- Page 1:

WIENER STÄDTISCHE Versicherung AG

- Page 4 and 5:

Stabilization measures. In connecti

- Page 6 and 7:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 8 and 9:

Proceeding Regarding BA-CA Versiche

- Page 10 and 11:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 12 and 13:

in detail factors which may influen

- Page 14 and 15:

“Benefia Non-Life” refers to BE

- Page 16 and 17:

“Unita” refers to Unita S.A. Vi

- Page 18 and 19:

Health insurance products are marke

- Page 20 and 21:

The Vienna Insurance Group can give

- Page 22 and 23:

The Offer Period and the Employee O

- Page 24 and 25:

Entitlement to Dividends: . . . . .

- Page 26 and 27:

RISK FACTORS Potential investors sh

- Page 28 and 29:

negative effects on the Vienna Insu

- Page 30 and 31:

safeguard the stability of the publ

- Page 32 and 33:

The Vienna Insurance Group depends

- Page 34 and 35:

Since the purchase price of the Tar

- Page 36 and 37:

always passed such resolutions as p

- Page 38 and 39:

General THE OFFERING The Offering c

- Page 40 and 41:

Global Coordinators on the basis of

- Page 42 and 43:

PLAN OF DISTRIBUTION Scope of and A

- Page 44 and 45:

Termination, Indemnification The Pu

- Page 46 and 47:

Japan The Offer Shares have not bee

- Page 48 and 49:

CAPITALIZATION The following table

- Page 50 and 51:

USE OF PROCEEDS Assuming all of the

- Page 52 and 53:

DIVIDEND POLICY All Existing Shares

- Page 54 and 55:

The respective country agreements i

- Page 56 and 57:

The table below sets forth key fina

- Page 58 and 59:

The table below sets forth key fina

- Page 60 and 61:

The table below sets forth key fina

- Page 62 and 63:

year, the Target Companies derived

- Page 64 and 65:

SELECTED FINANCIAL DATA The followi

- Page 66 and 67:

Vienna Insurance Group ranked secon

- Page 68 and 69:

Year Real economic growth Consumer

- Page 70 and 71:

therefore, good growth potential st

- Page 72 and 73:

Non-life rate-setting Rate-setting

- Page 74 and 75:

has also remained between 9.5 and 1

- Page 76 and 77:

Insurance policies generally includ

- Page 78 and 79:

Severance obligations Based on stat

- Page 80 and 81:

increase also came from insurance c

- Page 82 and 83:

of the scope of consolidation throu

- Page 84 and 85:

Financial result The following tabl

- Page 86 and 87:

The following table sets forth by r

- Page 88 and 89:

Health insurance segment The follow

- Page 90 and 91:

individual subsidiaries are respons

- Page 92 and 93:

Currently, neither the Management B

- Page 94 and 95:

EMBEDDED VALUE OF WIENER STÄDTISCH

- Page 96 and 97:

Group Embedded Value The following

- Page 98 and 99:

Overview BUSINESS With approximatel

- Page 100 and 101:

Life Insurance The life insurance b

- Page 102 and 103:

for a strong demand for these produ

- Page 104 and 105:

For more information regarding comp

- Page 106 and 107:

that entity. In 1938, “Gemeinde W

- Page 108 and 109:

In 2005, the Issuer acquired a part

- Page 110 and 111:

The following table sets forth the

- Page 112 and 113:

damages. The changes in the Vienna

- Page 114 and 115:

Corporate Customers In the property

- Page 116 and 117:

medical treatment, medicines (inclu

- Page 118 and 119:

In connection with endowment insura

- Page 120 and 121:

Wiener Städtische AG offers produc

- Page 122 and 123:

premiums written in fiscal year 200

- Page 124 and 125:

The Vienna Insurance Group conducts

- Page 126 and 127:

KOMUNÁLNA Poist’ovňa, a.s. Vien

- Page 128 and 129:

Description of the Six Most Importa

- Page 130 and 131:

The following table sets forth the

- Page 132 and 133:

11.8%), with premiums increasing by

- Page 134 and 135:

subsidiary of TBIH) transferred its

- Page 136 and 137:

The investment policy is more conse

- Page 138 and 139:

The following table sets forth the

- Page 140 and 141:

at equity). The table below provide

- Page 142 and 143:

ought against them will have a mate

- Page 144 and 145:

