Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL STATEMENTS<br />

Note 6 - Financial and commercial risk management F23<br />

Credit risk management<br />

<strong>Hydro</strong> manages credit risk by setting counterparty risk limits and establishing procedures for monitoring exposures and timely<br />

settlement of customer accounts. <strong>Hydro</strong> is also monitoring the financial performance of key suppliers in order to reduce the<br />

risk of default on operations and key projects. Our overall credit risk exposure is reduced due to a diversified customer base<br />

representing various industries and geographic areas. Enforceable netting agreements, guarantees, and credit insurance, also<br />

contribute to a lower credit risk.<br />

Credit risk arising from derivatives is generally limited to net exposures. Exposure limits are established for financial institutions<br />

relating to current accounts, deposits and other obligations. Credit risk related to commodity derivatives is limited by<br />

settlement through commodity exchanges. Current counterparty risk related to the use of derivative instruments and financial<br />

operations is considered limited.<br />

Liquidity risk<br />

Volatile commodity prices and exchange rates as well as fluctuation business volumes and inventory levels can have a<br />

substantial effect on <strong>Hydro</strong>'s cash positions and borrowing requirements.<br />

To fund cash deficits of a more permanent nature <strong>Hydro</strong> will normally raise long-term bond or bank debt in available markets.<br />

<strong>Hydro</strong> has entered into agreements with banks for a stand-by credit facility of USD 1.7 billion maturing in 2014. This facility<br />

was undrawn at year-end 2011. A revolving EUR 750 million credit facility maturing in 2012 was canceled in 2011.<br />

<strong>Hydro</strong> has obtained bank guarantees to cover daily settlements for positions held toward electricity or commodity exchanges.<br />

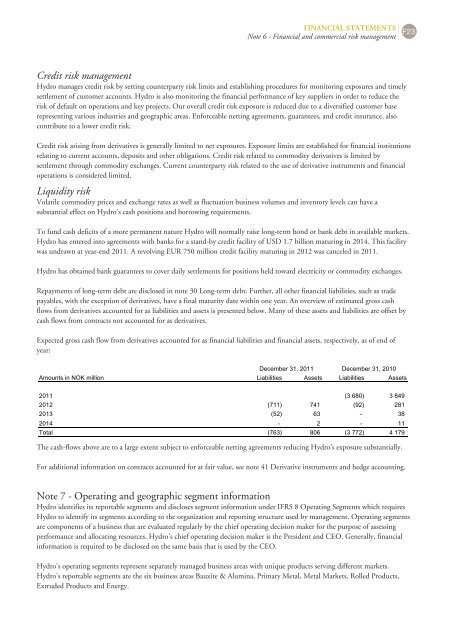

Repayments of long-term debt are disclosed in note 30 Long-term debt. Further, all other financial liabilities, such as trade<br />

payables, with the exception of derivatives, have a final maturity date within one year. An overview of estimated gross cash<br />

flows from derivatives accounted for as liabilities and assets is presented below. Many of these assets and liabilities are offset by<br />

cash flows from contracts not accounted for as derivatives.<br />

Expected gross cash flow from derivatives accounted for as financial liabilities and financial assets, respectively, as of end of<br />

year:<br />

December 31, 2011 December 31, 2010<br />

Amounts in NOK million Liabilities Assets Liabilities Assets<br />

2011 (3 680) 3 849<br />

2012 (711) 741 (92) 281<br />

2013 (52) 63 38<br />

2014 2 11<br />

Total (763) 806 (3 772) 4 179<br />

The cash-flows above are to a large extent subject to enforceable netting agreements reducing <strong>Hydro</strong>'s exposure substantially.<br />

For additional information on contracts accounted for at fair value, see note 41 Derivative instruments and hedge accounting.<br />

Note 7 - Operating and geographic segment information<br />

<strong>Hydro</strong> identifies its reportable segments and discloses segment information under IFRS 8 Operating Segments which requires<br />

<strong>Hydro</strong> to identify its segments according to the organization and reporting structure used by management. Operating segments<br />

are components of a business that are evaluated regularly by the chief operating decision maker for the purpose of assessing<br />

performance and allocating resources. <strong>Hydro</strong>'s chief operating decision maker is the President and CEO. Generally, financial<br />

information is required to be disclosed on the same basis that is used by the CEO.<br />

<strong>Hydro</strong>'s operating segments represent separately managed business areas with unique products serving different markets.<br />

<strong>Hydro</strong>'s reportable segments are the six business areas Bauxite & Alumina, Primary Metal, Metal Markets, Rolled Products,<br />

Extruded Products and Energy.