Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F34<br />

FINANCIAL STATEMENTS<br />

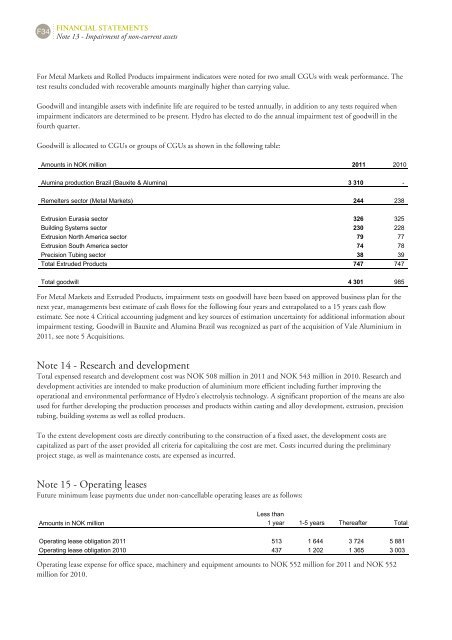

Note 13 - Impairment of non-current assets<br />

For Metal Markets and Rolled Products impairment indicators were noted for two small CGUs with weak performance. The<br />

test results concluded with recoverable amounts marginally higher than carrying value.<br />

Goodwill and intangible assets with indefinite life are required to be tested annually, in addition to any tests required when<br />

impairment indicators are determined to be present. <strong>Hydro</strong> has elected to do the annual impairment test of goodwill in the<br />

fourth quarter.<br />

Goodwill is allocated to CGUs or groups of CGUs as shown in the following table:<br />

Amounts in NOK million 2011 2010<br />

Alumina production Brazil (Bauxite & Alumina) 3 310 <br />

Remelters sector (Metal Markets) 244 238<br />

Extrusion Eurasia sector 326 325<br />

Building Systems sector 230 228<br />

Extrusion North America sector 79 77<br />

Extrusion South America sector 74 78<br />

Precision Tubing sector 38 39<br />

Total Extruded Products 747 747<br />

Total goodwill 4 301 985<br />

For Metal Markets and Extruded Products, impairment tests on goodwill have been based on approved business plan for the<br />

next year, managements best estimate of cash flows for the following four years and extrapolated to a 15 years cash flow<br />

estimate. See note 4 Critical accounting judgment and key sources of estimation uncertainty for additional information about<br />

impairment testing. Goodwill in Bauxite and Alumina Brazil was recognized as part of the acquisition of Vale Aluminium in<br />

2011, see note 5 Acquisitions.<br />

Note 14 - Research and development<br />

Total expensed research and development cost was NOK 508 million in 2011 and NOK 543 million in 2010. Research and<br />

development activities are intended to make production of aluminium more efficient including further improving the<br />

operational and environmental performance of <strong>Hydro</strong>'s electrolysis technology. A significant proportion of the means are also<br />

used for further developing the production processes and products within casting and alloy development, extrusion, precision<br />

tubing, building systems as well as rolled products.<br />

To the extent development costs are directly contributing to the construction of a fixed asset, the development costs are<br />

capitalized as part of the asset provided all criteria for capitalizing the cost are met. Costs incurred during the preliminary<br />

project stage, as well as maintenance costs, are expensed as incurred.<br />

Note 15 - Operating leases<br />

Future minimum lease payments due under non-cancellable operating leases are as follows:<br />

Less than<br />

Amounts in NOK million 1 year 15 years Thereafter Total<br />

Operating lease obligation 2011 513 1 644 3 724 5 881<br />

Operating lease obligation 2010 437 1 202 1 365 3 003<br />

Operating lease expense for office space, machinery and equipment amounts to NOK 552 million for 2011 and NOK 552<br />

million for 2010.