Trademarks and Patents The names

- Page 146 and 147:

Risk Management Organization The Gr

- Page 148 and 149:

Auditing In keeping with the minimu

- Page 150 and 151:

Reinsurers with a lower rating are

- Page 152 and 153:

Real Estate Risk The value of the r

- Page 154 and 155:

On the basis of the Group’s inter

- Page 156 and 157:

INSURANCE SUPERVISION Wiener Städt

- Page 158 and 159:

an ongoing basis. Insurance compani

- Page 160 and 161:

Persons that would like to directly

- Page 162 and 163:

In addition to his responsibilities

- Page 164 and 165:

Chairman of the supervisory board o

- Page 166 and 167:

Member of the supervisory board of

- Page 168 and 169:

General director (retired) KR Dr. K

- Page 170 and 171:

Members of the Extended Board The f

- Page 172 and 173:

Members of the Group Management Boa

- Page 174 and 175:

the extended Group board since 2008

- Page 176 and 177:

Member of management board, supervi

- Page 178 and 179:

Member of management board, supervi

- Page 180 and 181:

Member of management board, supervi

- Page 182 and 183:

Member of management board, supervi

- Page 184 and 185:

Shares and Stock Options Held by Me

- Page 186 and 187:

Human Resources Committee (committe

- Page 188 and 189:

DESCRIPTION OF SHARE CAPITAL AND SU

- Page 190 and 191:

through a resolution of the shareho

- Page 192 and 193:

After the capital increase resolved

- Page 194 and 195:

The following measures require purs

- Page 196 and 197:

Neither Austrian law nor the Articl

- Page 198 and 199:

Dividend Rights The offered New Sha

- Page 200 and 201:

the purchase price exceeds 10% of t

- Page 202 and 203:

The executive bodies of WST-Versich

- Page 204 and 205:

esolution on the formal approval of

- Page 206 and 207:

Taxation in Austria TAXATION Taxes

- Page 208 and 209:

Capital Gains Resident Shareholders

- Page 210 and 211:

tax consequences that may be releva

- Page 212 and 213:

liability and may entitle such hold

- Page 214 and 215:

THE VIENNA STOCK EXCHANGE The infor

- Page 216 and 217:

Trading Volume In 2006, the aggrega

- Page 218 and 219:

Czech languages. The dissemination

- Page 220 and 221:

Takeover Commission and must prepar

- Page 222 and 223:

THE PRAGUE STOCK EXCHANGE The follo

- Page 224 and 225:

est quotation. During the closed ph

- Page 226 and 227:

obligations; or (iv) a criminal off

- Page 228 and 229:

Operating private hospitals in the

- Page 230 and 231:

RESPONSIBILITY STATEMENT PURSUANT T

- Page 232 and 233:

CONSOLIDATED BALANCE SHEET AS OF 31

- Page 234 and 235:

CONSOLIDATED SHAREHOLDERS’ EQUITY

- Page 236 and 237:

CONSOLIDATED CASH FLOW STATEMENT FR

- Page 238 and 239:

SEGMENT REPORTING CONSOLIDATED INCO

- Page 240 and 241:

total of 29 domestic and 41 foreign

- Page 242 and 243:

In the third quarter, the Celetná

- Page 244 and 245:

existing on the balance sheet repor

- Page 246 and 247:

For both owner-occupied and third p

- Page 248 and 249:

The credit quality of each contract

- Page 250 and 251:

not set to zero for Group subsidiar

- Page 252 and 253:

The calculations for 31 December 20

- Page 254 and 255:

RISK REPORTING The Vienna Insurance

- Page 256 and 257:

internal processes, strategic procu

- Page 258 and 259:

Concentration risk Concentration ri

- Page 260 and 261:

Other securities Financial investme

- Page 262 and 263:

The following table shows Vienna In

- Page 264 and 265:

measurement of the value of a compa

- Page 266 and 267:

that occurred in the current and al

- Page 268 and 269:

amount, the closely held corporatio

- Page 270 and 271:

Unrealised profits and losses are a

- Page 272 and 273:

Affiliated companies and participat

- Page 274 and 275:

Affiliated companies and participat

- Page 276 and 277:

Detail: Acquisition Costs Carried F

- Page 278 and 279:

9. RECEIVABLES Detail in EUR ’000

- Page 280 and 281:

