PacifiCorp 2007 Integrated Resource Plan (May 30, 2007)

PacifiCorp 2007 Integrated Resource Plan (May 30, 2007)

PacifiCorp 2007 Integrated Resource Plan (May 30, 2007)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

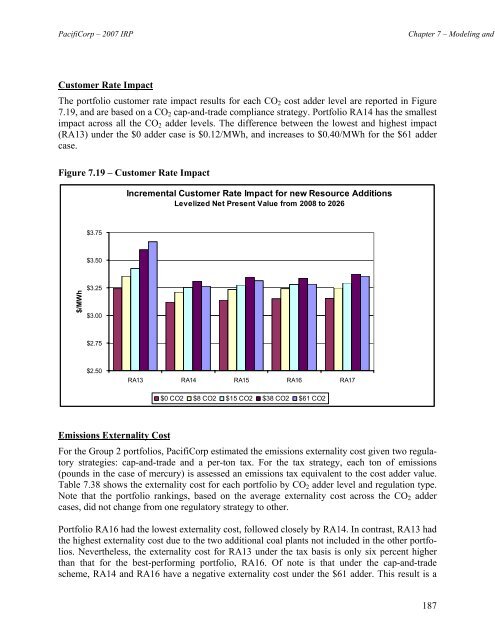

<strong>PacifiCorp</strong> – <strong>2007</strong> IRPChapter 7 – Modeling andCustomer Rate ImpactThe portfolio customer rate impact results for each CO 2 cost adder level are reported in Figure7.19, and are based on a CO 2 cap-and-trade compliance strategy. Portfolio RA14 has the smallestimpact across all the CO 2 adder levels. The difference between the lowest and highest impact(RA13) under the $0 adder case is $0.12/MWh, and increases to $0.40/MWh for the $61 addercase.Figure 7.19 – Customer Rate ImpactIncremental Customer Rate Impact for new <strong>Resource</strong> AdditionsLevelized Net Present Value from 2008 to 2026$3.75$3.50$/MWh$3.25$3.00$2.75$2.50RA13 RA14 RA15 RA16 RA17$0 CO2 $8 CO2 $15 CO2 $38 CO2 $61 CO2Emissions Externality CostFor the Group 2 portfolios, <strong>PacifiCorp</strong> estimated the emissions externality cost given two regulatorystrategies: cap-and-trade and a per-ton tax. For the tax strategy, each ton of emissions(pounds in the case of mercury) is assessed an emissions tax equivalent to the cost adder value.Table 7.38 shows the externality cost for each portfolio by CO 2 adder level and regulation type.Note that the portfolio rankings, based on the average externality cost across the CO 2 addercases, did not change from one regulatory strategy to other.Portfolio RA16 had the lowest externality cost, followed closely by RA14. In contrast, RA13 hadthe highest externality cost due to the two additional coal plants not included in the other portfolios.Nevertheless, the externality cost for RA13 under the tax basis is only six percent higherthan that for the best-performing portfolio, RA16. Of note is that under the cap-and-tradescheme, RA14 and RA16 have a negative externality cost under the $61 adder. This result is a187