Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

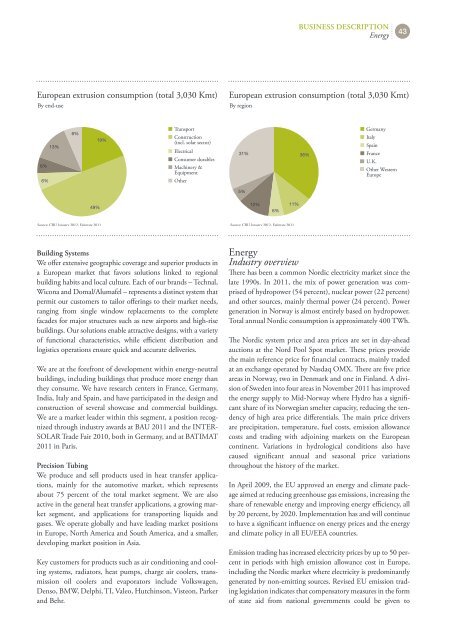

European extrusion consumption (total 3,030 Kmt)<br />

By end-use<br />

6%<br />

6%<br />

13%<br />

6%<br />

49%<br />

Source: CRU January 2012, Estimate 2011<br />

19%<br />

Transport<br />

Construction<br />

(incl. solar sector)<br />

Electrical<br />

Consumer durables<br />

Machinery &<br />

Equipment<br />

Other<br />

Building systems<br />

We offer extensive geographic coverage and superior products in<br />

a European market that favors solutions linked to regional<br />

building habits and local culture. Each of our brands – Technal,<br />

Wicona and Domal/Alumafel – represents a distinct system that<br />

permit our customers to tailor offerings to their market needs,<br />

ranging from single window replacements to the complete<br />

facades for major structures such as new airports and high-rise<br />

buildings. Our solutions enable attractive designs, with a variety<br />

of functional characteristics, while efficient distribution and<br />

logistics operations ensure quick and accurate deliveries.<br />

We are at the forefront of development within energy-neutral<br />

buildings, including buildings that produce more energy than<br />

they consume. We have research centers in france, Germany,<br />

India, Italy and Spain, and have participated in the design and<br />

construction of several showcase and commercial buildings.<br />

We are a market leader within this segment, a position recognized<br />

through industry awards at BAU 2011 and the INTER-<br />

SOLAR Trade fair 2010, both in Germany, and at BATIMAT<br />

2011 in Paris.<br />

precision tubing<br />

We produce and sell products used in heat transfer applications,<br />

mainly for the automotive market, which represents<br />

about 75 percent of the total market segment. We are also<br />

active in the general heat transfer applications, a growing market<br />

segment, and applications for transporting liquids and<br />

gases. We operate globally and have leading market positions<br />

in Europe, North America and South America, and a smaller,<br />

developing market position in Asia.<br />

Key customers for products such as air conditioning and cooling<br />

systems, radiators, heat pumps, charge air coolers, transmission<br />

oil coolers and evaporators include volkswagen,<br />

Denso, BMW, Delphi, TI, valeo, Hutchinson, visteon, Parker<br />

and Behr.<br />

BusIness DesCrIptIon<br />

Energy<br />

43<br />

European extrusion consumption (total 3,030 Kmt)<br />

By region<br />

31% 36%<br />

5%<br />

12% 11%<br />

6%<br />

Source: CRU January 2012, Estimate 2011<br />

Germany<br />

Italy<br />

Spain<br />

France<br />

U.K.<br />

Other Western<br />

Europe<br />

Energy<br />

Industry overview<br />

There has been a common Nordic electricity market since the<br />

late 1990s. In 2011, the mix of power generation was comprised<br />

of hydropower (54 percent), nuclear power (22 percent)<br />

and other sources, mainly thermal power (24 percent). Power<br />

generation in Norway is almost entirely based on hydropower.<br />

Total annual Nordic consumption is approximately 400 TWh.<br />

The Nordic system price and area prices are set in day-ahead<br />

auctions at the Nord Pool Spot market. These prices provide<br />

the main reference price for financial contracts, mainly traded<br />

at an exchange operated by Nasdaq OMX. There are five price<br />

areas in Norway, two in Denmark and one in finland. A division<br />

of Sweden into four areas in November 2011 has improved<br />

the energy supply to Mid-Norway where <strong>Hydro</strong> has a significant<br />

share of its Norwegian smelter capacity, reducing the tendency<br />

of high area price differentials. The main price drivers<br />

are precipitation, temperature, fuel costs, emission allowance<br />

costs and trading with adjoining markets on the European<br />

continent. variations in hydrological conditions also have<br />

caused significant annual and seasonal price variations<br />

throughout the history of the market.<br />

In April 2009, the EU approved an energy and climate package<br />

aimed at reducing greenhouse gas emissions, increasing the<br />

share of renewable energy and improving energy efficiency, all<br />

by 20 percent, by 2020. Implementation has and will continue<br />

to have a significant influence on energy prices and the energy<br />

and climate policy in all EU/EEA countries.<br />

Emission trading has increased electricity prices by up to 50 percent<br />

in periods with high emission allowance cost in Europe,<br />

including the Nordic market where electricity is predominantly<br />

gene rated by non-emitting sources. Revised EU emission trading<br />

legislation indicates that compensatory measures in the form<br />

of state aid from national governments could be given to