Liberal Arts and Science - Manchester Community College ...

Liberal Arts and Science - Manchester Community College ...

Liberal Arts and Science - Manchester Community College ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

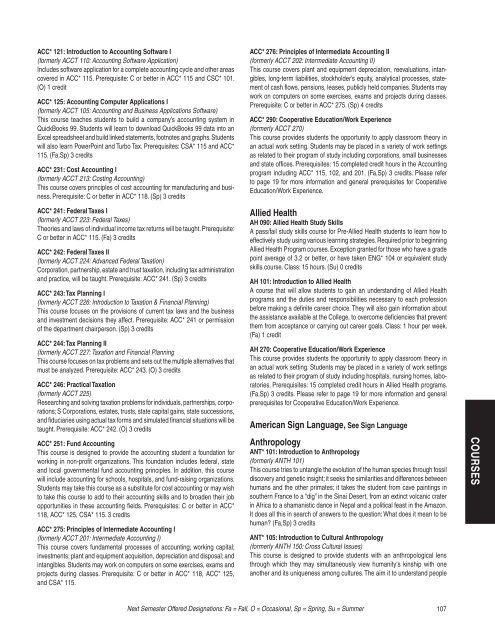

ACC* 121: Introduction to Accounting Software I<br />

(formerly ACCT 110: Accounting Software Application)<br />

Includes software application for a complete accounting cycle <strong>and</strong> other areas<br />

covered in ACC* 115. Prerequisite: C or better in ACC* 115 <strong>and</strong> CSC* 101.<br />

(O) 1 credit<br />

ACC* 125: Accounting Computer Applications I<br />

(formerly ACCT 105: Accounting <strong>and</strong> Business Applications Software)<br />

This course teaches students to build a company’s accounting system in<br />

QuickBooks 99. Students will learn to download QuickBooks 99 data into an<br />

Excel spreadsheet <strong>and</strong> build linked statements, footnotes <strong>and</strong> graphs. Students<br />

will also learn PowerPoint <strong>and</strong> Turbo Tax. Prerequisites: CSA* 115 <strong>and</strong> ACC*<br />

115. (Fa,Sp) 3 credits<br />

ACC* 231: Cost Accounting I<br />

(formerly ACCT 213: Costing Accounting)<br />

This course covers principles of cost accounting for manufacturing <strong>and</strong> business.<br />

Prerequisite: C or better in ACC* 118. (Sp) 3 credits<br />

ACC* 241: Federal Taxes I<br />

(formerly ACCT 223: Federal Taxes)<br />

Theories <strong>and</strong> laws of individual income tax returns will be taught. Prerequisite:<br />

C or better in ACC* 115. (Fa) 3 credits<br />

ACC* 242: Federal Taxes II<br />

(formerly ACCT 224: Advanced Federal Taxation)<br />

Corporation, partnership, estate <strong>and</strong> trust taxation, including tax administration<br />

<strong>and</strong> practice, will be taught. Prerequisite: ACC* 241. (Sp) 3 credits<br />

ACC* 243: Tax Planning I<br />

(formerly ACCT 226: Introduction to Taxation & Financial Planning)<br />

This course focuses on the provisions of current tax laws <strong>and</strong> the business<br />

<strong>and</strong> investment decisions they affect. Prerequisite: ACC* 241 or permission<br />

of the department chairperson. (Sp) 3 credits<br />

ACC* 244: Tax Planning II<br />

(formerly ACCT 227: Taxation <strong>and</strong> Financial Planning<br />

This course focuses on tax problems <strong>and</strong> sets out the multiple alternatives that<br />

must be analyzed. Prerequisite: ACC* 243. (O) 3 credits<br />

ACC* 246: Practical Taxation<br />

(formerly ACCT 225)<br />

Researching <strong>and</strong> solving taxation problems for individuals, partnerships, corporations;<br />

S Corporations, estates, trusts, state capital gains, state successions,<br />

<strong>and</strong> fiduciaries using actual tax forms <strong>and</strong> simulated financial situations will be<br />

taught. Prerequisite: ACC* 242. (O) 3 credits<br />

ACC* 251: Fund Accounting<br />

This course is designed to provide the accounting student a foundation for<br />

working in non-profit organizations. This foundation includes federal, state<br />

<strong>and</strong> local governmental fund accounting principles. In addition, this course<br />

will include accounting for schools, hospitals, <strong>and</strong> fund-raising organizations.<br />

