Wood, Marjorie A.MathematicsBS, Drexel <strong>University</strong>, 1968MS, <strong>University</strong> <strong>of</strong> Southern California, 1986Wood, Robert L.EconomicsBS, Sophia <strong>University</strong> (Japan), 1955MA, George Washington <strong>University</strong>, 1958BS, Georgetown <strong>University</strong>, 1960Woodard, Kimberly R.Criminology/Criminal JusticeAB, Duke <strong>University</strong>, 1994JD, George Washington <strong>University</strong>, 1997Woodbury-Burley, L. LatoyaCriminology/Criminal JusticeBA, <strong>University</strong> <strong>of</strong> the District <strong>of</strong> Columbia, 1990JD, Washington <strong>College</strong> <strong>of</strong> Law, American <strong>University</strong>,1996Worsham, James B.JournalismBS, Central Missouri State <strong>College</strong>, 1964MA, <strong>University</strong> <strong>of</strong> Iowa, 1967Worthington, Lucia A.Business and ManagementBA, California State Polytechnic <strong>University</strong>, Pomona,1975BA, California State Polytechnic <strong>University</strong>, Pomona,1976MA, Claremont Graduate <strong>University</strong>, 1998Wortman, Kristin A.Computer and Information ScienceBS, <strong>University</strong> <strong>of</strong> <strong>Maryland</strong> <strong>University</strong> <strong>College</strong>, 1979MS, <strong>University</strong> <strong>of</strong> <strong>Maryland</strong> <strong>University</strong> <strong>College</strong>, 2000Wright, Brian K.Computer StudiesBS, U.S. Coast Guard Academy, 1983MS, Naval Postgraduate School, 1992Wright, RosalindGerontologyBSN, Coppin State <strong>College</strong>, 1981MSN, <strong>University</strong> <strong>of</strong> <strong>Maryland</strong>, Baltimore, 1986Wu, Huei-FenComputer and Information ScienceBS, Tunghai <strong>University</strong> (Taiwan), 1987MS, George Washington <strong>University</strong>, 1990PhD, George Washington <strong>University</strong>, 1997Wulu, John T.MathematicsBS, <strong>University</strong> <strong>of</strong> Liberia, 1981MA, Western Michigan <strong>University</strong>, 1984MS, Michigan State <strong>University</strong>, 1989PhD, <strong>University</strong> <strong>of</strong> Alabama, 1999Wussow, John M.MarketingBBA, <strong>University</strong> <strong>of</strong> Wisconsin–Madison, 1957MS, <strong>University</strong> <strong>of</strong> Wisconsin–Madison, 1960Xenakis, WilliamStatistics and ProbabilityBA, Boston <strong>University</strong>, 1961MA, <strong>University</strong> <strong>of</strong> Southern California, 1970EdD, <strong>University</strong> <strong>of</strong> Southern California, 1982Xiang, DanComputer Information Systems and TechnologyBS, Tsinghua <strong>University</strong> (China), 1985PhD, Tsinghua <strong>University</strong> (China), 1990MS, John Hopkins <strong>University</strong>, 2001Xiong, XiaoxiongComputer StudiesBS, Beijing Institute <strong>of</strong> Technology (China), 1980MS, Southeastern Massachusetts <strong>University</strong>, 1986PhD, <strong>University</strong> <strong>of</strong> <strong>Maryland</strong>, <strong>College</strong> Park, 1991Yang, ZhongweiComputer and Information ScienceBS, Fudan <strong>University</strong> (China), 1991MS, Fudan <strong>University</strong> (China), 1994MS, Wayne State <strong>University</strong>, 1998Yearwood, Donald R.MarketingBS, U.S. Merchant Marine Academy, 1961MBA, Baruch <strong>College</strong>, City <strong>University</strong> <strong>of</strong> New York,1968Yeatman, CarolLegal StudiesBA, Washburn <strong>University</strong>JD, Northwestern School <strong>of</strong> Law <strong>of</strong> Lewis & Clark<strong>College</strong>, 1993Yu, LijiaComputer Information TechnologyBS, Shenyang <strong>College</strong> <strong>of</strong> Pharmacy, 1982MS, Shenyang <strong>College</strong> <strong>of</strong> Pharmacy, 1987PhD, Albert Einstein <strong>College</strong> <strong>of</strong> Medicine <strong>of</strong> Yeshiva<strong>University</strong>, 1993Yuan, Bill P.Business and ManagementBS, <strong>University</strong> <strong>of</strong> <strong>Maryland</strong>, <strong>College</strong> Park, 1984MS, Univerite Catholique de Louvain (Belgium),1987Yurcik, William J.Computer and Information ScienceBS, <strong>University</strong> <strong>of</strong> <strong>Maryland</strong>, <strong>College</strong> Park, 1984MS, Johns Hopkins <strong>University</strong>, 1990MA, George Washington <strong>University</strong>, 1992Ziaee, RezaComputer Information TechnologyBS, West Virginia Institute <strong>of</strong> Technology, 1981MS, Loyola <strong>College</strong> in <strong>Maryland</strong>, 1990Ziegler, Herbert L.SociologyBA, State <strong>University</strong> <strong>of</strong> New York at Stony Brook,1970MA, State <strong>University</strong> <strong>of</strong> New York at Stony Brook,1976PhD, <strong>University</strong> <strong>of</strong> <strong>Maryland</strong>, <strong>College</strong> Park, 1982Zimmer, Janet M.Information Systems ManagementBA, Briar Cliff <strong>College</strong> (Iowa), 1985MS, Johns Hopkins <strong>University</strong>, 1989Zubritsky, JohnCommunication StudiesBA, <strong>University</strong> <strong>of</strong> <strong>Maryland</strong>, <strong>College</strong> Park, 1964MA, George Washington <strong>University</strong>, 1972PhD, George Washington <strong>University</strong>, 1981289

