Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

which result in recognition of indemnification assets of approximately NOK 150 million. The fair value of <strong>Hydro</strong>'s previous<br />

ownership interests in Alunorte and CAP is part of the initial recognition of the acquired entities. A remeasurement gain of<br />

NOK 4,222 million was recognized in Other income, net.<br />

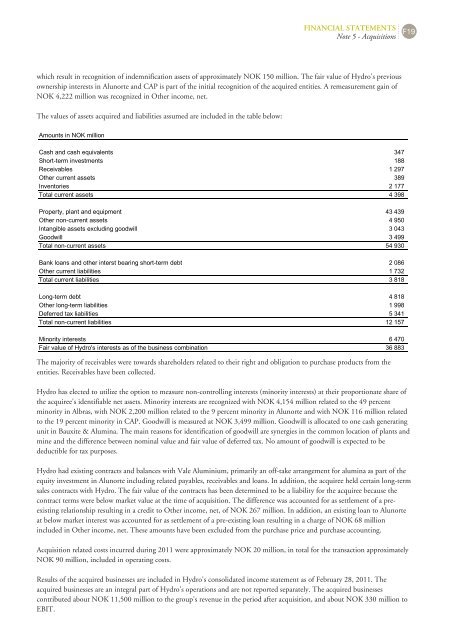

The values of assets acquired and liabilities assumed are included in the table below:<br />

Amounts in NOK million<br />

FINANCIAL STATEMENTS<br />

Note 5 - Acquisitions F19<br />

Cash and cash equivalents 347<br />

Shortterm investments 188<br />

Receivables 1 297<br />

Other current assets 389<br />

Inventories 2 177<br />

Total current assets 4 398<br />

Property, plant and equipment 43 439<br />

Other noncurrent assets 4 950<br />

Intangible assets excluding goodwill 3 043<br />

Goodwill 3 499<br />

Total noncurrent assets 54 930<br />

Bank loans and other interst bearing shortterm debt 2 086<br />

Other current liabilities 1 732<br />

Total current liabilities 3 818<br />

Longterm debt 4 818<br />

Other longterm liabilities 1 998<br />

Deferred tax liabilities 5 341<br />

Total noncurrent liabilities 12 157<br />

Minority interests 6 470<br />

Fair value of <strong>Hydro</strong>'s interests as of the business combination 36 883<br />

The majority of receivables were towards shareholders related to their right and obligation to purchase products from the<br />

entities. Receivables have been collected.<br />

<strong>Hydro</strong> has elected to utilize the option to measure non-controlling interests (minority interests) at their proportionate share of<br />

the acquiree's identifiable net assets. Minority interests are recognized with NOK 4,154 million related to the 49 percent<br />

minority in Albras, with NOK 2,200 million related to the 9 percent minority in Alunorte and with NOK 116 million related<br />

to the 19 percent minority in CAP. Goodwill is measured at NOK 3,499 million. Goodwill is allocated to one cash generating<br />

unit in Bauxite & Alumina. The main reasons for identification of goodwill are synergies in the common location of plants and<br />

mine and the difference between nominal value and fair value of deferred tax. No amount of goodwill is expected to be<br />

deductible for tax purposes.<br />

<strong>Hydro</strong> had existing contracts and balances with Vale Aluminium, primarily an off-take arrangement for alumina as part of the<br />

equity investment in Alunorte including related payables, receivables and loans. In addition, the acquiree held certain long-term<br />

sales contracts with <strong>Hydro</strong>. The fair value of the contracts has been determined to be a liability for the acquiree because the<br />

contract terms were below market value at the time of acquisition. The difference was accounted for as settlement of a preexisting<br />

relationship resulting in a credit to Other income, net, of NOK 267 million. In addition, an existing loan to Alunorte<br />

at below market interest was accounted for as settlement of a pre-existing loan resulting in a charge of NOK 68 million<br />

included in Other income, net. These amounts have been excluded from the purchase price and purchase accounting.<br />

Acquisition related costs incurred during 2011 were approximately NOK 20 million, in total for the transaction approximately<br />

NOK 90 million, included in operating costs.<br />

Results of the acquired businesses are included in <strong>Hydro</strong>'s consolidated income statement as of February 28, 2011. The<br />

acquired businesses are an integral part of <strong>Hydro</strong>'s operations and are not reported separately. The acquired businesses<br />

contributed about NOK 11,500 million to the group's revenue in the period after acquisition, and about NOK 330 million to<br />

EBIT.