Students may take this course as a substitute for cost accounting or may wish<br />

to take this course to add to their accounting skills <strong>and</strong> to broaden their job<br />

opportunities in these accounting fields. Prerequisites: C or better in ACC*<br />

118, ACC* 125, CSA* 115. 3 credits<br />

ACC* 275: Principles of Intermediate Accounting I<br />

(formerly ACCT 201: Intermediate Accounting I)<br />

This course covers fundamental processes of accounting; working capital;<br />

investments; plant <strong>and</strong> equipment acquisition, depreciation <strong>and</strong> disposal; <strong>and</strong><br />

intangibles. Students may work on computers on some exercises, exams <strong>and</strong><br />

projects during classes. Prerequisite: C or better in ACC* 118, ACC* 125,<br />

<strong>and</strong> CSA* 115.<br />

ACC* 276: Principles of Intermediate Accounting II<br />

(formerly ACCT 202: Intermediate Accounting II)<br />

This course covers plant <strong>and</strong> equipment depreciation, reevaluations, intangibles,<br />

long-term liabilities, stockholder’s equity, analytical processes, statement<br />

of cash flows, pensions, leases, publicly held companies. Students may<br />

work on computers on some exercises, exams <strong>and</strong> projects during classes.<br />

Prerequisite: C or better in ACC* 275. (Sp) 4 credits<br />

ACC* 290: Cooperative Education/Work Experience<br />

(formerly ACCT 270)<br />

This course provides students the opportunity to apply classroom theory in<br />

an actual work setting. Students may be placed in a variety of work settings<br />

as related to their program of study including corporations, small businesses<br />

<strong>and</strong> state offices. Prerequisites: 15 completed credit hours in the Accounting<br />

program including ACC* 115, 102, <strong>and</strong> 201. (Fa,Sp) 3 credits. Please refer<br />

to page 19 for more information <strong>and</strong> general prerequisites for Cooperative<br />

Education/Work Experience.<br />

Allied Health<br />

AH 090: Allied Health Study Skills<br />

A pass/fail study skills course for Pre-Allied Health students to learn how to<br />

effectively study using various learning strategies. Required prior to beginning<br />

Allied Health Program courses. Exception granted for those who have a grade<br />

point average of 3.2 or better, or have taken ENG* 104 or equivalent study<br />

skills course. Class: 15 hours. (Su) 0 credits<br />

AH 101: Introduction to Allied Health<br />

A course that will allow students to gain an underst<strong>and</strong>ing of Allied Health<br />

programs <strong>and</strong> the duties <strong>and</strong> responsibilities necessary to each profession<br />

before making a definite career choice. They will also gain information about<br />

the assistance available at the <strong>College</strong>, to overcome deficiencies that prevent<br />

them from acceptance or carrying out career goals. Class: 1 hour per week.<br />

(Fa) 1 credit<br />

AH 270: Cooperative Education/Work Experience<br />

This course provides students the opportunity to apply classroom theory in<br />

an actual work setting. Students may be placed in a variety of work settings<br />

as related to their program of study including hospitals, nursing homes, laboratories.<br />

Prerequisites: 15 completed credit hours in Allied Health programs.<br />

(Fa,Sp) 3 credits. Please refer to page 19 for more information <strong>and</strong> general<br />

prerequisites for Cooperative Education/Work Experience.<br />

American Sign Language, See Sign Language<br />

Anthropology<br />

ANT* 101: Introduction to Anthropology<br />

(formerly ANTH 101)<br />

This course tries to untangle the evolution of the human species through fossil<br />

discovery <strong>and</strong> genetic insight; it seeks the similarities <strong>and</strong> differences between<br />

humans <strong>and</strong> the other primates; it takes the student from cave paintings in<br />

southern France to a “dig” in the Sinai Desert, from an extinct volcanic crater<br />

in Africa to a shamanistic dance in Nepal <strong>and</strong> a political feast in the Amazon.<br />

It does all this in search of answers to the question: What does it mean to be<br />

human? (Fa,Sp) 3 credits<br />

ANT* 105: Introduction to Cultural Anthropology<br />

(formerly ANTH 150: Cross Cultural Issues)<br />

This course is designed to provide students with an anthropological lens<br />

through which they may simultaneously view humanity‘s kinship with one<br />

another <strong>and</strong> its uniqueness among cultures. The aim it to underst<strong>and</strong> people<br />

Next Semester Offered Designations: Fa = Fall, O = Occasional, Sp = Spring, Su = Summer 107<br />

COURSES