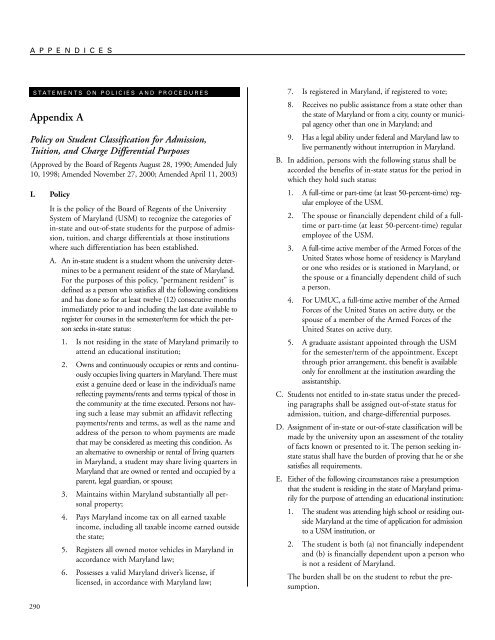

A P P E N D I C E SSTATEMENTS ON POLICIES AND PROCEDURESAppendix APolicy on Student Classification for Admission,Tuition, and Charge Differential Purposes(Approved by the Board <strong>of</strong> Regents August 28, 1990; Amended July10, 1998; Amended November 27, 2000; Amended April 11, <strong>2003</strong>)I. PolicyIt is the policy <strong>of</strong> the Board <strong>of</strong> Regents <strong>of</strong> the <strong>University</strong>System <strong>of</strong> <strong>Maryland</strong> (USM) to recognize the categories <strong>of</strong>in-state and out-<strong>of</strong>-state students for the purpose <strong>of</strong> admission,tuition, and charge differentials at those institutionswhere such differentiation has been established.A. An in-state student is a student whom the university determinesto be a permanent resident <strong>of</strong> the state <strong>of</strong> <strong>Maryland</strong>.For the purposes <strong>of</strong> this policy, “permanent resident” isdefined as a person who satisfies all the following conditionsand has done so for at least twelve (12) consecutive monthsimmediately prior to and including the last date available toregister for courses in the semester/term for which the personseeks in-state status:1. Is not residing in the state <strong>of</strong> <strong>Maryland</strong> primarily toattend an educational institution;2. Owns and continuously occupies or rents and continuouslyoccupies living quarters in <strong>Maryland</strong>. There mustexist a genuine deed or lease in the individual’s namereflecting payments/rents and terms typical <strong>of</strong> those inthe community at the time executed. Persons not havingsuch a lease may submit an affidavit reflectingpayments/rents and terms, as well as the name andaddress <strong>of</strong> the person to whom payments are madethat may be considered as meeting this condition. Asan alternative to ownership or rental <strong>of</strong> living quartersin <strong>Maryland</strong>, a student may share living quarters in<strong>Maryland</strong> that are owned or rented and occupied by aparent, legal guardian, or spouse;3. Maintains within <strong>Maryland</strong> substantially all personalproperty;4. Pays <strong>Maryland</strong> income tax on all earned taxableincome, including all taxable income earned outsidethe state;5. Registers all owned motor vehicles in <strong>Maryland</strong> inaccordance with <strong>Maryland</strong> law;6. Possesses a valid <strong>Maryland</strong> driver’s license, iflicensed, in accordance with <strong>Maryland</strong> law;7. Is registered in <strong>Maryland</strong>, if registered to vote;8. Receives no public assistance from a state other thanthe state <strong>of</strong> <strong>Maryland</strong> or from a city, county or municipalagency other than one in <strong>Maryland</strong>; and9. Has a legal ability under federal and <strong>Maryland</strong> law tolive permanently without interruption in <strong>Maryland</strong>.B. In addition, persons with the following status shall beaccorded the benefits <strong>of</strong> in-state status for the period inwhich they hold such status:1. A full-time or part-time (at least 50-percent-time) regularemployee <strong>of</strong> the USM.2. The spouse or financially dependent child <strong>of</strong> a fulltimeor part-time (at least 50-percent-time) regularemployee <strong>of</strong> the USM.3. A full-time active member <strong>of</strong> the Armed Forces <strong>of</strong> theUnited States whose home <strong>of</strong> residency is <strong>Maryland</strong>or one who resides or is stationed in <strong>Maryland</strong>, orthe spouse or a financially dependent child <strong>of</strong> sucha person.4. For UMUC, a full-time active member <strong>of</strong> the ArmedForces <strong>of</strong> the United States on active duty, or thespouse <strong>of</strong> a member <strong>of</strong> the Armed Forces <strong>of</strong> theUnited States on active duty.5. A graduate assistant appointed through the USMfor the semester/term <strong>of</strong> the appointment. Exceptthrough prior arrangement, this benefit is availableonly for enrollment at the institution awarding theassistantship.C. Students not entitled to in-state status under the precedingparagraphs shall be assigned out-<strong>of</strong>-state status foradmission, tuition, and charge-differential purposes.D. Assignment <strong>of</strong> in-state or out-<strong>of</strong>-state classification will bemade by the university upon an assessment <strong>of</strong> the totality<strong>of</strong> facts known or presented to it. The person seeking instatestatus shall have the burden <strong>of</strong> proving that he or shesatisfies all requirements.E. Either <strong>of</strong> the following circumstances raise a presumptionthat the student is residing in the state <strong>of</strong> <strong>Maryland</strong> primarilyfor the purpose <strong>of</strong> attending an educational institution:1. The student was attending high school or residing outside<strong>Maryland</strong> at the time <strong>of</strong> application for admissionto a USM institution, or2. The student is both (a) not financially independentand (b) is financially dependent upon a person whois not a resident <strong>of</strong> <strong>Maryland</strong>.The burden shall be on the student to rebut the presumption.290

- Page 2:

T A B L E O F C O N T E N T SBACHEL

- Page 6 and 7:

PRESENCE IN MARYLANDAlthough UMUC h

- Page 8 and 9:

Graduate SchoolAfter the undergradu

- Page 10 and 11:

SERVING ADULT STUDENTSUMUC understa

- Page 12 and 13:

a U.S. secondary education. While a

- Page 14 and 15:

REGISTRATIONOn SiteWays to Register

- Page 16 and 17:

Dishonored ChecksFor each check ret

- Page 18 and 19:

Learning Gained Through ExperienceL

- Page 20 and 21:

External Sources of College Credit(

- Page 22 and 23:

B A C H E L O R ’ S D E G R E E R

- Page 24 and 25:

CROSS-CURRICULAR REQUIREMENTS (9 S.

- Page 26 and 27:

Overall Bachelor’s Degree Require

- Page 28 and 29:

International PerspectiveAny foreig

- Page 30 and 31:

Civic ResponsibilityAASP 201 Introd

- Page 32 and 33:

PROGRAM CHOICES (continued)Discipli

- Page 34 and 35:

DESCRIPTIONS OF MAJORS AND MINORSAc

- Page 36 and 37:

Requirements for the MinorA minor i

- Page 38 and 39:

Supplemental Major Courses (12 s.h.

- Page 40 and 41:

Requirements for the MajorA major i

- Page 42 and 43:

BMGT 394 Real Estate Principles II

- Page 44 and 45:

•Employ critical-thinking, analyt

- Page 46 and 47:

•Apply media and techniques appro

- Page 48 and 49:

Minor in Communication StudiesThe c

- Page 50 and 51:

Computer InformationTechnologyStude

- Page 52 and 53:

Computer StudiesStudents may seek e

- Page 54 and 55:

Criminal Justice Issues Courses (6

- Page 56 and 57:

For a listing of all the requiremen

- Page 58 and 59:

•Develop comprehensive environmen

- Page 60 and 61:

For a listing of all the requiremen

- Page 62 and 63:

Requirements for the MinorA minor i

- Page 64 and 65:

Government and PoliticsStudents may

- Page 66 and 67:

HIST 480 History of Traditional Chi

- Page 68 and 69:

ObjectivesThe student who graduates

- Page 70 and 71:

Human Resource Management Coursewor

- Page 72 and 73:

ObjectivesThe student who graduates

- Page 74 and 75:

•Integrate the emerging online ma

- Page 76 and 77:

•Develop effective written and or

- Page 78 and 79:

Mathematics Coursework (17 s.h.)Req

- Page 80 and 81:

PsychologyStudents may seek either

- Page 82 and 83:

Social Science Coursework (30 s.h.)

