Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F50<br />

FINANCIAL STATEMENTS<br />

Note 34 - Shareholders' equity<br />

The number of shares for the year 2010 until the rights issue was completed on July 16, 2010 and all previous presented<br />

periods were adjusted for the implicit rebate in the subscription price compared to the theoretical ex-rights price at closing on<br />

June 24, 2010, i.e. immediately before trading of the subscription rights. The adjustment represented a factor of 1.055 to the<br />

number of outstanding shares for all periods.<br />

<strong>Hydro</strong>'s outstanding founder certificates and subscription certificates entitle the holders to participate in any share capital<br />

increase, provided that the capital increase is not made in order to allot shares to third parties as compensation for their transfer<br />

of assets to <strong>Hydro</strong>. These certificates represent dilutive elements for the earnings per share computation.<br />

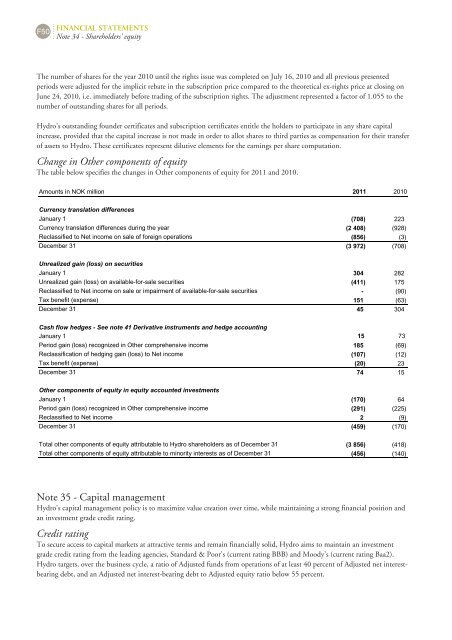

Change in Other components of equity<br />

The table below specifies the changes in Other components of equity for 2011 and 2010.<br />

Amounts in NOK million 2011 2010<br />

Currency translation differences<br />

January 1 (708) 223<br />

Currency translation differences during the year (2 408) (928)<br />

Reclassified to Net income on sale of foreign operations (856) (3)<br />

December 31 (3 972) (708)<br />

Unrealized gain (loss) on securities<br />

January 1 304 282<br />

Unrealized gain (loss) on availableforsale securities (411) 175<br />

Reclassified to Net income on sale or impairment of availableforsale securities (90)<br />

Tax benefit (expense) 151 (63)<br />

December 31 45 304<br />

Cash flow hedges See note 41 Derivative instruments and hedge accounting<br />

January 1 15 73<br />

Period gain (loss) recognized in Other comprehensive income 185 (69)<br />

Reclassification of hedging gain (loss) to Net income (107) (12)<br />

Tax benefit (expense) (20) 23<br />

December 31 74 15<br />

Other components of equity in equity accounted investments<br />

January 1 (170) 64<br />

Period gain (loss) recognized in Other comprehensive income (291) (225)<br />

Reclassified to Net income 2 (9)<br />

December 31 (459) (170)<br />

Total other components of equity attributable to <strong>Hydro</strong> shareholders as of December 31 (3 856) (418)<br />

Total other components of equity attributable to minority interests as of December 31 (456) (140)<br />

Note 35 - Capital management<br />

<strong>Hydro</strong>'s capital management policy is to maximize value creation over time, while maintaining a strong financial position and<br />

an investment grade credit rating.<br />

Credit rating<br />

To secure access to capital markets at attractive terms and remain financially solid, <strong>Hydro</strong> aims to maintain an investment<br />

grade credit rating from the leading agencies, Standard & Poor's (current rating BBB) and Moody's (current rating Baa2).<br />

<strong>Hydro</strong> targets, over the business cycle, a ratio of Adjusted funds from operations of at least 40 percent of Adjusted net interestbearing<br />

debt, and an Adjusted net interest-bearing debt to Adjusted equity ratio below 55 percent.