Liberal Arts and Science - Manchester Community College ...

Liberal Arts and Science - Manchester Community College ...

Liberal Arts and Science - Manchester Community College ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

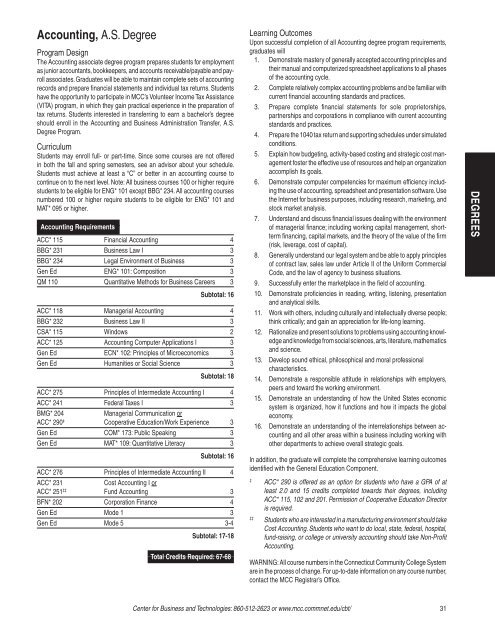

Accounting, A.S. Degree<br />

Program Design<br />

The Accounting associate degree program prepares students for employment<br />

as junior accountants, bookkeepers, <strong>and</strong> accounts receivable/payable <strong>and</strong> payroll<br />

associates. Graduates will be able to maintain complete sets of accounting<br />

records <strong>and</strong> prepare financial statements <strong>and</strong> individual tax returns. Students<br />

have the opportunity to participate in MCC’s Volunteer Income Tax Assistance<br />

(VITA) program, in which they gain practical experience in the preparation of<br />

tax returns. Students interested in transferring to earn a bachelor’s degree<br />

should enroll in the Accounting <strong>and</strong> Business Administration Transfer, A.S.<br />

Degree Program.<br />

Curriculum<br />

Students may enroll full- or part-time. Since some courses are not offered<br />

in both the fall <strong>and</strong> spring semesters, see an advisor about your schedule.<br />

Students must achieve at least a “C” or better in an accounting course to<br />

continue on to the next level. Note: All business courses 100 or higher require<br />

students to be eligible for ENG* 101 except BBG* 234. All accounting courses<br />

numbered 100 or higher require students to be eligible for ENG* 101 <strong>and</strong><br />

MAT* 095 or higher.<br />

Accounting Requirements<br />

ACC* 115 Financial Accounting 4<br />

BBG* 231 Business Law I 3<br />

BBG* 234 Legal Environment of Business 3<br />

Gen Ed ENG* 101: Composition 3<br />

QM 110 Quantitative Methods for Business Careers 3<br />

Subtotal: 16<br />

ACC* 118 Managerial Accounting 4<br />

BBG* 232 Business Law II 3<br />

CSA* 115 Windows 2<br />

ACC* 125 Accounting Computer Applications I 3<br />

Gen Ed ECN* 102: Principles of Microeconomics 3<br />

Gen Ed Humanities or Social <strong>Science</strong> 3<br />

Subtotal: 18<br />

ACC* 275 Principles of Intermediate Accounting I 4<br />

ACC* 241 Federal Taxes I 3<br />

BMG* 204 Managerial Communication or<br />

ACC* 290 ‡ Cooperative Education/Work Experience 3<br />

Gen Ed COM* 173: Public Speaking 3<br />

Gen Ed MAT* 109: Quantitative Literacy 3<br />

Subtotal: 16<br />

ACC* 276 Principles of Intermediate Accounting II 4<br />

ACC* 231 Cost Accounting I or<br />

ACC* 251 ‡‡ Fund Accounting 3<br />

BFN* 202 Corporation Finance 4<br />

Gen Ed Mode 1 3<br />

Gen Ed Mode 5 3-4<br />

Subtotal: 17-18<br />

Total Credits Required: 67-68<br />

Learning Outcomes<br />

Upon successful completion of all Accounting degree program requirements,<br />

graduates will<br />

1. Demonstrate mastery of generally accepted accounting principles <strong>and</strong><br />

their manual <strong>and</strong> computerized spreadsheet applications to all phases<br />

of the accounting cycle.<br />

2. Complete relatively complex accounting problems <strong>and</strong> be familiar with<br />

current financial accounting st<strong>and</strong>ards <strong>and</strong> practices.<br />