- Page 84 and 85:

Strategic andEntrepreneurialManagem

- Page 86 and 87:

A S S O C I A T E ’ S D E G R E E

- Page 88 and 89:

Legal StudiesMathematicsRequired Fo

- Page 90 and 91:

C E R T I F I C A T E P R O G R A M

- Page 92 and 93:

Bio-SecurityThe Bio-Security certif

- Page 94 and 95:

Customer ServiceManagementThe Custo

- Page 96 and 97:

E-Commerce ManagementThe E-Commerce

- Page 98 and 99:

Information ManagementThe Informati

- Page 100 and 101:

Program CoursesRequired CoursesStud

- Page 102 and 103:

Program CoursesStudents must take t

- Page 104 and 105:

Visual Basic ProgrammingThe Visual

- Page 106 and 107:

I N F O R M A T I O N O N C O U R S

- Page 108 and 109:

UNDERGRADUATE COURSESThe following

- Page 110 and 111:

ACCT 427 Advanced Auditing (3)Prere

- Page 112 and 113:

ANTH 398I Death and Dying: Cross-Cu

- Page 114 and 115:

ARTT 458 Graphic Design andIllustra

- Page 116 and 117:

ARTH 486A Internship in Art History

- Page 118 and 119:

ASTR 486B Internship in AstronomyTh

- Page 120 and 121:

Biological ScienceCourses in biolog

- Page 122 and 123:

BIOL 304 The Biology of Cancer (3)(

- Page 124 and 125:

BIOL 420 Epidemiology and PublicHea

- Page 126 and 127:

BMGT 305 Knowledge Management (3)(C

- Page 128 and 129:

BMGT 339 Government and BusinessCon

- Page 130 and 131:

BMGT 372 Introduction to LogisticsM

- Page 132 and 133:

BMGT 412 Program Analysis andEvalua

- Page 134 and 135:

BMGT 487 Project Management I (3)(T

- Page 136 and 137:

CHEM 233 Organic Chemistry I (4)(Fu

- Page 138 and 139:

COMM 395 Writing in the HealthProfe

- Page 140 and 141:

CMIS 102 Introduction to Problem So

- Page 142 and 143:

CMIS 415 Advanced UNIX and C (3)Pre

- Page 144 and 145:

Computer InformationTechnologyCours

- Page 146 and 147:

CMIT 480 Designing Security for a W

- Page 148 and 149:

CMSC 150 Introduction to DiscreteSt

- Page 150 and 151:

CMSC 486B Internship in Computer Sc

- Page 152 and 153:

CMST 100N Introduction to Microcomp

- Page 154 and 155:

CMST 486A Internship in Computer St

- Page 156 and 157:

CCJS 352 Drugs and Crime (3)Prerequ

- Page 158 and 159:

CCJS 486A Internship in Criminal Ju

- Page 160 and 161:

ECON 307 Development of Economic Id

- Page 162 and 163:

EDCP 101X Effective Writing Skills

- Page 164 and 165:

ENGL 345 Modern Poetry (3)(Not open

- Page 166 and 167:

ENGL 483 Creative Writing: Writing

- Page 168 and 169:

ENMT 330 Environmental Monitoring a

- Page 170 and 171:

FSCN 302 Advanced Fire Administrati

- Page 172 and 173:

GerontologyCourses in gerontology (

- Page 174 and 175:

GERO 351 Management of Senior Housi

- Page 176 and 177:

GERO 495L Movement, Stress Manageme

- Page 178 and 179:

GVPT 199H Conflicts in Contemporary

- Page 180 and 181:

GVPT 377L U.N. Peacekeeping (1)A st

- Page 182 and 183:

GVPT 399T National Security Secrets

- Page 184 and 185:

GVPT 451 Foreign Policy of Russia a

- Page 186 and 187:

GVPT 498X Terrorism, Antiterrorism,

- Page 188 and 189:

HIST 372 Legacy of the Civil Rights

- Page 190 and 191:

HIST 486B Internship in History Thr

- Page 192 and 193:

