Hydro Annual Report 2011b

Hydro Annual Report 2011b

Hydro Annual Report 2011b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

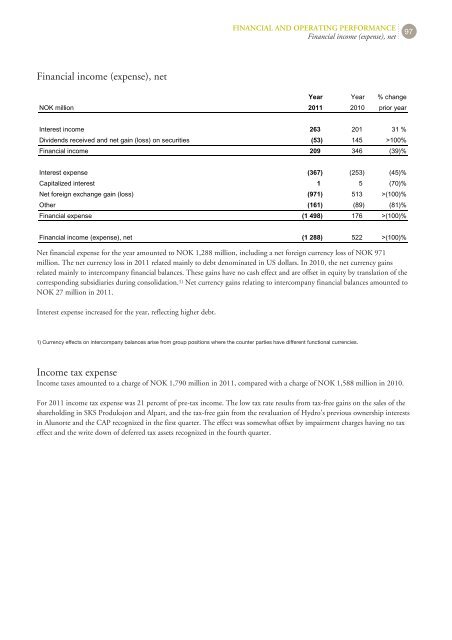

Financial income (expense), net<br />

Year Year % change<br />

NOK million 2011 2010 prior year<br />

Interest income 263 201 31 %<br />

Dividends received and net gain (loss) on securities (53) 145 >100%<br />

Financial income 209 346 (39)%<br />

Interest expense (367) (253) (45)%<br />

Capitalized interest 1 5 (70)%<br />

Net foreign exchange gain (loss) (971) 513 >(100)%<br />

Other (161) (89) (81)%<br />

Financial expense (1 498) 176 >(100)%<br />

Financial income (expense), net (1 288) 522 >(100)%<br />

Net financial expense for the year amounted to NOK 1,288 million, including a net foreign currency loss of NOK 971<br />

million. The net currency loss in 2011 related mainly to debt denominated in US dollars. In 2010, the net currency gains<br />

related mainly to intercompany financial balances. These gains have no cash effect and are offset in equity by translation of the<br />

corresponding subsidiaries during consolidation. 1) Net currency gains relating to intercompany financial balances amounted to<br />

NOK 27 million in 2011.<br />

Interest expense increased for the year, reflecting higher debt.<br />

FINANCIAL AND OPERATING PERFORMANCE<br />

Financial income (expense), net<br />

1) Currency effects on intercompany balances arise from group positions where the counter parties have different functional currencies.<br />

Income tax expense<br />

Income taxes amounted to a charge of NOK 1,790 million in 2011, compared with a charge of NOK 1,588 million in 2010.<br />

For 2011 income tax expense was 21 percent of pre-tax income. The low tax rate results from tax-free gains on the sales of the<br />

shareholding in SKS Produksjon and Alpart, and the tax-free gain from the revaluation of <strong>Hydro</strong>'s previous ownership interests<br />

in Alunorte and the CAP recognized in the first quarter. The effect was somewhat offset by impairment charges having no tax<br />

effect and the write down of deferred tax assets recognized in the fourth quarter.<br />

97