Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Active risk management<br />

We have developed expertise within our sourcing and trading<br />

operations to enhance the value of our commercial portfolio,<br />

using strategies aimed at reducing the exposure of our margins<br />

to changes in the LME commodity prices and currency rates.<br />

We will continue to leverage this expertise by developing and<br />

executing strategies to hedge such risk exposures within our<br />

upstream and downstream businesses, mainly resulting from<br />

time lags between our manufacturing process and the pricing<br />

of products to our customers.<br />

Operations<br />

Metal Markets includes all sales and distribution activities<br />

relating to products from our primary metal plants, our standalone<br />

remelters and our high purity aluminium business. We<br />

operate nine remelters, which recycle scrap as well as standard<br />

ingot 1) into new products. We also market metal products<br />

from our part-owned smelters and third parties and engage in<br />

other sourcing and trading activities, including hedging activities<br />

on behalf of all business areas in <strong>Hydro</strong>.<br />

Cost and revenue drivers<br />

Our results are mainly impacted by the operating results of our<br />

stand-alone remelters and high purity aluminium business,<br />

margins on sales of third party products and results from physical<br />

and LME trading activities.<br />

Revenues for our stand-alone remelters are influenced by volumes<br />

and product premiums over LME. Costs are driven by<br />

the cost of scrap and standard ingot premiums over LME,<br />

freight costs to customers and operational costs including<br />

energy consumption and prices.<br />

Our results can be heavily influenced by currency effects 2) and<br />

ingot inventory valuation effects 3)<br />

Competitive strengths<br />

• Leading worldwide supplier of extrusion ingot, sheet ingot,<br />

wire rod and foundry alloys<br />

• Extensive multi-sourcing system including broad network<br />

of primary casthouses, stand-alone remelters, and partly<br />

owned primary sources<br />

• Flexible sourcing system enabling significant, rapid and<br />

cost effective volume adjustments<br />

• Growing market position in US and Asia through Qatalum<br />

volumes<br />

• Commercial expertise and risk management competence<br />

enabling us to secure manufacturing margins<br />

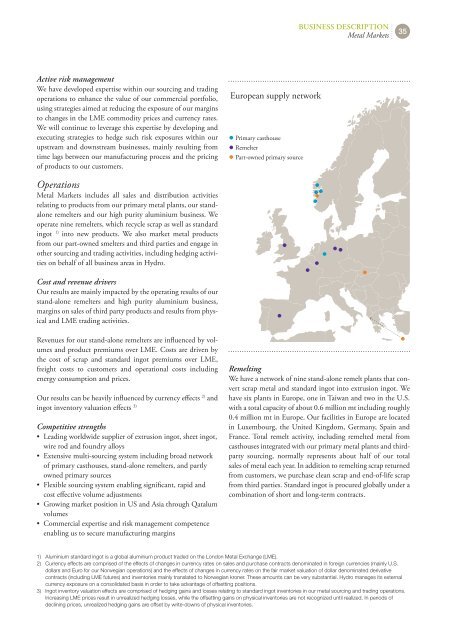

European supply network<br />

Primary casthouse<br />

Remelter<br />

Part-owned primary source<br />

BusIness DesCrIptIon<br />

Metal Markets<br />

35<br />

Remelting<br />

We have a network of nine stand-alone remelt plants that convert<br />

scrap metal and standard ingot into extrusion ingot. We<br />

have six plants in Europe, one in Taiwan and two in the U.S.<br />

with a total capacity of about 0.6 million mt including roughly<br />

0.4 million mt in Europe. Our facilities in Europe are located<br />

in Luxembourg, the United Kingdom, Germany, Spain and<br />

france. Total remelt activity, including remelted metal from<br />

casthouses integrated with our primary metal plants and thirdparty<br />

sourcing, normally represents about half of our total<br />

sales of metal each year. In addition to remelting scrap returned<br />

from customers, we purchase clean scrap and end-of-life scrap<br />

from third parties. Standard ingot is procured globally under a<br />

combination of short and long-term contracts.<br />

1) Aluminium standard ingot is a global aluminium product traded on the London Metal Exchange (LME).<br />

2) Currency effects are comprised of the effects of changes in currency rates on sales and purchase contracts denominated in foreign currencies (mainly U.S.<br />

dollars and Euro for our Norwegian operations) and the effects of changes in currency rates on the fair market valuation of dollar denominated derivative<br />

contracts (including LME futures) and inventories mainly translated to Norwegian kroner. These amounts can be very substantial. <strong>Hydro</strong> manages its external<br />

currency exposure on a consolidated basis in order to take advantage of offsetting positions.<br />

3) Ingot inventory valuation effects are comprised of hedging gains and losses relating to standard ingot inventories in our metal sourcing and trading operations.<br />

Increasing LME prices result in unrealized hedging losses, while the offsetting gains on physical inventories are not recognized until realized. In periods of<br />

declining prices, unrealized hedging gains are offset by write-downs of physical inventories.