Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

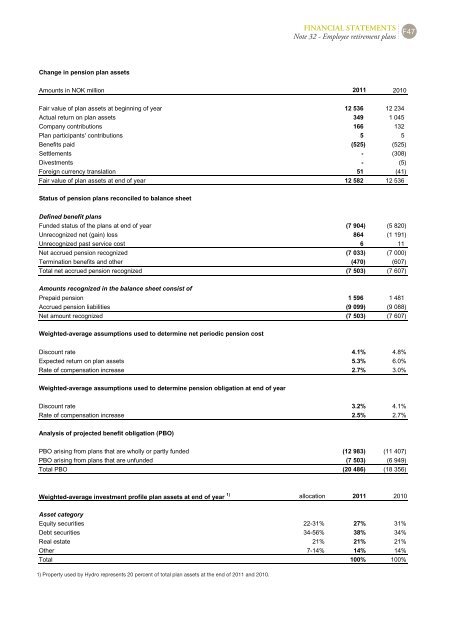

Change in pension plan assets<br />

Amounts in NOK million 2011 2010<br />

Fair value of plan assets at beginning of year 12 536 12 234<br />

Actual return on plan assets 349 1 045<br />

Company contributions 166 132<br />

Plan participants' contributions 5 5<br />

Benefits paid (525) (525)<br />

Settlements (308)<br />

Divestments (5)<br />

Foreign currency translation 51 (41)<br />

Fair value of plan assets at end of year 12 582 12 536<br />

Status of pension plans reconciled to balance sheet<br />

Defined benefit plans<br />

Funded status of the plans at end of year (7 904) (5 820)<br />

Unrecognized net (gain) loss 864 (1 191)<br />

Unrecognized past service cost 6 11<br />

Net accrued pension recognized (7 033) (7 000)<br />

Termination benefits and other (470) (607)<br />

Total net accrued pension recognized (7 503) (7 607)<br />

Amounts recognized in the balance sheet consist of<br />

Prepaid pension 1 596 1 481<br />

Accrued pension liabilities (9 099) (9 088)<br />

Net amount recognized (7 503) (7 607)<br />

Weightedaverage assumptions used to determine net periodic pension cost<br />

Discount rate 4.1% 4.8%<br />

Expected return on plan assets 5.3% 6.0%<br />

Rate of compensation increase 2.7% 3.0%<br />

Weightedaverage assumptions used to determine pension obligation at end of year<br />

Discount rate 3.2% 4.1%<br />

Rate of compensation increase 2.5% 2.7%<br />

Analysis of projected benefit obligation (PBO)<br />

PBO arising from plans that are wholly or partly funded (12 983) (11 407)<br />

PBO arising from plans that are unfunded (7 503) (6 949)<br />

Total PBO (20 486) (18 356)<br />

Weightedaverage investment profile plan assets at end of year 1) allocation 2011 2010<br />

Asset category<br />

Equity securities 2231% 27% 31%<br />

Debt securities 3456% 38% 34%<br />

Real estate 21% 21% 21%<br />

Other 714% 14% 14%<br />

Total 100% 100%<br />

1) Property used by <strong>Hydro</strong> represents 20 percent of total plan assets at the end of 2011 and 2010.<br />

FINANCIAL STATEMENTS<br />

Note 32 - Employee retirement plans F47