Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F42<br />

FINANCIAL STATEMENTS<br />

Note 26 - Investments in jointly controlled entities<br />

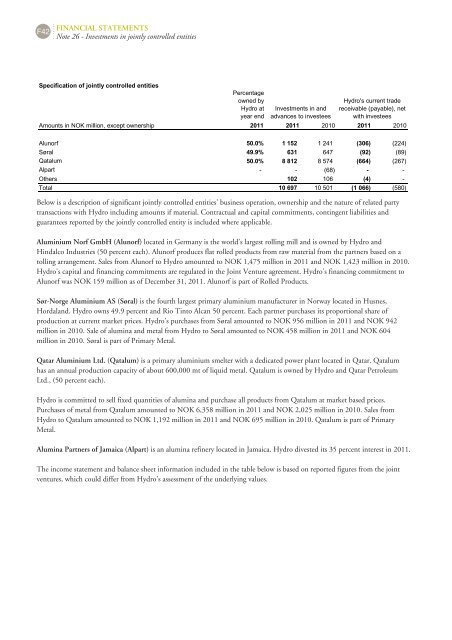

Specification of jointly controlled entities<br />

Percentage<br />

owned by<br />

<strong>Hydro</strong> at<br />

year end<br />

Investments in and<br />

advances to investees<br />

<strong>Hydro</strong>'s current trade<br />

receivable (payable), net<br />

with investees<br />

Amounts in NOK million, except ownership 2011 2011 2010 2011 2010<br />

Alunorf 50.0% 1 152 1 241 (306) (224)<br />

Søral 49.9% 631 647 (92) (89)<br />

Qatalum 50.0% 8 812 8 574 (664) (267)<br />

Alpart (68) <br />

Others 102 106 (4) <br />

Total 10 697 10 501 (1 066) (580)<br />

Below is a description of significant jointly controlled entities' business operation, ownership and the nature of related party<br />

transactions with <strong>Hydro</strong> including amounts if material. Contractual and capital commitments, contingent liabilities and<br />

guarantees reported by the jointly controlled entity is included where applicable.<br />

Aluminium Norf GmbH (Alunorf) located in Germany is the world's largest rolling mill and is owned by <strong>Hydro</strong> and<br />

Hindalco Industries (50 percent each). Alunorf produces flat rolled products from raw material from the partners based on a<br />

tolling arrangement. Sales from Alunorf to <strong>Hydro</strong> amounted to NOK 1,475 million in 2011 and NOK 1,423 million in 2010.<br />

<strong>Hydro</strong>'s capital and financing commitments are regulated in the Joint Venture agreement. <strong>Hydro</strong>'s financing commitment to<br />

Alunorf was NOK 159 million as of December 31, 2011. Alunorf is part of Rolled Products.<br />

Sør-Norge Aluminium AS (Søral) is the fourth largest primary aluminium manufacturer in Norway located in Husnes,<br />

Hordaland. <strong>Hydro</strong> owns 49.9 percent and Rio Tinto Alcan 50 percent. Each partner purchases its proportional share of<br />

production at current market prices. <strong>Hydro</strong>'s purchases from Søral amounted to NOK 956 million in 2011 and NOK 942<br />

million in 2010. Sale of alumina and metal from <strong>Hydro</strong> to Søral amounted to NOK 458 million in 2011 and NOK 604<br />

million in 2010. Søral is part of Primary Metal.<br />

Qatar Aluminium Ltd. (Qatalum) is a primary aluminium smelter with a dedicated power plant located in Qatar. Qatalum<br />

has an annual production capacity of about 600,000 mt of liquid metal. Qatalum is owned by <strong>Hydro</strong> and Qatar Petroleum<br />

Ltd., (50 percent each).<br />

<strong>Hydro</strong> is committed to sell fixed quantities of alumina and purchase all products from Qatalum at market based prices.<br />

Purchases of metal from Qatalum amounted to NOK 6,358 million in 2011 and NOK 2,025 million in 2010. Sales from<br />

<strong>Hydro</strong> to Qatalum amounted to NOK 1,192 million in 2011 and NOK 695 million in 2010. Qatalum is part of Primary<br />

Metal.<br />

Alumina Partners of Jamaica (Alpart) is an alumina refinery located in Jamaica. <strong>Hydro</strong> divested its 35 percent interest in 2011.<br />

The income statement and balance sheet information included in the table below is based on reported figures from the joint<br />

ventures, which could differ from <strong>Hydro</strong>'s assessment of the underlying values.