Brand-South Africa - Annual report 2015 - 2016

During the past financial year, aligned with its mandate to build pride and patriotism in the Nation Brand, Brand South Africa has worked on initiatives to encourage active citizenship in partnership with its stakeholders in government, business, civil society and identified influential forums to increase the participation of all people, particularly our young people, in building a strong, cohesive Nation Brand. These activities, together with engagements at provincial level on Nation Brand alignment, contribute to social cohesion and a positive Nation Brand. Brand South Africa’s activities took place under the leadership of its new CEO, Amb. Kingsley Makhubela, PhD, who joined the organisation during the year.

During the past financial year, aligned with its mandate to build pride and patriotism in the Nation Brand, Brand South Africa has worked on initiatives to encourage active citizenship in partnership with its stakeholders in government, business, civil society and identified influential forums to increase the participation of all people, particularly our young people, in building a strong, cohesive Nation Brand. These activities, together with engagements at provincial level on Nation Brand alignment, contribute to social cohesion and a positive Nation Brand.

Brand South Africa’s activities took place under the leadership of its new CEO, Amb. Kingsley Makhubela, PhD, who joined the organisation during the year.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

and south africa <strong>Annual</strong> Report <strong>2015</strong>/<strong>2016</strong><br />

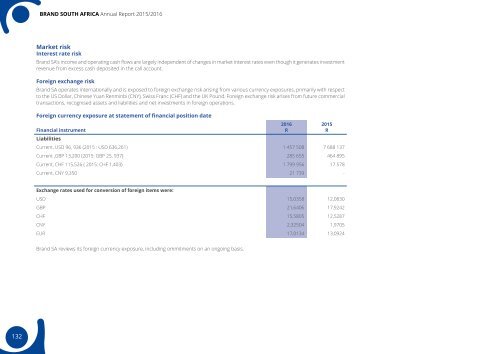

Market risk<br />

Interest rate risk<br />

<strong>Brand</strong> SA’s income and operating cash flows are largely independent of changes in market interest rates even though it generates investment<br />

revenue from excess cash deposited in the call account.<br />

Foreign exchange risk<br />

<strong>Brand</strong> SA operates internationally and is exposed to foreign exchange risk arising from various currency exposures, primarily with respect<br />

to the US Dollar, Chinese Yuan Renminbi (CNY), Swiss Franc (CHF) and the UK pound. Foreign exchange risk arises from future commercial<br />

transactions, recognised assets and liabilities and net investments in foreign operations.<br />

Foreign currency exposure at statement of financial position date<br />

Financial instrument<br />

<strong>2016</strong><br />

R<br />

<strong>2015</strong><br />

R<br />

Liabilities<br />

Current, USD 96, 936 (<strong>2015</strong> : USD 636,261) 1 457 508 7 688 137<br />

Current ,GBP 13,200 (<strong>2015</strong>: GBP 25, 937) 285 655 464 895<br />

Current, CHF 115,526 ( <strong>2015</strong>: CHF 1,403) 1 799 956 17 578<br />

Current, CNY 9,350 21 739 -<br />

Exchange rates used for conversion of foreign items were:<br />

USD 15,0358 12,0830<br />

GBP 21,6406 17,9242<br />

CHF 15,5805 12,5287<br />

CNY 2,32504 1,9705<br />

EUR 17,0134 13,0924<br />

<strong>Brand</strong> SA reviews its foreign currency exposure, including ommitments on an ongoing basis.<br />

132