Postgraduate - Edith Cowan University

Postgraduate - Edith Cowan University

Postgraduate - Edith Cowan University

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

It includes issues such as test design, project evaluation, and ongoing<br />

evaluation of classroom language learning and teaching.<br />

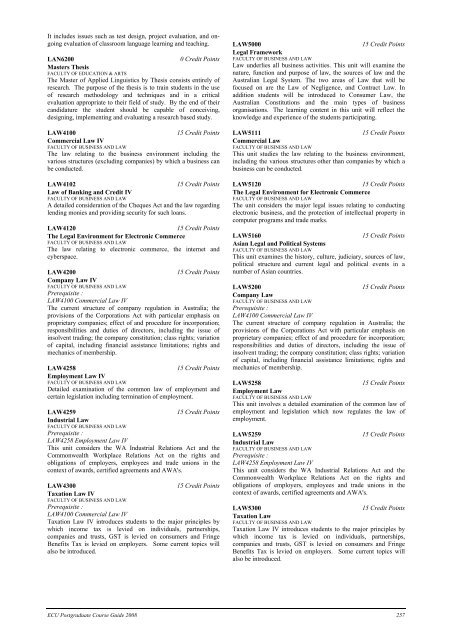

LAN6200 0 Credit Points<br />

Masters Thesis<br />

FACULTY OF EDUCATION & ARTS<br />

The Master of Applied Linguistics by Thesis consists entirely of<br />

research. The purpose of the thesis is to train students in the use<br />

of research methodology and techniques and in a critical<br />

evaluation appropriate to their field of study. By the end of their<br />

candidature the student should be capable of conceiving,<br />

designing, implementing and evaluating a research based study.<br />

LAW4100 15 Credit Points<br />

Commercial Law IV<br />

FACULTY OF BUSINESS AND LAW<br />

The law relating to the business environment including the<br />

various structures (excluding companies) by which a business can<br />

be conducted.<br />

LAW4102 15 Credit Points<br />

Law of Banking and Credit IV<br />

FACULTY OF BUSINESS AND LAW<br />

A detailed consideration of the Cheques Act and the law regarding<br />

lending monies and providing security for such loans.<br />

LAW4120 15 Credit Points<br />

The Legal Environment for Electronic Commerce<br />

FACULTY OF BUSINESS AND LAW<br />

The law relating to electronic commerce, the internet and<br />

cyberspace.<br />

LAW4200 15 Credit Points<br />

Company Law IV<br />

FACULTY OF BUSINESS AND LAW<br />

Prerequisite :<br />

LAW4100 Commercial Law IV<br />

The current structure of company regulation in Australia; the<br />

provisions of the Corporations Act with particular emphasis on<br />

proprietary companies; effect of and procedure for incorporation;<br />

responsibilities and duties of directors, including the issue of<br />

insolvent trading; the company constitution; class rights; variation<br />

of capital, including financial assistance limitations; rights and<br />

mechanics of membership.<br />

LAW4258 15 Credit Points<br />

Employment Law IV<br />

FACULTY OF BUSINESS AND LAW<br />

Detailed examination of the common law of employment and<br />

certain legislation including termination of employment.<br />

LAW4259 15 Credit Points<br />

Industrial Law<br />

FACULTY OF BUSINESS AND LAW<br />

Prerequisite :<br />

LAW4258 Employment Law IV<br />

This unit considers the WA Industrial Relations Act and the<br />

Commonwealth Workplace Relations Act on the rights and<br />

obligations of employers, employees and trade unions in the<br />

context of awards, certified agreements and AWA's.<br />

LAW4300 15 Credit Points<br />

Taxation Law IV<br />

FACULTY OF BUSINESS AND LAW<br />

Prerequisite :<br />

LAW4100 Commercial Law IV<br />

Taxation Law IV introduces students to the major principles by<br />

which income tax is levied on individuals, partnerships,<br />

companies and trusts, GST is levied on consumers and Fringe<br />

Benefits Tax is levied on employers. Some current topics will<br />

also be introduced.<br />

LAW5000 15 Credit Points<br />

Legal Framework<br />

FACULTY OF BUSINESS AND LAW<br />

Law underlies all business activities. This unit will examine the<br />

nature, function and purpose of law, the sources of law and the<br />

Australian Legal System. The two areas of Law that will be<br />

focused on are the Law of Negligence, and Contract Law. In<br />

addition students will be introduced to Consumer Law, the<br />

Australian Constitutions and the main types of business<br />

organisations. The learning content in this unit will reflect the<br />

knowledge and experience of the students participating.<br />

LAW5111 15 Credit Points<br />

Commercial Law<br />

FACULTY OF BUSINESS AND LAW<br />

This unit studies the law relating to the business environment,<br />

including the various structures other than companies by which a<br />

business can be conducted.<br />

LAW5120 15 Credit Points<br />

The Legal Environment for Electronic Commerce<br />

FACULTY OF BUSINESS AND LAW<br />

The unit considers the major legal issues relating to conducting<br />

electronic business, and the protection of intellectual property in<br />

computer programs and trade marks.<br />

LAW5160 15 Credit Points<br />

Asian Legal and Political Systems<br />

FACULTY OF BUSINESS AND LAW<br />

This unit examines the history, culture, judiciary, sources of law,<br />

political structure and current legal and political events in a<br />

number of Asian countries.<br />

LAW5200 15 Credit Points<br />

Company Law<br />

FACULTY OF BUSINESS AND LAW<br />

Prerequisite :<br />

LAW4100 Commercial Law IV<br />

The current structure of company regulation in Australia; the<br />

provisions of the Corporations Act with particular emphasis on<br />

proprietary companies; effect of and procedure for incorporation;<br />

responsibilities and duties of directors, including the issue of<br />

insolvent trading; the company constitution; class rights; variation<br />

of capital, including financial assistance limitations; rights and<br />

mechanics of membership.<br />

LAW5258 15 Credit Points<br />

Employment Law<br />

FACULTY OF BUSINESS AND LAW<br />

This unit involves a detailed examination of the common law of<br />

employment and legislation which now regulates the law of<br />

employment.<br />

LAW5259 15 Credit Points<br />

Industrial Law<br />

FACULTY OF BUSINESS AND LAW<br />

Prerequisite :<br />

LAW4258 Employment Law IV<br />

This unit considers the WA Industrial Relations Act and the<br />

Commonwealth Workplace Relations Act on the rights and<br />

obligations of employers, employees and trade unions in the<br />

context of awards, certified agreements and AWA's.<br />

LAW5300 15 Credit Points<br />

Taxation Law<br />

FACULTY OF BUSINESS AND LAW<br />

Taxation Law IV introduces students to the major principles by<br />

which income tax is levied on individuals, partnerships,<br />

companies and trusts, GST is levied on consumers and Fringe<br />

Benefits Tax is levied on employers. Some current topics will<br />

also be introduced.<br />

ECU <strong>Postgraduate</strong> Course Guide 2008 257