Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F58<br />

FINANCIAL STATEMENTS<br />

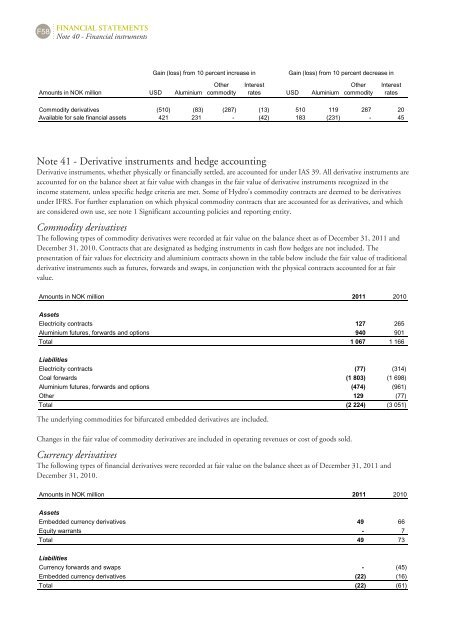

Note 40 - Financial instruments<br />

Amounts in NOK million USD Aluminium<br />

Gain (loss) from 10 percent increase in Gain (loss) from 10 percent decrease in<br />

Other<br />

commodity<br />

Interest<br />

rates USD Aluminium<br />

Other<br />

commodity<br />

Interest<br />

rates<br />

Commodity derivatives (510) (83) (287) (13) 510 119 287 20<br />

Available for sale financial assets 421 231 (42) 183 (231) 45<br />

Note 41 - Derivative instruments and hedge accounting<br />

Derivative instruments, whether physically or financially settled, are accounted for under IAS 39. All derivative instruments are<br />

accounted for on the balance sheet at fair value with changes in the fair value of derivative instruments recognized in the<br />

income statement, unless specific hedge criteria are met. Some of <strong>Hydro</strong>'s commodity contracts are deemed to be derivatives<br />

under IFRS. For further explanation on which physical commodity contracts that are accounted for as derivatives, and which<br />

are considered own use, see note 1 Significant accounting policies and reporting entity.<br />

Commodity derivatives<br />

The following types of commodity derivatives were recorded at fair value on the balance sheet as of December 31, 2011 and<br />

December 31, 2010. Contracts that are designated as hedging instruments in cash flow hedges are not included. The<br />

presentation of fair values for electricity and aluminium contracts shown in the table below include the fair value of traditional<br />

derivative instruments such as futures, forwards and swaps, in conjunction with the physical contracts accounted for at fair<br />

value.<br />

Amounts in NOK million 2011 2010<br />

Assets<br />

Electricity contracts 127 265<br />

Aluminium futures, forwards and options 940 901<br />

Total 1 067 1 166<br />

Liabilities<br />

Electricity contracts (77) (314)<br />

Coal forwards (1 803) (1 698)<br />

Aluminium futures, forwards and options (474) (961)<br />

Other 129 (77)<br />

Total (2 224) (3 051)<br />

The underlying commodities for bifurcated embedded derivatives are included.<br />

Changes in the fair value of commodity derivatives are included in operating revenues or cost of goods sold.<br />

Currency derivatives<br />

The following types of financial derivatives were recorded at fair value on the balance sheet as of December 31, 2011 and<br />

December 31, 2010.<br />

Amounts in NOK million 2011 2010<br />

Assets<br />

Embedded currency derivatives 49 66<br />

Equity warrants 7<br />

Total 49 73<br />

Liabilities<br />

Currency forwards and swaps (45)<br />

Embedded currency derivatives (22) (16)<br />

Total (22) (61)