3. Prepare complete financial statements for sole proprietorships,<br />

partnerships <strong>and</strong> corporations in compliance with current accounting<br />

st<strong>and</strong>ards <strong>and</strong> practices.<br />

4. Prepare the 1040 tax return <strong>and</strong> supporting schedules under simulated<br />

conditions.<br />

5. Explain how budgeting, activity-based costing <strong>and</strong> strategic cost management<br />

foster the effective use of resources <strong>and</strong> help an organization<br />

accomplish its goals.<br />

6. Demonstrate computer competencies for maximum efficiency including<br />

the use of accounting, spreadsheet <strong>and</strong> presentation software. Use<br />

the Internet for business purposes, including research, marketing, <strong>and</strong><br />

stock market analysis.<br />

7. Underst<strong>and</strong> <strong>and</strong> discuss financial issues dealing with the environment<br />

of managerial finance; including working capital management, shortterm<br />

financing, capital markets, <strong>and</strong> the theory of the value of the firm<br />

(risk, leverage, cost of capital).<br />

8. Generally underst<strong>and</strong> our legal system <strong>and</strong> be able to apply principles<br />

of contract law, sales law under Article II of the Uniform Commercial<br />

Code, <strong>and</strong> the law of agency to business situations.<br />

9. Successfully enter the marketplace in the field of accounting.<br />

10. Demonstrate proficiencies in reading, writing, listening, presentation<br />

<strong>and</strong> analytical skills.<br />

11. Work with others, including culturally <strong>and</strong> intellectually diverse people;<br />

think critically; <strong>and</strong> gain an appreciation for life-long learning.<br />

12. Rationalize <strong>and</strong> present solutions to problems using accounting knowledge<br />

<strong>and</strong> knowledge from social sciences, arts, literature, mathematics<br />

<strong>and</strong> science.<br />

13. Develop sound ethical, philosophical <strong>and</strong> moral professional<br />

characteristics.<br />

14. Demonstrate a responsible attitude in relationships with employers,<br />

peers <strong>and</strong> toward the working environment.<br />

15. Demonstrate an underst<strong>and</strong>ing of how the United States economic<br />

system is organized, how it functions <strong>and</strong> how it impacts the global<br />

economy.<br />

16. Demonstrate an underst<strong>and</strong>ing of the interrelationships between accounting<br />

<strong>and</strong> all other areas within a business including working with<br />

other departments to achieve overall strategic goals.<br />

In addition, the graduate will complete the comprehensive learning outcomes<br />

identified with the General Education Component.<br />

‡ ACC* 290 is offered as an option for students who have a GPA of at<br />

least 2.0 <strong>and</strong> 15 credits completed towards their degrees, including<br />

ACC* 115, 102 <strong>and</strong> 201. Permission of Cooperative Education Director<br />

is required.<br />

‡‡ Students who are interested in a manufacturing environment should take<br />

Cost Accounting. Students who want to do local, state, federal, hospital,<br />

fund-raising, or college or university accounting should take Non-Profit<br />

Accounting.<br />

WARNING: All course numbers in the Connecticut <strong>Community</strong> <strong>College</strong> System<br />

are in the process of change. For up-to-date information on any course number,<br />

contact the MCC Registrar’s Office.<br />

Center for Business <strong>and</strong> Technologies: 860-512-2623 or www.mcc.commnet.edu/cbt/<br />

31<br />

DEGREES