13. CONSOLIDATED SHAREHOLDERS’ EQ

- Page 282 and 283:

Development in EUR ’000 Property/

- Page 284 and 285:

Development in life insurance 31.12

- Page 286 and 287:

Development in severance obligation

- Page 288 and 289:

24. LIABILITIES Detail in EUR ’00

- Page 290 and 291:

Off-balance sheet commitments The f

- Page 292 and 293:

Premiums written — Direct life in

- Page 294 and 295:

Detail — income in EUR ’000 Cur

- Page 296 and 297:

Detail — expenses in EUR ’000 D

- Page 298 and 299:

Detail in EUR ’000 Property/Casua

- Page 300 and 301:

Detail in EUR ’000 Property/Casua

- Page 302 and 303:

The Supervisory Board is composed o

- Page 304 and 305:

the Austrian Stock Corporation Act

- Page 306 and 307:

SIGNIFICANT EVENTS AFTER THE BALANC

- Page 308 and 309:

REPORT OF THE SUPERVISORY BOARD The

- Page 310 and 311:

INDEPENDENT AUDITOR’S REPORT We h

- Page 312 and 313:

CONSOLIDATED BALANCE SHEET AS OF 31

- Page 314 and 315:

CONSOLIDATED SHAREHOLDERS’ EQUITY

- Page 316 and 317:

CONSOLIDATED CASH FLOW STATEMENT FR

- Page 318 and 319:

SEGMENT REPORTING CONSOLIDATED INCO

- Page 320 and 321:

28 does not exist, since Wiener St

- Page 322 and 323:

Information on the companies that a

- Page 324 and 325:

Accounting policies for specific it

- Page 326 and 327:

Financial investments Financial inv

- Page 328 and 329:

Active tax deferrals are not recogn

- Page 330 and 331:

policyholders. These reserves are f

- Page 332 and 333:

Operating expenses Group personnel

- Page 334 and 335:

To manage these underwriting risks,

- Page 336 and 337:

The Vienna Insurance Group has made

- Page 338 and 339:

Investments segment Health Life in

- Page 340 and 341:

Equities As of 31 December 2006, Vi

- Page 342 and 343:

The following table shows the Vienn

- Page 344 and 345:

The shareholder margin is calculate

- Page 346 and 347:

Reinsurance The Vienna Insurance Gr

- Page 348 and 349:

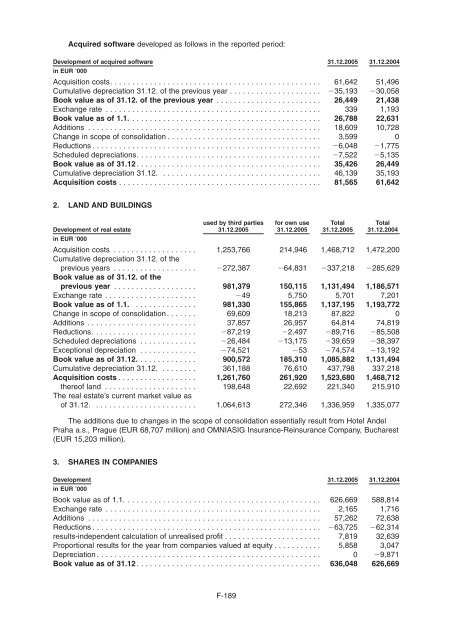

Development of purchased insurance

- Page 350 and 351:

4. PARTICIPATIONS On 31 December 20

- Page 352 and 353:

Affiliated companies and participat

- Page 354 and 355:

The information required under § 2

- Page 356 and 357:

For financial investments available

- Page 358 and 359:

9. RECEIVABLES Detail in EUR ’000

- Page 360 and 361:

13. CONSOLIDATED SHAREHOLDERS’ EQ

- Page 362 and 363:

14. SUBORDINATED LIABILITIES Subord

- Page 364 and 365:

Health insurance mathematical reser

- Page 366 and 367:

Maturities in EUR ’000 31.12.2006

- Page 368 and 369: 23. OTHER PROVISIONS Detail in EUR

- Page 370 and 371: agreements with other insurers conc

- Page 372 and 373: income statement. A portion of the

- Page 374 and 375: Detail — income in EUR ’000 Cur

- Page 376 and 377: The Other income of EUR 7,091 milli

- Page 378 and 379: 33. OTHER EXPENSES Detail in EUR

- Page 380 and 381: The Supervisory Board is comprised

- Page 382 and 383: The Managing Board is comprised of

- Page 384 and 385: Significant events after the balanc

- Page 386 and 387: AUDITOR’S REPORT We have audited

- Page 388 and 389: REPORT OF THE SUPERVISORY BOARD The

- Page 390 and 391: CONSOLIDATED BALANCE SHEET AS OF 31

- Page 392 and 393: CONSOLIDATED INCOME STATEMENT FOR T

- Page 394 and 395: SEGMENT REPORTING CONSOLIDATED BALA

- Page 396 and 397: NOTES TO THE CONSOLIDATED FINANCIAL

- Page 398 and 399: During the reporting period from 1

- Page 400 and 401: negative, taking into account capit

- Page 402 and 403: factors including contract and mark

- Page 404 and 405: The creditworthiness of each contra

- Page 406 and 407: formed at the individual policy lev

- Page 408 and 409: The reserves are recognised at the

- Page 410 and 411: The other capital assets item consi

- Page 412 and 413: date, real estate has not represent

- Page 414 and 415: Embedded value sensitivity analysis

- Page 416 and 417: IBNR provisions are formed to offse

- Page 420 and 421: Detail in EUR ’000 31.12.2005 31.

- Page 422 and 423: Affiliated companies and participat

- Page 424 and 425: Affiliated companies and participat

- Page 426 and 427: For financial instruments available

- Page 428 and 429: 10. CASH AND CASH EQUIVALENTS Detai

- Page 430 and 431: existing preferred shares may be is

- Page 432 and 433: 17. RESERVE FOR OUTSTANDING CLAIMS

- Page 434 and 435: 22. OTHER PROVISIONS Detail in EUR

- Page 436 and 437: Other threatened and pending court

- Page 438 and 439: Premiums written, total account Pro

- Page 440 and 441: 29. OTHER INCOME Detail in EUR ’0

- Page 442 and 443: Detail in EUR ’000 Property/Casua

- Page 444 and 445: 35. OTHER INFORMATION The Superviso

- Page 446 and 447: The Management Board is comprised o

- Page 448 and 449: in the area of pension funds in Bul

- Page 450 and 451: Tax-free reserves In the consolidat

- Page 452 and 453: AUDITOR’S REPORT We have audited

- Page 454 and 455: Banker’s blanket bond The Banker

- Page 456 and 457: Expense ratio The ratio of premium

- Page 458 and 459: Loss ratio The percentage ratio of

- Page 460 and 461: Shares of minority shareholders in

- Page 462 and 463: experience are normal and are to be

- Page 464 and 465: The FOG and the Cost of Non-Market

- Page 466 and 467: The NBV has only been calculated fo

- Page 468 and 469:

policyholder behaviors, i.e. some a

- Page 470 and 471:

The yields shown are risk-free euro

- Page 472 and 473:

Sensitivity Analysis EEV The follow

- Page 474 and 475:

B&W Deloitte GmbH Magnusstra�e 11

- Page 476 and 477:

Embedded Value of the Target Compan

- Page 478 and 479:

3.2 Value of In-Force The VIF is th

- Page 480 and 481:

5. Sensitivity Analysis The followi

- Page 482 and 483:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 484 and 485:

[THIS PAGE INTENTIONALLY LEFT BLANK

- Page 486 and 487:

ZUSAMMENFASSUNG DES PROSPEKTS Diese

- Page 488 and 489:

Gewinn vor Steuern von rund 1,05 Mr

- Page 490 and 491:

Sollten es die bisherigen Aktionär

- Page 492 and 493:

Mai 2008 ablaufen. Die Bezugsrechte

- Page 494 and 495:

diesem Prospekt enthaltenen Konzern

- Page 496 and 497:

SHRNUTÍ PROSPEKTU Toto shrnutí pr

- Page 498 and 499:

Dne 26. brˇezna 2008 uzavrˇely sp

- Page 500 and 501:

Uplatnění Upisovacích práv ze s

- Page 502 and 503:

prˇedstavují právo prˇevodu na

- Page 504 and 505:

Vybrané informativní finanční

- Page 506 and 507:

[THIS PAGE INTENTIONALLY LEFT BLANK