Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

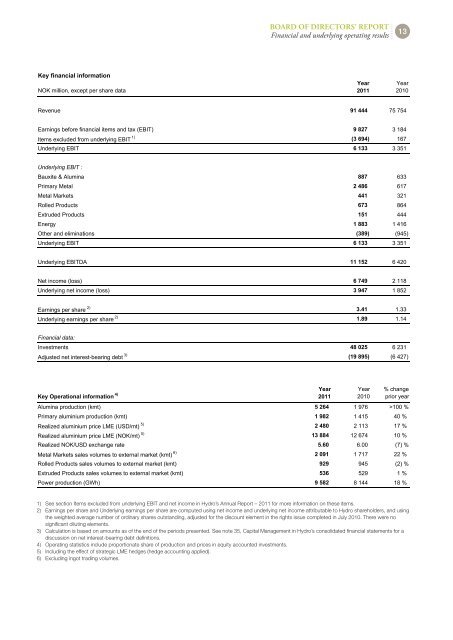

Key financial information<br />

NOK million, except per share data<br />

BoArD oF DIreCtors’ report<br />

Financial and underlying operating results<br />

Revenue 91 444 75 754<br />

Earnings before financial items and tax (EBIT) 9 827 3 184<br />

Items excluded from underlying EBIT 1) (3 694) 167<br />

Underlying EBIT 6 133 3 351<br />

Underlying EBIT :<br />

Bauxite & Alumina 887 633<br />

Primary Metal 2 486 617<br />

Metal Markets 441 321<br />

Rolled Products 673 864<br />

Extruded Products 151 444<br />

Energy 1 883 1 416<br />

Other and eliminations (389) (945)<br />

Underlying EBIT 6 133 3 351<br />

Underlying EBITDA 11 152 6 420<br />

Net income (loss) 6 749 2 118<br />

Underlying net income (loss) 3 947 1 852<br />

Earnings per share 2) 3.41 1.33<br />

Underlying earnings per share 2) 1.89 1.14<br />

Financial data:<br />

Investments 48 025 6 231<br />

Adjusted net interest-bearing debt 3) (19 895) (6 427)<br />

Key Operational information 4)<br />

1) See section Items excluded from underlying EBIT and net income in <strong>Hydro</strong>’s <strong>Annual</strong> <strong>Report</strong> – 2011 for more information on these items.<br />

2) Earnings per share and Underlying earnings per share are computed using net income and underlying net income attributable to <strong>Hydro</strong> shareholders, and using<br />

the weighted average number of ordinary shares outstanding, adjusted for the discount element in the rights issue completed in July 2010. There were no<br />

significant diluting elements.<br />

3) Calculation is based on amounts as of the end of the periods presented. See note 35, Capital Management in <strong>Hydro</strong>’s consolidated financial statements for a<br />

discussion on net interest-bearing debt definitions.<br />

4) Operating statistics include proportionate share of production and prices in equity accounted investments.<br />

5) Including the effect of strategic LME hedges (hedge accounting applied).<br />

6) Excluding ingot trading volumes.<br />

Year<br />

2011<br />

Year<br />

2011<br />

Year<br />

2010<br />

13<br />

Year<br />

2010<br />

% change<br />

prior year<br />

Alumina production (kmt) 5 264 1 976 >100 %<br />

Primary aluminium production (kmt) 1 982 1 415 40 %<br />

Realized aluminium price LME (USD/mt) 5) 2 480 2 113 17 %<br />

Realized aluminium price LME (NOK/mt) 5) 13 884 12 674 10 %<br />

Realized NOK/USD exchange rate 5.60 6.00 (7) %<br />

Metal Markets sales volumes to external market (kmt) 6) 2 091 1 717 22 %<br />

Rolled Products sales volumes to external market (kmt) 929 945 (2) %<br />

Extruded Products sales volumes to external market (kmt) 536 529 1 %<br />

Power production (GWh) 9 582 8 144 18 %