Liberal Arts and Science - Manchester Community College ...

Liberal Arts and Science - Manchester Community College ...

Liberal Arts and Science - Manchester Community College ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CERTIFICATES<br />

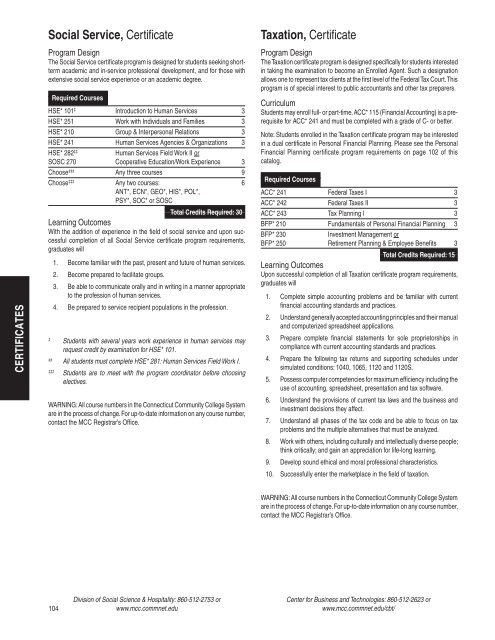

Social Service, Certificate<br />

Program Design<br />

The Social Service certificate program is designed for students seeking shortterm<br />

academic <strong>and</strong> in-service professional development, <strong>and</strong> for those with<br />

extensive social service experience or an academic degree.<br />

Required Courses<br />

HSE* 101 ‡ Introduction to Human Services 3<br />

HSE* 251 Work with Individuals <strong>and</strong> Families 3<br />

HSE* 210 Group & Interpersonal Relations 3<br />

HSE* 241 Human Services Agencies & Organizations 3<br />

HSE* 282 ‡‡ Human Services Field Work II or<br />

SOSC 270 Cooperative Education/Work Experience 3<br />

Choose ‡‡‡ Any three courses 9<br />

Choose ‡‡‡ Any two courses: 6<br />

ANT*, ECN*, GEO*, HIS*, POL*,<br />

PSY*, SOC* or SOSC<br />

Total Credits Required: 30<br />

Learning Outcomes<br />

With the addition of experience in the field of social service <strong>and</strong> upon successful<br />

completion of all Social Service certificate program requirements,<br />

graduates will<br />

1. Become familiar with the past, present <strong>and</strong> future of human services.<br />

2. Become prepared to facilitate groups.<br />

3. Be able to communicate orally <strong>and</strong> in writing in a manner appropriate<br />

to the profession of human services.<br />

4. Be prepared to service recipient populations in the profession.<br />

‡ Students with several years work experience in human services may<br />

request credit by examination for HSE* 101.<br />

‡‡ All students must complete HSE* 281: Human Services Field Work I.<br />

‡‡‡ Students are to meet with the program coordinator before choosing<br />

104<br />

electives.<br />

WARNING: All course numbers in the Connecticut <strong>Community</strong> <strong>College</strong> System<br />

are in the process of change. For up-to-date information on any course number,<br />

contact the MCC Registrar’s Office.<br />

Division of Social <strong>Science</strong> & Hospitality: 860-512-2753 or<br />

www.mcc.commnet.edu<br />

Taxation, Certificate<br />

Program Design<br />

The Taxation certificate program is designed specifically for students interested<br />

in taking the examination to become an Enrolled Agent. Such a designation<br />

allows one to represent tax clients at the first level of the Federal Tax Court. This<br />

program is of special interest to public accountants <strong>and</strong> other tax preparers.<br />

Curriculum<br />

Students may enroll full- or part-time. ACC* 115 (Financial Accounting) is a prerequisite<br />

for ACC* 241 <strong>and</strong> must be completed with a grade of C- or better.<br />

Note: Students enrolled in the Taxation certificate program may be interested<br />

in a dual certificate in Personal Financial Planning. Please see the Personal<br />

Financial Planning certificate program requirements on page 102 of this<br />

catalog.<br />

Required Courses<br />

ACC* 241 Federal Taxes I 3<br />

ACC* 242 Federal Taxes II 3<br />

ACC* 243 Tax Planning I 3<br />

BFP* 210 Fundamentals of Personal Financial Planning 3<br />

BFP* 230 Investment Management or<br />

BFP* 250 Retirement Planning & Employee Benefits 3<br />

Total Credits Required: 15<br />

Learning Outcomes<br />

Upon successful completion of all Taxation certificate program requirements,<br />

graduates will<br />

1. Complete simple accounting problems <strong>and</strong> be familiar with current<br />

financial accounting st<strong>and</strong>ards <strong>and</strong> practices.<br />

2. Underst<strong>and</strong> generally accepted accounting principles <strong>and</strong> their manual<br />

<strong>and</strong> computerized spreadsheet applications.<br />

3. Prepare complete financial statements for sole proprietorships in<br />

compliance with current accounting st<strong>and</strong>ards <strong>and</strong> practices.<br />

4. Prepare the following tax returns <strong>and</strong> supporting schedules under<br />

simulated conditions: 1040, 1065, 1120 <strong>and</strong> 1120S.<br />

5. Possess computer competencies for maximum efficiency including the<br />

use of accounting, spreadsheet, presentation <strong>and</strong> tax software.<br />

6. Underst<strong>and</strong> the provisions of current tax laws <strong>and</strong> the business <strong>and</strong><br />

investment decisions they affect.<br />

7. Underst<strong>and</strong> all phases of the tax code <strong>and</strong> be able to focus on tax<br />

problems <strong>and</strong> the multiple alternatives that must be analyzed.<br />

8. Work with others, including culturally <strong>and</strong> intellectually diverse people;<br />

think critically; <strong>and</strong> gain an appreciation for life-long learning.<br />

9. Develop sound ethical <strong>and</strong> moral professional characteristics.<br />

10. Successfully enter the marketplace in the field of taxation.<br />

WARNING: All course numbers in the Connecticut <strong>Community</strong> <strong>College</strong> System<br />

are in the process of change. For up-to-date information on any course number,<br />

contact the MCC Registrar’s Office.<br />

Center for Business <strong>and</strong> Technologies: 860-512-2623 or<br />

www.mcc.commnet.edu/cbt/