Liberal Arts and Science - Manchester Community College ...

Liberal Arts and Science - Manchester Community College ...

Liberal Arts and Science - Manchester Community College ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CERTIFICATES<br />

Personal Financial Planning, Certificate<br />

Program Design<br />

The Personal Financial Planning certificate program is principally designed for<br />

individuals employed in financial planning or in areas related to the financial services<br />

industry. Students entering this program are assumed to have a business<br />

foundation gained either through college instruction or on-the-job learning.<br />

Student population for this program is likely to include:<br />

• Financial planning practitioners looking to update <strong>and</strong> strengthen their<br />

knowledge or broaden their base.<br />

• Practitioners interested in earning the CFP® professional designation.<br />

• Employees in financial institutions seeking professional development.<br />

• Mature employees seeking a career change.<br />

• <strong>Liberal</strong> arts college graduates seeking courses in financial planning.<br />

• Students <strong>and</strong> graduates from business programs who are interested<br />

in financial planning courses not offered by their institutions.<br />

• Adult learners returning to the labor force who are interested in working<br />

in the financial services industry.<br />

Students who complete each course successfully <strong>and</strong> who meet all other certification<br />

requirements may be eligible to sit for the national Certified Financial<br />

Planner (CFP) exam, administered by the CFP Board of St<strong>and</strong>ards.<br />

To sit for this comprehensive exam, a student must complete a minimum of<br />

60 semester credit hours of college level education <strong>and</strong> a fee must be paid to<br />

the CFP Board. Anyone considering seeking the CFP designation must meet<br />

individually with the program coordinator to be advised of CFP procedures<br />

<strong>and</strong> certification requirements.<br />

Curriculum<br />

The program may be completed on a part-time basis over three regular semesters.<br />

Evening courses will be offered during the fall <strong>and</strong> spring semesters.<br />

Students should have a financial calculator capable of computing internal rate<br />

of return (IRR) to successfully complete the program.<br />

Note: Students enrolled in the Personal Financial Planning certificate program<br />

may be interested in a dual certificate in Taxation. With the completion of two<br />

additional courses, students may complete a dual certificate in taxation <strong>and</strong> sit<br />

for the Enrolled Agent Examination. Please see the Taxation certificate requirements<br />

on page 104. People coming from a non-business background should<br />

seek the counseling of the department chairperson or program coordinator.<br />

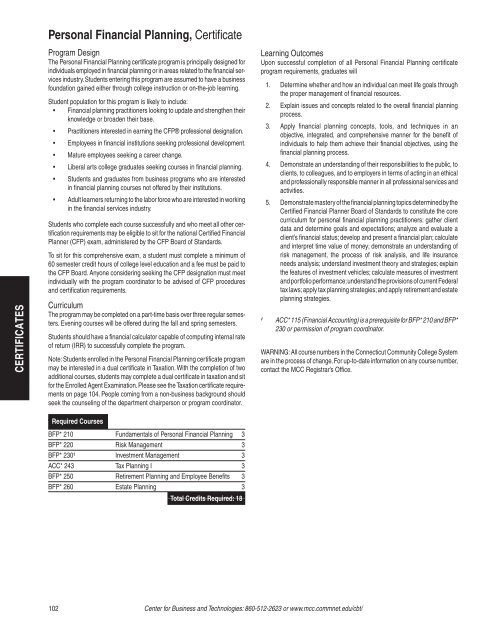

Required Courses<br />

BFP* 210 Fundamentals of Personal Financial Planning 3<br />

BFP* 220 Risk Management 3<br />

BFP* 230 ‡ Investment Management 3<br />

ACC* 243 Tax Planning I 3<br />

BFP* 250 Retirement Planning <strong>and</strong> Employee Benefits 3<br />

BFP* 260 Estate Planning 3<br />

102<br />

Total Credits Required: 18<br />

Learning Outcomes<br />

Upon successful completion of all Personal Financial Planning certificate<br />

program requirements, graduates will<br />

1. Determine whether <strong>and</strong> how an individual can meet life goals through<br />

the proper management of financial resources.<br />

2. Explain issues <strong>and</strong> concepts related to the overall financial planning<br />

process.<br />

3. Apply financial planning concepts, tools, <strong>and</strong> techniques in an<br />

objective, integrated, <strong>and</strong> comprehensive manner for the benefit of<br />

individuals to help them achieve their financial objectives, using the<br />

financial planning process.<br />

4. Demonstrate an underst<strong>and</strong>ing of their responsibilities to the public, to<br />

clients, to colleagues, <strong>and</strong> to employers in terms of acting in an ethical<br />

<strong>and</strong> professionally responsible manner in all professional services <strong>and</strong><br />

activities.<br />

5. Demonstrate mastery of the financial planning topics determined by the<br />

Certified Financial Planner Board of St<strong>and</strong>ards to constitute the core<br />

curriculum for personal financial planning practitioners: gather client<br />

data <strong>and</strong> determine goals <strong>and</strong> expectations; analyze <strong>and</strong> evaluate a<br />

client’s financial status; develop <strong>and</strong> present a financial plan; calculate<br />

<strong>and</strong> interpret time value of money; demonstrate an underst<strong>and</strong>ing of<br />

risk management, the process of risk analysis, <strong>and</strong> life insurance<br />

needs analysis; underst<strong>and</strong> investment theory <strong>and</strong> strategies; explain<br />

the features of investment vehicles; calculate measures of investment<br />

<strong>and</strong> portfolio performance; underst<strong>and</strong> the provisions of current Federal<br />

tax laws; apply tax planning strategies; <strong>and</strong> apply retirement <strong>and</strong> estate<br />

planning strategies.<br />

‡ ACC* 115 (Financial Accounting) is a prerequisite for BFP* 210 <strong>and</strong> BFP*<br />

230 or permission of program coordinator.<br />

WARNING: All course numbers in the Connecticut <strong>Community</strong> <strong>College</strong> System<br />

are in the process of change. For up-to-date information on any course number,<br />

contact the MCC Registrar’s Office.<br />

Center for Business <strong>and</strong> Technologies: 860-512-2623 or www.mcc.commnet.edu/cbt/