Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

24<br />

BusIness DesCrIptIon<br />

Business and operating information<br />

At the same time, <strong>Hydro</strong> invested roughly NOK 18 billion in<br />

its aluminium and energy businesses in Norway, including<br />

NOK 11 billion in its Norwegian smelter system, NOK 2.2<br />

billion upgrading and expanding its hydropower production<br />

operations and NOK 3 billion in research, development and<br />

production support relating to both its upstream and downstream<br />

aluminium operations. As a result, annual electrolysis<br />

production in Norway increased from 760,000 mt to about<br />

900,000 mt, including the shutdown of roughly 250,000 mt<br />

of older, higher cost and higher emission capacity.<br />

Transforming transaction<br />

In 2011, <strong>Hydro</strong> transformed its business through the acquisition<br />

of the aluminium assets of vale SA, securing its position<br />

in bauxite and alumina and lifting the company to the top tier<br />

in the aluminium industry. Combining vale Aluminium with<br />

<strong>Hydro</strong> has resulted in a stronger company, fully integrated<br />

into bauxite, with a long alumina position and a preferred<br />

standing in a more consolidated market place.<br />

for further information, see www.hydro.com/about hydro/<br />

our history<br />

Business and operating information<br />

The following section includes a description of the industry<br />

developments impacting our business, our strategies for developing<br />

and exploiting our competitive strengths, key performance<br />

targets, including results, and a description of operations<br />

for each of our business areas including key revenue and cost<br />

drivers.<br />

See section – financial and operating review – later in this<br />

report for comparative production and sales volume information<br />

for our different business areas.<br />

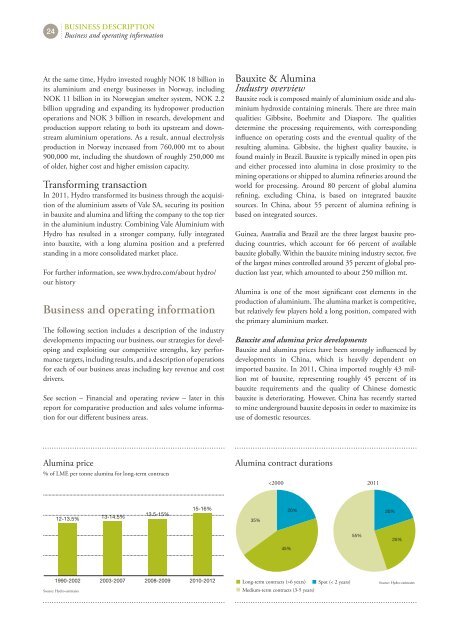

Alumina price<br />

% of LME per tonne alumina for long-term contracts<br />

12-13.5%<br />

1990-2002<br />

Source: <strong>Hydro</strong> estimates<br />

13-14.5%<br />

2003-2007<br />

13.5-15%<br />

2008-2009<br />

15-16%<br />

2010-2012<br />

Bauxite & Alumina<br />

Industry overview<br />

Bauxite rock is composed mainly of aluminium oxide and aluminium<br />

hydroxide containing minerals. There are three main<br />

qualities: Gibbsite, Boehmite and Diaspore. The qualities<br />

determine the processing requirements, with corresponding<br />

influence on operating costs and the eventual quality of the<br />

resulting alumina. Gibbsite, the highest quality bauxite, is<br />

found mainly in Brazil. Bauxite is typically mined in open pits<br />

and either processed into alumina in close proximity to the<br />

mining operations or shipped to alumina refineries around the<br />

world for processing. Around 80 percent of global alumina<br />

refining, excluding China, is based on integrated bauxite<br />

sources. In China, about 55 percent of alumina refining is<br />

based on integrated sources.<br />

Guinea, Australia and Brazil are the three largest bauxite producing<br />

countries, which account for 66 percent of available<br />

bauxite globally. Within the bauxite mining industry sector, five<br />

of the largest mines controlled around 35 percent of global production<br />

last year, which amounted to about 250 million mt.<br />

Alumina is one of the most significant cost elements in the<br />

production of aluminium. The alumina market is competitive,<br />

but relatively few players hold a long position, compared with<br />

the primary aluminium market.<br />

Bauxite and alumina price developments<br />

Bauxite and alumina prices have been strongly influenced by<br />

developments in China, which is heavily dependent on<br />

imported bauxite. In 2011, China imported roughly 43 million<br />

mt of bauxite, representing roughly 45 percent of its<br />

bauxite requirements and the quality of Chinese domestic<br />

bauxite is deteriorating. However, China has recently started<br />

to mine underground bauxite deposits in order to maximize its<br />

use of domestic resources.<br />

Alumina contract durations<br />

35%<br />

6 years) Spot (< 2 years)<br />

Medium-term contracts (3-5 years)<br />

55%<br />

20%<br />

25%<br />

Source: <strong>Hydro</strong> estimates