Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

F44<br />

FINANCIAL STATEMENTS<br />

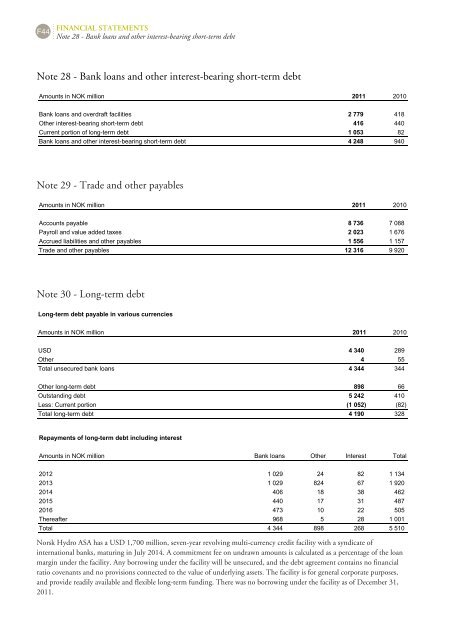

Note 28 - Bank loans and other interest-bearing short-term debt<br />

Note 28 - Bank loans and other interest-bearing short-term debt<br />

Amounts in NOK million 2011 2010<br />

Bank loans and overdraft facilities 2 779 418<br />

Other interestbearing shortterm debt 416 440<br />

Current portion of longterm debt 1 053 82<br />

Bank loans and other interestbearing shortterm debt 4 248 940<br />

Note 29 - Trade and other payables<br />

Amounts in NOK million 2011 2010<br />

Accounts payable 8 736 7 088<br />

Payroll and value added taxes 2 023 1 676<br />

Accrued liabilities and other payables 1 556 1 157<br />

Trade and other payables 12 316 9 920<br />

Note 30 - Long-term debt<br />

Longterm debt payable in various currencies<br />

Amounts in NOK million 2011 2010<br />

USD 4 340 289<br />

Other 4 55<br />

Total unsecured bank loans 4 344 344<br />

Other longterm debt 898 66<br />

Outstanding debt 5 242 410<br />

Less: Current portion (1 052) (82)<br />

Total longterm debt 4 190 328<br />

Repayments of longterm debt including interest<br />

Amounts in NOK million Bank loans Other Interest Total<br />

2012 1 029 24 82 1 134<br />

2013 1 029 824 67 1 920<br />

2014 406 18 38 462<br />

2015 440 17 31 487<br />

2016 473 10 22 505<br />

Thereafter 968 5 28 1 001<br />

Total 4 344 898 268 5 510<br />

Norsk <strong>Hydro</strong> ASA has a USD 1,700 million, seven-year revolving multi-currency credit facility with a syndicate of<br />

international banks, maturing in July 2014. A commitment fee on undrawn amounts is calculated as a percentage of the loan<br />

margin under the facility. Any borrowing under the facility will be unsecured, and the debt agreement contains no financial<br />

ratio covenants and no provisions connected to the value of underlying assets. The facility is for general corporate purposes,<br />

and provide readily available and flexible long-term funding. There was no borrowing under the facility as of December 31,<br />

2011.