meetings where<br />

the company's financial statements are discussed. At these meetings the<br />

auditor will review material changes in the company's accounting policies,<br />

assess material accounting estimates and any other material matters on<br />

which the exteranl auditor and executive management may disagree, and<br />

identify weaknesses in and suggest improvements to the company's<br />

internal controls.<br />

Both the board of directors and the audit committee hold meetings with<br />

the external auditor without members of the corporate management<br />

present. The audit committee holds meetings with the management of<br />

Internal audit at least once a year without members of the executive<br />

management present.<br />

<strong>Hydro</strong> places importance on independence and has clear guidelines<br />

regarding the use of services from external auditors. All use of services<br />

from an external auditor, including non-audit services, are subject to prior<br />

approval as defined by the audit committee.<br />

Remuneration of the external auditor is stated in the annual report and<br />

approved the general meeting of shareholders<br />

In 2010 the general meeting of shareholders chose KPMG as the new<br />

group external auditor with effect from reporting period 2010.<br />

See also page 115 and 125<br />

Read more about the <strong>Hydro</strong> share at<br />

www.hydro.com/no/investor<br />

See also page 72 and F77<br />

See also page 125<br />

Note 43