Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Operations<br />

<strong>Hydro</strong> is a global energy player, purchasing and consuming substantial<br />

quantities of energy for its smelters, rolling mills and<br />

alumina refinery operations. We are the largest privately owned<br />

power producer in Norway, operating 17 hydroelectric power<br />

plants with a total installed capacity of approximately 1,850<br />

MW and annual normal production of 9.4 TWh. 1) We also purchase<br />

around 7 TWh annually under long-term contracts,<br />

mainly with the Norwegian state-owned company, Statkraft.<br />

Cost and revenue drivers<br />

Production volumes and market prices are strongly influenced<br />

by hydrological conditions. Seasonal factors affect both supply<br />

and demand. We have a relatively stable cost base and annual<br />

contribution to underlying EBIT, but with the potential for<br />

large quarterly variations due to volatile spot volumes and prices.<br />

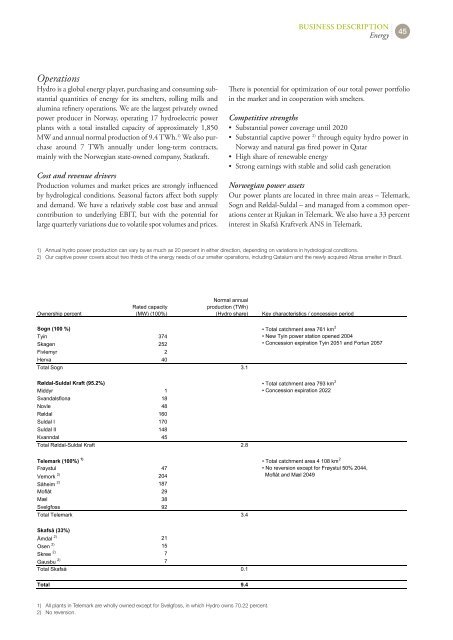

Ownership percent<br />

Rated capacity<br />

(MW) (100%)<br />

Sogn (100 %)<br />

Tyin 374<br />

Skagen 252<br />

Fivlemyr 2<br />

Herva 40<br />

Total Sogn 3.1<br />

Røldal-Suldal Kraft (95.2%)<br />

Middyr 1<br />

Svandalsflona 18<br />

Novle 48<br />

Røldal 160<br />

Suldal I 170<br />

Suldal II 148<br />

Kvanndal 45<br />

Total Røldal-Suldal Kraft 2.8<br />

Telemark (100%) 1)<br />

Frøystul 47<br />

Vemork 2) 204<br />

Såheim 2) 187<br />

Moflåt 29<br />

Mæl 38<br />

Svelgfoss 92<br />

Total Telemark 3.4<br />

Skafså (33%)<br />

Åmdal 2) 21<br />

Osen 2) 15<br />

Skree 2) 7<br />

Gausbu 2) 7<br />

Total Skafså 0.1<br />

BusIness DesCrIptIon<br />

Energy<br />

45<br />

There is potential for optimization of our total power portfolio<br />

in the market and in cooperation with smelters.<br />

Competitive strengths<br />

• Substantial power coverage until 2020<br />

• Substantial captive power 2) through equity hydro power in<br />

Norway and natural gas fired power in Qatar<br />

• High share of renewable energy<br />

• Strong earnings with stable and solid cash generation<br />

Norwegian power assets<br />

Our power plants are located in three main areas – Telemark,<br />

Sogn and Røldal-Suldal – and managed from a common operations<br />

center at Rjukan in Telemark. We also have a 33 percent<br />

interest in Skafså Kraftverk ANS in Telemark.<br />

1) <strong>Annual</strong> hydro power production can vary by as much as 20 percent in either direction, depending on variations in hydrological conditions.<br />

2) Our captive power covers about two thirds of the energy needs of our smelter operations, including Qatalum and the newly acquired Albras smelter in Brazil.<br />

Total 9.4<br />

1) All plants in Telemark are wholly owned except for Svelgfoss, in which <strong>Hydro</strong> owns 70.22 percent.<br />

2) No reversion.<br />

Normal annual<br />

production (TWh)<br />

(<strong>Hydro</strong> share) Key characteristics / concession period<br />

• Total catchment area 761 km 2<br />

• New Tyin power station opened 2004<br />

• Concession expiration Tyin 2051 and Fortun 2057<br />

• Total catchment area 793 km 2<br />

• Concession expiration 2022<br />

• Total catchment area 4 108 km 2<br />

• No reversion except for Frøystul 50% 2044,<br />

Moflåt and Mæl 2049