Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

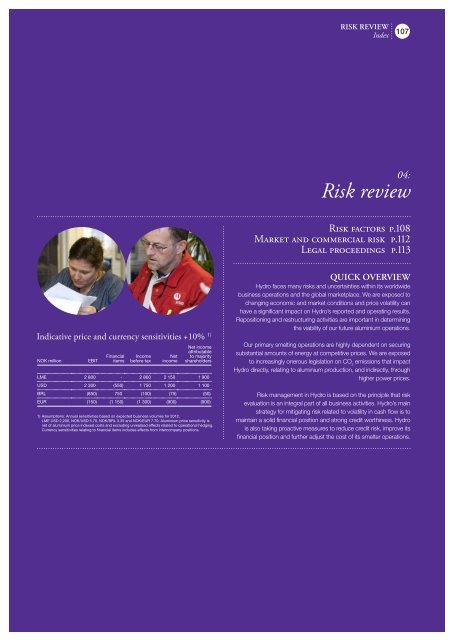

Indicative price and currency sensitivities +10% 1)<br />

NOK million EBIT<br />

Financial<br />

items<br />

Income<br />

before tax<br />

Net<br />

income<br />

Net income<br />

attributable<br />

to majority<br />

shareholders<br />

LME 2 800 - 2 800 2 150 1 900<br />

USD 2 300 (550) 1 750 1 200 1 100<br />

BRL (850) 750 (100) (75) (50)<br />

EUR (150) (1 150) (1 300) (900) (900)<br />

1) Assumptions: <strong>Annual</strong> sensitivities based on expected business volumes for 2012,<br />

LME USD 2,200, NOK/USD 5.70, NOK/BRL 3.35 and NOK/EUR 7.70. Aluminium price sensitivity is<br />

net of aluminium price indexed costs and excluding unrealized effects related to operational hedging.<br />

Currency sensitivities relating to financial items includes effects from intercompany positions.<br />

riSk review<br />

Index<br />

107<br />

04:<br />

Risk review<br />

Risk factors p.108<br />

Market and commercial risk p.112<br />

Legal proceedings p.113<br />

Quick overview<br />

<strong>Hydro</strong> faces many risks and uncertainties within its worldwide<br />

business operations and the global marketplace. We are exposed to<br />

changing economic and market conditions and price volatility can<br />

have a significant impact on <strong>Hydro</strong>’s reported and operating results.<br />

Repositioning and restructuring activities are important in determining<br />

the viability of our future aluminium operations.<br />

Our primary smelting operations are highly dependent on securing<br />

substantial amounts of energy at competitive prices. We are exposed<br />

to increasingly onerous legislation on CO 2 emissions that impact<br />

<strong>Hydro</strong> directly, relating to aluminium production, and indirectly, through<br />

higher power prices.<br />

Risk management in <strong>Hydro</strong> is based on the principle that risk<br />

evaluation is an integral part of all business activities. <strong>Hydro</strong>’s main<br />

strategy for mitigating risk related to volatility in cash flow is to<br />

maintain a solid financial position and strong credit worthiness. <strong>Hydro</strong><br />

is also taking proactive measures to reduce credit risk, improve its<br />

financial position and further adjust the cost of its smelter operations.