Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F56<br />

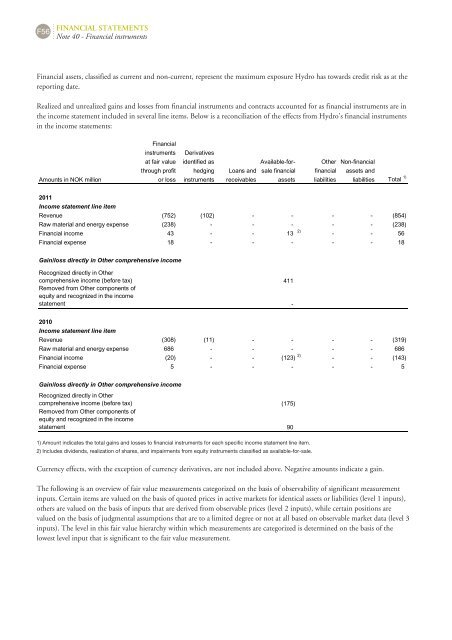

Financial assets, classified as current and non-current, represent the maximum exposure <strong>Hydro</strong> has towards credit risk as at the<br />

reporting date.<br />

Realized and unrealized gains and losses from financial instruments and contracts accounted for as financial instruments are in<br />

the income statement included in several line items. Below is a reconciliation of the effects from <strong>Hydro</strong>'s financial instruments<br />

in the income statements:<br />

Financial<br />

instruments Derivatives<br />

at fair value identified as Availablefor Other Nonfinancial<br />

through profit hedging Loans and sale financial financial assets and<br />

Amounts in NOK million or loss instruments receivables assets liabilities liabilities Total 1)<br />

2011<br />

Income statement line item<br />

Revenue (752) (102) (854)<br />

Raw material and energy expense (238) (238)<br />

Financial income 43 13 2)<br />

56<br />

Financial expense 18 18<br />

Gain/loss directly in Other comprehensive income<br />

Recognized directly in Other<br />

comprehensive income (before tax) 411<br />

Removed from Other components of<br />

equity and recognized in the income<br />

statement <br />

2010<br />

FINANCIAL STATEMENTS<br />

Note 40 - Financial instruments<br />

Income statement line item<br />

Revenue (308) (11) (319)<br />

Raw material and energy expense 686 686<br />

Financial income (20) (123) 2)<br />

(143)<br />

Financial expense 5 5<br />

Gain/loss directly in Other comprehensive income<br />

Recognized directly in Other<br />

comprehensive income (before tax) (175)<br />

Removed from Other components of<br />

equity and recognized in the income<br />

statement 90<br />

1) Amount indicates the total gains and losses to financial instruments for each specific income statement line item.<br />

2) Includes dividends, realization of shares, and impairments from equity instruments classified as available-for-sale.<br />

Currency effects, with the exception of currency derivatives, are not included above. Negative amounts indicate a gain.<br />

The following is an overview of fair value measurements categorized on the basis of observability of significant measurement<br />

inputs. Certain items are valued on the basis of quoted prices in active markets for identical assets or liabilities (level 1 inputs),<br />

others are valued on the basis of inputs that are derived from observable prices (level 2 inputs), while certain positions are<br />

valued on the basis of judgmental assumptions that are to a limited degree or not at all based on observable market data (level 3<br />

inputs). The level in this fair value hierarchy within which measurements are categorized is determined on the basis of the<br />

lowest level input that is significant to the fair value measurement.