Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL STATEMENTS<br />

Note 41 - Derivative instruments and hedge accounting F59<br />

Unless used in connection with hedge accounting, changes in the fair value of currency derivatives are included in Financial<br />

expense, net, in the income statement.<br />

Embedded derivatives<br />

Some contracts contain pricing links that affect cash flows in a manner different than the underlying commodity or financial<br />

instrument in the contract. For accounting purposes, these embedded derivatives are in some circumstances separated from the<br />

host contract and recognized at fair value. <strong>Hydro</strong> has separated and recognized at fair value embedded derivatives related to<br />

aluminium, inflation and coal links, in addition to currency forwards, from the underlying contracts.<br />

Cash flow hedges<br />

<strong>Hydro</strong> has periodically entered into hedge programs to secure the price of aluminium and alumina to be sold. Aluminium<br />

futures, options and swaps on the London Metal Exchange and with external banks have been used for this purpose. Certain of<br />

these hedge programs have been accounted for as cash flow hedges, where gains and losses on the hedge derivatives are<br />

recognized in Other Comprehensive Income, and accumulated in the hedging reserve in equity and will be reclassified into<br />

operating revenues when the corresponding forecasted sale of aluminium or alumina is recognized.<br />

In anticipation of the Vale transaction, <strong>Hydro</strong> entered into forward and option instruments in 2010 relating to sales of alumina<br />

and aluminium to be produced in the Vale Aluminium entities Alunorte and Albras acquired February 28, 2011, see note 5<br />

Acquisitions. Hedge accounting was applied for these instruments from July 1, 2011. At the end of 2011, this cash flow hedge<br />

program had expired. No new cash flow hedges were entered into during 2011.<br />

Ineffectiveness amounting to NOK 21 million was recognized in the income statement in 2010. No ineffectiveness was<br />

recognized in 2011 in connection with cash flow hedges.<br />

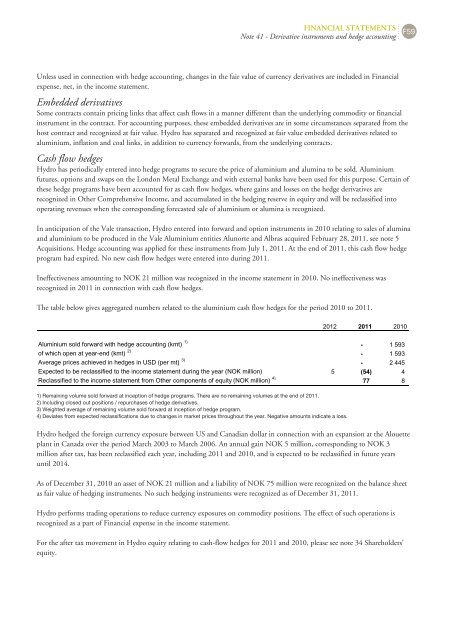

The table below gives aggregated numbers related to the aluminium cash flow hedges for the period 2010 to 2011.<br />

2012 2011 2010<br />

Aluminium sold forward with hedge accounting (kmt) 1)<br />

1 593<br />

of which open at yearend (kmt) 2)<br />

1 593<br />

Average prices achieved in hedges in USD (per mt) 3)<br />

2 445<br />

Expected to be reclassified to the income statement during the year (NOK million) 5 (54) 4<br />

Reclassified to the income statement from Other components of equity (NOK million) 4)<br />

77 8<br />

1) Remaining volume sold forward at inception of hedge programs. There are no remaining volumes at the end of 2011.<br />

2) Including closed out positions / repurchases of hedge derivatives.<br />

3) Weighted average of remaining volume sold forward at inception of hedge program.<br />

4) Deviates from expected reclassifications due to changes in market prices throughout the year. Negative amounts indicate a loss.<br />

<strong>Hydro</strong> hedged the foreign currency exposure between US and Canadian dollar in connection with an expansion at the Alouette<br />

plant in Canada over the period March 2003 to March 2006. An annual gain NOK 5 million, corresponding to NOK 3<br />

million after tax, has been reclassified each year, including 2011 and 2010, and is expected to be reclassified in future years<br />

until 2014.<br />

As of December 31, 2010 an asset of NOK 21 million and a liability of NOK 75 million were recognized on the balance sheet<br />

as fair value of hedging instruments. No such hedging instruments were recognized as of December 31, 2011.<br />

<strong>Hydro</strong> performs trading operations to reduce currency exposures on commodity positions. The effect of such operations is<br />

recognized as a part of Financial expense in the income statement.<br />

For the after tax movement in <strong>Hydro</strong> equity relating to cash-flow hedges for 2011 and 2010, please see note 34 Shareholders'<br />

equity.