Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

F40<br />

FINANCIAL STATEMENTS<br />

Note 25 - Investments in associates<br />

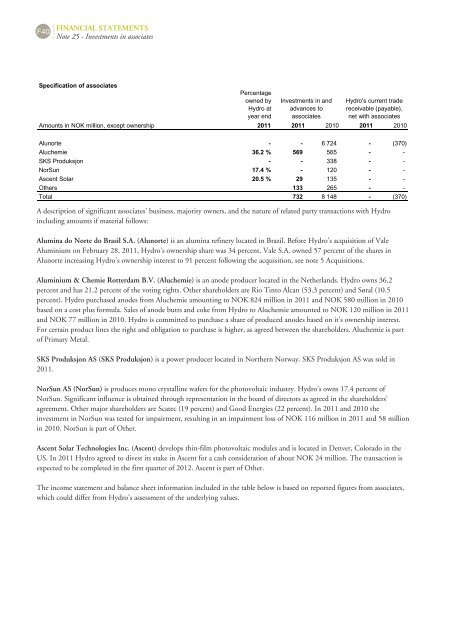

Specification of associates<br />

Percentage<br />

owned by<br />

<strong>Hydro</strong> at<br />

year end<br />

Investments in and<br />

advances to<br />

associates<br />

<strong>Hydro</strong>'s current trade<br />

receivable (payable),<br />

net with associates<br />

Amounts in NOK million, except ownership 2011 2011 2010 2011 2010<br />

Alunorte 6 724 (370)<br />

Aluchemie 36.2 % 569 565 <br />

SKS Produksjon 338 <br />

NorSun 17.4 % 120 <br />

Ascent Solar 20.5 % 29 135 <br />

Others 133 265 <br />

Total 732 8 148 (370)<br />

A description of significant associates' business, majority owners, and the nature of related party transactions with <strong>Hydro</strong><br />

including amounts if material follows:<br />

Alumina do Norte do Brasil S.A. (Alunorte) is an alumina refinery located in Brazil. Before <strong>Hydro</strong>'s acquisition of Vale<br />

Aluminium on February 28, 2011, <strong>Hydro</strong>'s ownership share was 34 percent. Vale S.A. owned 57 percent of the shares in<br />

Alunorte increasing <strong>Hydro</strong>'s ownership interest to 91 percent following the acquisition, see note 5 Acquisitions.<br />

Aluminium & Chemie Rotterdam B.V. (Aluchemie) is an anode producer located in the Netherlands. <strong>Hydro</strong> owns 36.2<br />

percent and has 21.2 percent of the voting rights. Other shareholders are Rio Tinto Alcan (53.3 percent) and Søral (10.5<br />

percent). <strong>Hydro</strong> purchased anodes from Aluchemie amounting to NOK 824 million in 2011 and NOK 580 million in 2010<br />

based on a cost plus formula. Sales of anode butts and coke from <strong>Hydro</strong> to Aluchemie amounted to NOK 120 million in 2011<br />

and NOK 77 million in 2010. <strong>Hydro</strong> is committed to purchase a share of produced anodes based on it's ownership interest.<br />

For certain product lines the right and obligation to purchase is higher, as agreed between the shareholders. Aluchemie is part<br />

of Primary Metal.<br />

SKS Produksjon AS (SKS Produksjon) is a power producer located in Northern Norway. SKS Produksjon AS was sold in<br />

2011.<br />

NorSun AS (NorSun) is produces mono crystalline wafers for the photovoltaic industry. <strong>Hydro</strong>'s owns 17.4 percent of<br />

NorSun. Significant influence is obtained through representation in the board of directors as agreed in the shareholders'<br />

agreement. Other major shareholders are Scatec (19 percent) and Good Energies (22 percent). In 2011 and 2010 the<br />

investment in NorSun was tested for impairment, resulting in an impairment loss of NOK 116 million in 2011 and 58 million<br />

in 2010. NorSun is part of Other.<br />

Ascent Solar Technologies Inc. (Ascent) develops thin-film photovoltaic modules and is located in Denver, Colorado in the<br />

US. In 2011 <strong>Hydro</strong> agreed to divest its stake in Ascent for a cash consideration of about NOK 24 million. The transaction is<br />

expected to be completed in the first quarter of 2012. Ascent is part of Other.<br />

The income statement and balance sheet information included in the table below is based on reported figures from associates,<br />

which could differ from <strong>Hydro</strong>'s assessment of the underlying values.