Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F18<br />

FINANCIAL STATEMENTS<br />

Note 4 - Critical accounting judgment and key sources of estimation uncertainty<br />

obligations require interpretation of scientific and legal data, in addition to assumptions about probability and future costs. A<br />

description of <strong>Hydro</strong>'s major contingencies is included in note 38 Contingent liabilities and contingent assets.<br />

Insurance and other compensation<br />

<strong>Hydro</strong> has insurance contracts and certain other arrangements giving right to compensation for damage and/or losses.<br />

Compensation claims are recognized when it is deemed to be virtually certain that <strong>Hydro</strong> will receive a compensation under<br />

the contract. Such determination requires detailed analysis of the legal basis for the claim; any contingencies that are or may be<br />

raised by the liable party; evaluation of assessment from technical, legal or other third party experts; and other relevant<br />

information. To recognize such claims <strong>Hydro</strong> normally expect to have received either a confirmation from the liable party that<br />

the claim is valid and will be honored, or a confirmation from an external expert that <strong>Hydro</strong> has a valid claim with no or<br />

remote risk of not being honored. The claim is measured at <strong>Hydro</strong>'s best estimate of the amount to be received.<br />

Income tax<br />

<strong>Hydro</strong> calculates income tax expense based on reported income in the different legal entities. Deferred income tax expense is<br />

calculated based on the differences between the carrying value of assets and liabilities for financial reporting purposes and their<br />

respective tax basis that are considered temporary in nature. Valuation of deferred tax assets is dependent on management's<br />

assessment of future recoverability of the deferred benefit. Expected recoverability may result from expected taxable income in<br />

the future, planned transactions or planned tax optimizing measures. Economic conditions may change and lead to a different<br />

conclusion regarding recoverability. Tax authorities in different jurisdictions may challenge <strong>Hydro</strong>'s calculation of taxes payable<br />

from prior periods. Such processes may lead to changes to prior periods' taxable income, resulting in changes to income tax<br />

expense in the period of change.<br />

Note 5 - Acquisitions<br />

On February 28, 2011 <strong>Hydro</strong> acquired the majority of Vale S.A.'s aluminium business. Vale Aluminium included the<br />

following equity interests all of which are located in the state of Pará:<br />

57 percent of the shares in the alumina refinery Alunorte - Alumina do Norte do Brasil S.A. (Alunorte), increasing<br />

<strong>Hydro</strong>'s ownership interest from 34 percent to 91 percent<br />

60 percent ownership interest in the bauxite mine Paragominas with the right and obligation to acquire the remaining 40<br />

percent ownership within a period of five years from completion of the acquisition. The put and call arrangements are at a<br />

fixed price and effectively transfer the majority of the economic exposure to <strong>Hydro</strong>, and is thus accounted for as a<br />

purchase of the remaining shares with deferred payment.<br />

51 percent ownership in the aluminium smelter Albras - Aluminio Brasileiro S.A. (Albras)<br />

61 percent ownership in Companhia de Alumina do Pará S.A. (CAP), an alumina refinery under evaluation for<br />

development, increasing <strong>Hydro</strong> ownership interest from 20 percent to 81 percent.<br />

In addition, <strong>Hydro</strong> acquired certain commercial contracts related to sale of alumina and aluminium. The acquired business was<br />

consolidated as of the acquisition date and has improved <strong>Hydro</strong>'s access to bauxite and alumina, the main raw materials for<br />

production of aluminium.<br />

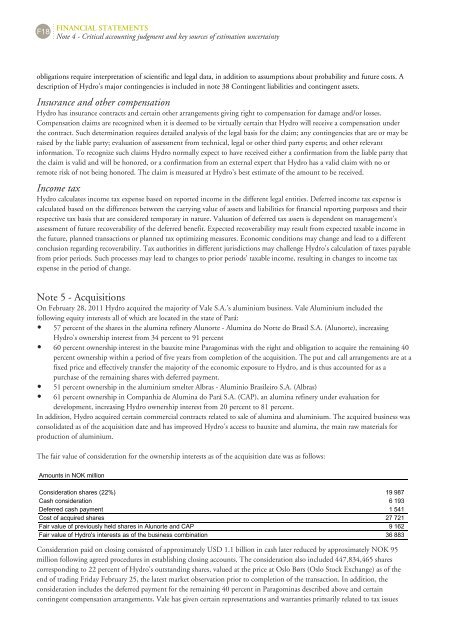

The fair value of consideration for the ownership interests as of the acquisition date was as follows:<br />

Amounts in NOK million<br />

Consideration shares (22%) 19 987<br />

Cash consideration 6 193<br />

Deferred cash payment 1 541<br />

Cost of acquired shares 27 721<br />

Fair value of previously held shares in Alunorte and CAP 9 162<br />

Fair value of <strong>Hydro</strong>'s interests as of the business combination 36 883<br />

Consideration paid on closing consisted of approximately USD 1.1 billion in cash later reduced by approximately NOK 95<br />

million following agreed procedures in establishing closing accounts. The consideration also included 447,834,465 shares<br />

corresponding to 22 percent of <strong>Hydro</strong>'s outstanding shares, valued at the price at Oslo Børs (Oslo Stock Exchange) as of the<br />

end of trading Friday February 25, the latest market observation prior to completion of the transaction. In addition, the<br />

consideration includes the deferred payment for the remaining 40 percent in Paragominas described above and certain<br />

contingent compensation arrangements. Vale has given certain representations and warranties primarily related to tax issues