PacifiCorp 2007 Integrated Resource Plan (May 30, 2007)

PacifiCorp 2007 Integrated Resource Plan (May 30, 2007)

PacifiCorp 2007 Integrated Resource Plan (May 30, 2007)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

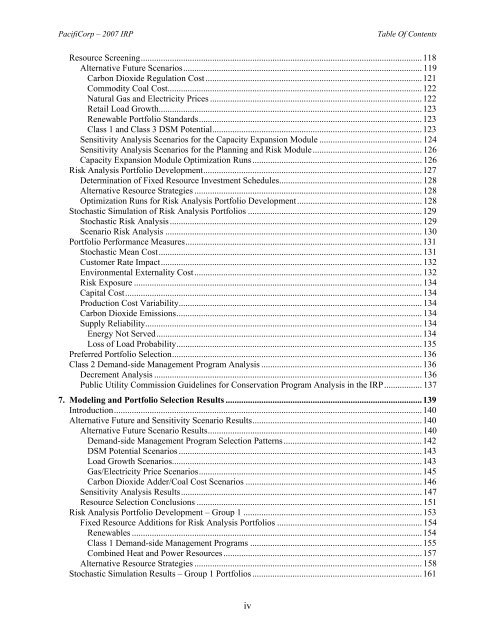

<strong>PacifiCorp</strong> – <strong>2007</strong> IRPTable Of Contents<strong>Resource</strong> Screening..............................................................................................................................118Alternative Future Scenarios........................................................................................................... 119Carbon Dioxide Regulation Cost .................................................................................................121Commodity Coal Cost..................................................................................................................122Natural Gas and Electricity Prices ...............................................................................................122Retail Load Growth......................................................................................................................123Renewable Portfolio Standards....................................................................................................123Class 1 and Class 3 DSM Potential..............................................................................................123Sensitivity Analysis Scenarios for the Capacity Expansion Module .............................................. 124Sensitivity Analysis Scenarios for the <strong>Plan</strong>ning and Risk Module................................................. 126Capacity Expansion Module Optimization Runs ............................................................................ 126Risk Analysis Portfolio Development..................................................................................................127Determination of Fixed <strong>Resource</strong> Investment Schedules................................................................ 128Alternative <strong>Resource</strong> Strategies ...................................................................................................... 128Optimization Runs for Risk Analysis Portfolio Development........................................................ 128Stochastic Simulation of Risk Analysis Portfolios ..............................................................................129Stochastic Risk Analysis................................................................................................................. 129Scenario Risk Analysis ................................................................................................................... 1<strong>30</strong>Portfolio Performance Measures..........................................................................................................131Stochastic Mean Cost...................................................................................................................... 131Customer Rate Impact..................................................................................................................... 132Environmental Externality Cost...................................................................................................... 132Risk Exposure ................................................................................................................................. 134Capital Cost..................................................................................................................................... 134Production Cost Variability............................................................................................................. 134Carbon Dioxide Emissions.............................................................................................................. 134Supply Reliability............................................................................................................................ 134Energy Not Served.......................................................................................................................134Loss of Load Probability..............................................................................................................135Preferred Portfolio Selection................................................................................................................136Class 2 Demand-side Management Program Analysis ........................................................................136Decrement Analysis ........................................................................................................................ 136Public Utility Commission Guidelines for Conservation Program Analysis in the IRP................. 1377. Modeling and Portfolio Selection Results ........................................................................................139Introduction..........................................................................................................................................140Alternative Future and Sensitivity Scenario Results............................................................................140Alternative Future Scenario Results................................................................................................ 140Demand-side Management Program Selection Patterns..............................................................142DSM Potential Scenarios .............................................................................................................143Load Growth Scenarios................................................................................................................143Gas/Electricity Price Scenarios....................................................................................................145Carbon Dioxide Adder/Coal Cost Scenarios ...............................................................................146Sensitivity Analysis Results............................................................................................................ 147<strong>Resource</strong> Selection Conclusions ..................................................................................................... 151Risk Analysis Portfolio Development – Group 1 ................................................................................153Fixed <strong>Resource</strong> Additions for Risk Analysis Portfolios ................................................................. 154Renewables ..................................................................................................................................154Class 1 Demand-side Management Programs .............................................................................155Combined Heat and Power <strong>Resource</strong>s.........................................................................................157Alternative <strong>Resource</strong> Strategies ...................................................................................................... 158Stochastic Simulation Results – Group 1 Portfolios ............................................................................161iv