Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F36<br />

FINANCIAL STATEMENTS<br />

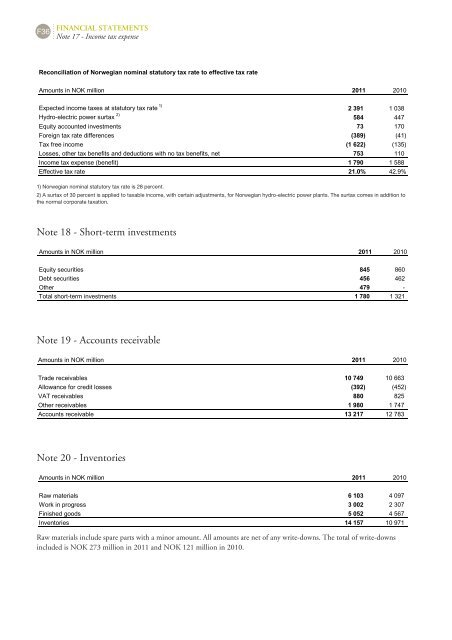

Note 17 - Income tax expense<br />

Reconciliation of Norwegian nominal statutory tax rate to effective tax rate<br />

Amounts in NOK million 2011 2010<br />

Expected income taxes at statutory tax rate 1)<br />

2 391 1 038<br />

<strong>Hydro</strong>electric power surtax 2)<br />

584 447<br />

Equity accounted investments 73 170<br />

Foreign tax rate differences (389) (41)<br />

Tax free income (1 622) (135)<br />

Losses, other tax benefits and deductions with no tax benefits, net 753 110<br />

Income tax expense (benefit) 1 790 1 588<br />

Effective tax rate 21.0% 42.9%<br />

1) Norwegian nominal statutory tax rate is 28 percent.<br />

2) A surtax of 30 percent is applied to taxable income, with certain adjustments, for Norwegian hydro-electric power plants. The surtax comes in addition to<br />

the normal corporate taxation.<br />

Note 18 - Short-term investments<br />

Amounts in NOK million 2011 2010<br />

Equity securities 845 860<br />

Debt securities 456 462<br />

Other 479 <br />

Total shortterm investments 1 780 1 321<br />

Note 19 - Accounts receivable<br />

Amounts in NOK million 2011 2010<br />

Trade receivables 10 749 10 663<br />

Allowance for credit losses (392) (452)<br />

VAT receivables 880 825<br />

Other receivables 1 980 1 747<br />

Accounts receivable 13 217 12 783<br />

Note 20 - Inventories<br />

Amounts in NOK million 2011 2010<br />

Raw materials 6 103 4 097<br />

Work in progress 3 002 2 307<br />

Finished goods 5 052 4 567<br />

Inventories 14 157 10 971<br />

Raw materials include spare parts with a minor amount. All amounts are net of any write-downs. The total of write-downs<br />

included is NOK 273 million in 2011 and NOK 121 million in 2010.