HUMN 375 Social History ofWashingto

- Page 194 and 195:

HRMN 392 Stress Management inOrgani

- Page 196 and 197:

IFSM 204 History and Future Trends

- Page 198 and 199:

IFSM 446 Java-Based Information Sys

- Page 200 and 201:

JOUR 331 Public Relations Technique

- Page 202 and 203:

drafting and preparing simple wills

- Page 204 and 205:

procedures involved in U.S. immigra

- Page 206 and 207:

MGST 162 Personnel Counseling (3)A

- Page 208 and 209:

MRKT 357 Marketing Public Relations

- Page 210 and 211:

MRKT 475 Sales Management (3)Prereq

- Page 212 and 213:

MATH 220 Elementary Calculus I (3)P

- Page 214 and 215:

MusicCourses in music (designated M

- Page 216 and 217:

PHIL 140 Contemporary Moral Issues

- Page 218 and 219:

PSYC 307 Special Topics in Psycholo

- Page 220 and 221:

PSYC 309H Psychological Consequence

- Page 222 and 223:

PSYC 354 Cross-Cultural Psychology

- Page 224 and 225:

PSYC 451 Principles of Psychologica

- Page 226 and 227:

SOCY 331 Work, Bureaucracy, andIndu

- Page 228 and 229:

SOCY 498I Applied Sociology (3)A pr

- Page 230 and 231:

SPCH 420 Group Discussion and Decis

- Page 232 and 233:

STAT 486B Internship in Statistics

- Page 234 and 235:

A passing grade is recorded on the

- Page 236 and 237:

of credits may exceed 12. An academ

- Page 238 and 239:

Code of Student ConductStudents are

- Page 240 and 241: enables them to change personal inf

- Page 242 and 243: time undergraduate students. For mo

- Page 244 and 245: ment. Other veterans who were volun

- Page 246 and 247: STUDENT ADVISORY COUNCILThe Student

- Page 248 and 249: TutoringA number of online, on-site

- Page 250 and 251: School of Undergraduate StudiesOffi

- Page 252 and 253: Melissa Zupancic John, Student Rela

- Page 254 and 255: London OfficeAddresses• From over

- Page 256 and 257: Okinawa OfficeAddresses• From ove

- Page 258 and 259: Attaway, JohnBusiness and Managemen

- Page 260 and 261: Bonfigli, Michael C.JournalismBA, U

- Page 262 and 263: Chargois, Cynthia A.Health Services

- Page 264 and 265: Daston, Melissa G.MarketingBA, Duke

- Page 266 and 267: Fekete, GyorgyComputer and Informat

- Page 268 and 269: Greene, Melvin A.Business and Manag

- Page 270 and 271: Hernandez, GemaGerontologyBA, Unive

- Page 272 and 273: Jarc, Duane J.Computer and Informat

- Page 274 and 275: Kuang, LinComputer StudiesBS, Heilo

- Page 276 and 277: Mangold, Sanford D.Business and Man

- Page 278 and 279: Motes, Michael J.AccountingBS, Corn

- Page 280 and 281: Patterson, Thomas H.Library SkillsB

- Page 282 and 283: Redcay, Miriam R.Business and Manag

- Page 284 and 285: Scheffler, Elizabeth R.AccountingBS

- Page 286 and 287: Stein, Shelly K.SpeechBA, Universit

- Page 288 and 289: Van Brunt, John E.Experiential Lear

- Page 292 and 293: II.ProceduresA. An initial determin

- Page 294 and 295: III.Admission of Transfer Students

- Page 296 and 297: VI.F. A sending institution shall d

- Page 298 and 299: IX.Transfer Mediation CommitteeA. T

- Page 300 and 301: Minimum Number of Credits Required

- Page 302 and 303: Financial Aid Denied StatusStudents

- Page 304 and 305: . If, as a result of the hearing, t

- Page 306 and 307: Maryland AlliancesAACC-UMUC Allianc

- Page 308 and 309: Asiacontacts in, 253sites in, 16Asi

- Page 310 and 311: EE-commercecertificate programs in,

- Page 312 and 313: Journalismcourse descriptions, 198m

- Page 314 and 315: SSales, track in, 75Satisfactory/D/

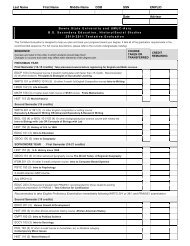

- Page 316 and 317: A P P L I C A T I O N F O R A D M I

- Page 318 and 319: Application for Admission Page 3Nam

- Page 320 and 321: C U R R I C U L U M P L A N N I N G

- Page 322: University of Maryland University C