Erste Bank JPMorgan Merrill Lynch International

Erste Bank JPMorgan Merrill Lynch International

Erste Bank JPMorgan Merrill Lynch International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

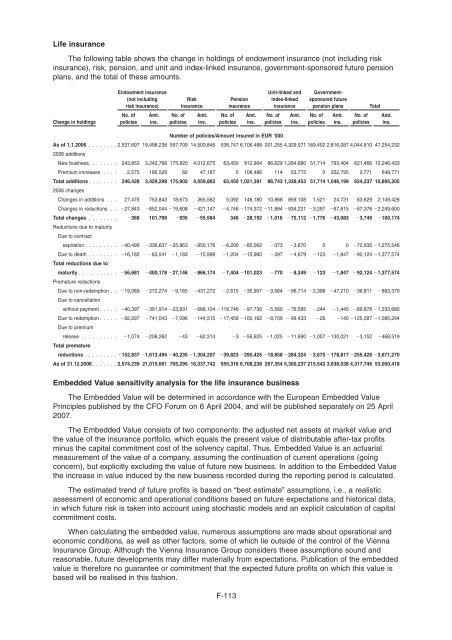

Life insurance<br />

The following table shows the change in holdings of endowment insurance (not including risk<br />

insurance), risk, pension, and unit and index-linked insurance, government-sponsored future pension<br />

plans, and the total of these amounts.<br />

Change in holdings<br />

Endowment insurance<br />

(not including<br />

risk insurance)<br />

No. of<br />

policies<br />

Amt.<br />

ins.<br />

No. of<br />

policies<br />

Risk<br />

insurance<br />

Amt.<br />

ins.<br />

Pension<br />

insurance<br />

No. of<br />

policies<br />

Amt.<br />

ins.<br />

Unit-linked and<br />

index-linked<br />

insurance<br />

No. of<br />

policies<br />

Amt.<br />

ins.<br />

Governmentsponsored<br />

future<br />

pension plans Total<br />

No. of<br />

policies<br />

Amt.<br />

ins.<br />

No. of<br />

policies<br />

Number of policies/Amount insured in EUR ’000<br />

As of 1.1.2006 ........2,537,697 19,498,238 597,709 14,503,846<br />

2006 additions<br />

538,747 6,106,488 201,255 4,329,571 169,402 2,816,087 4,044,810 47,254,232<br />

New business. ....... 243,853 3,242,768 175,820 4,012,675 63,450 912,904 86,629 1,284,680 51,714 793,404 621,466 10,246,433<br />

Premium increases . . . . 2,575 186,529 82 47,187 0 108,486 114 53,772 0 252,795 2,771 648,771<br />

Total additions ........<br />

2006 changes<br />

246,428 3,429,298 175,902 4,059,862 63,450 1,021,391 86,743 1,338,453 51,714 1,046,199 624,237 10,895,205<br />

Changes in additions . . . 27,475 753,843 18,673 365,562 5,092 146,180 10,868 859,108 1,521 24,731 63,629 2,149,426<br />

Changes in reductions . . �27,843 �652,044 �19,608 �421,147 �4,746 �174,372 �11,884 �934,221 �3,297 �67,815 �67,378 �2,249,600<br />

Total changes ........<br />

Reductions due to maturity<br />

Due to contract<br />

�368 101,799 �935 �55,584 346 �28,192 �1,016 �75,112 �1,776 �43,083 �3,749 �100,174<br />

expiration . . ....... �40,499 �336,637 �25,863 �850,176 �6,200 �85,062 �373 �3,670 0 0 �72,935 �1,275,546<br />

Due to death . .......<br />

Total reductions due to<br />

�16,182 �63,541 �1,183 �15,998 �1,204 �15,960 �397 �4,679 �123 �1,847 �92,124 �1,377,574<br />

maturity ...........<br />

Premature reductions<br />

�56,681 �400,178 �27,146 �866,174 �7,404 �101,023 �770 �8,349 �123 �1,847 �92,124 �1,377,574<br />

Due to non-redemption . .<br />

Due to cancellation<br />

�19,069 �272,274 �9,165 �431,272 �2,615 �35,907 �3,564 �96,714 �2,398 �47,210 �36,811 �883,379<br />

without payment ..... �40,397 �391,914 �23,931 �666,104 �119,746 �97,730 �5,560 �76,585 �244 �1,445 �89,878 �1,233,680<br />

Due to redemption .....<br />

Due to premium<br />

�92,297 �741,043 �7,096 �144,515 �17,459 �100,162 �8,709 �99,433 �26 �140 �125,587 �1,085,294<br />

release . . ........<br />

Total premature<br />

�1,074 �208,262 �43 �62,314 �3 �56,625 �1,025 �11,690 �1,007 �130,021 �3,152 �468,519<br />

reductions .........�152,837 �1,613,494 �40,235 �1,304,207 �39,823 �290,425 �18,858 �284,324 �3,675 �178,817 �255,428 �3,671,270<br />

As of 31.12.2006 .......2,574,239 21,015,661 705,295 16,337,742 555,316 6,708,238 267,354 5,300,237 215,542 3,638,538 4,317,746 53,000,418<br />

Embedded Value sensitivity analysis for the life insurance business<br />

The Embedded Value will be determined in accordance with the European Embedded Value<br />

Principles published by the CFO Forum on 6 April 2004, and will be published separately on 25 April<br />

2007.<br />

The Embedded Value consists of two components: the adjusted net assets at market value and<br />

the value of the insurance portfolio, which equals the present value of distributable after-tax profits<br />

minus the capital commitment cost of the solvency capital. Thus, Embedded Value is an actuarial<br />

measurement of the value of a company, assuming the continuation of current operations (going<br />

concern), but explicitly excluding the value of future new business. In addition to the Embedded Value<br />

the increase in value induced by the new business recorded during the reporting period is calculated.<br />

The estimated trend of future profits is based on “best estimate” assumptions, i.e., a realistic<br />

assessment of economic and operational conditions based on future expectations and historical data,<br />

in which future risk is taken into account using stochastic models and an explicit calculation of capital<br />

commitment costs.<br />

When calculating the embedded value, numerous assumptions are made about operational and<br />

economic conditions, as well as other factors, some of which lie outside of the control of the Vienna<br />

Insurance Group. Although the Vienna Insurance Group considers these assumptions sound and<br />

reasonable, future developments may differ materially from expectations. Publication of the embedded<br />

value is therefore no guarantee or commitment that the expected future profits on which this value is<br />

based will be realised in this fashion.<br />

F-113<br />

Amt.<br />

ins.