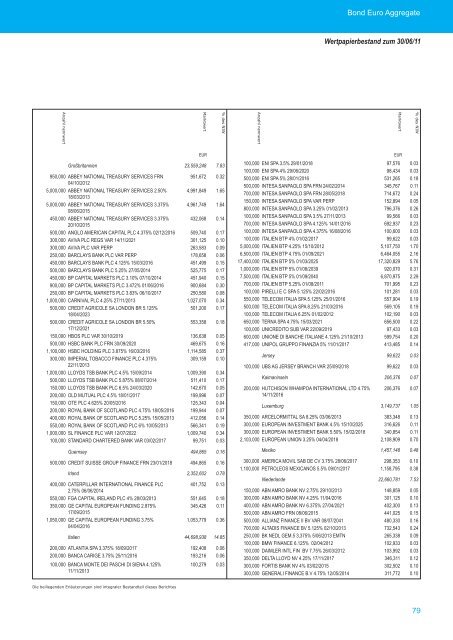

Bond Euro Aggregate Wertpapierbestand zum Anzahl nennwert Positive Positionen Übertragbare und amtlich notierte Wertpapiere und/oder auf anderen Märkten gehandelte Wertpapiere Renten Australien 100,000 AMCOR LTD 4.625% 16/04/2019 300,000 COMMONWEALTH BANK OF AUSTRALIEN 4.25% 06/04/2018 400,000 WESTPAC BANKING CORP 4.125% 25/05/2018 Belgien 350,000 BELGIEN KINGDOM 3.50% 28/03/2015 1,000,000 BELGIEN 3.75% 28/09/2020 2,000,000 BELGIEN 4.25 28/09/2021 Dänemark 600,000 CARLSBERG 3.375% 13/10/2017 100,000 CARLSBERG 6% 28/05/2014 Deutschland Finnland 3,500,000 FINNLAND 4% 04/07/2025 150,000 POHJOLA BANK PLC 3% 08/09/2017 400,000 SAMPO OYJ 6.339% 10/04/2012 Frankreich 30/06/11 300,000 BERTELSMANN <strong>AG</strong> 7.875% 16/01/2014 600,000 <strong>AG</strong>ENCE FRANCAISE DE DEVELOPPEMENT VAR PERP 300,000 ALSTOM 2.875% 05/10/2015 100,000 BANQUE PSA FINANCE 3.625% 17/09/2013 400,000 BANQUE PSA FINANCE 3.875% 14/01/2015 1,000,000 BANQUE PSA FINANCE 3.875% 18/01/2013 100,000 BNP PARIBAS TSR 5.70% 15/05/2012 3,500,000 BNP PARIBAS COVERED BONDS 4.75% 28/05/2013 350,000 BNP PARIBAS VAR PERP 100,000 BNP PARIBAS VAR PERP 700,000 BNP PARIBAS 3.50% 07/03/2016 600,000 BNP PARIBAS 5.25% 17/12/2012 500,000 BOUYGUES 4% 12/02/2018 400,000 BPCE FRN PERP 270,000 BPCE FRN PERP Die beiliegenden Erläuterungen sind integraler Bestandteil dieses Berichtes 78 150,000 COMZBK <strong>AG</strong> 5.50% 25/10/2011 9,500,000 DEUTSCHLAND BUND 3% 04/07/2020 1,650,000 DEUTSCHLAND BUND 4.75% 04/07/2040 12,500,000 DEUTSCHLAND BUNDEI 1.75% 15/04/2020 150,000 DEUTSCHLAND 3.75% 04/01/2019 7,500,000 DEUTSCHLAND 4% 04/01/2018 3,000,000 DEUTSCHLAND 4.25% 04/07/2018 500,000 KREDITANSTALT FUR WIEDERAUFBAU 5.125% 17/06/2013 700,000 MUNICH RE FINANCE FRN 26/05/2041 100,000 NORDRHEIN-WESTFALEN 6% 22/01/2014 1,200,000 VOLKSW<strong>AG</strong>EN LEASING GMBH 3.375% 03/06/2016 Marktwert 288,234,709 806,517 102,470 302,811 401,236 3,365,513 356,003 982,570 2,026,940 690,198 582,126 108,072 40,238,839 336,075 4,178,277 3,622,850 143,387 412,040 68,234,949 569,970 291,660 100,575 396,712 1,012,770 101,870 3,656,205 316,463 105,124 699,902 619,206 505,440 356,428 315,498 % des NIW 95.75 0.27 0.03 0.10 0.14 1.12 0.12 0.33 0.67 0.23 0.19 0.04 13.37 0.11 1.39 1.20 0.05 0.14 22.66 0.19 0.10 0.03 0.13 0.34 0.03 1.21 0.11 0.03 0.23 0.21 0.17 0.12 0.10 Anzahl nennwert EUR EUR 297,576,835 98.85 900,000 BPCE 2.875% 22/09/2015 877,356 300,000 BPCE 5.50% 30/10/2011 303,282 289,481,199 96.16 140,000 BPCE 9.25% PERP 142,594 151,707 9,563,460 1,931,292 14,154,242 160,220 8,127,375 3,301,140 531,100 677,138 108,918 1,196,172 0.05 3.18 0.64 4.70 0.05 2.70 1.10 0.18 0.22 0.04 0.40 300,000 CAISSE CENTRALE DU CREDIT IMMOBILIER 3.75% 22/01/2015 5,000,000 CAISSE D’AMORTISSEMENT DETTE SOCIETE 3.375% 25/04/2021 5,500,000 CAISSE DE REFINANCEMENT HABITATION 5% 25/10/2013 150,000 CAISSE NATIONALE AUTOROUTES 4.375% 19/05/2014 300,000 CAISSE NATIONALE AUTOROUTES 6% 26/10/2015 300,000 CASINO GUICHARD-PERRACHON 5.5% 30/01/2015 100,000 CASINO 7.875% 09/08/2012 400,000 CFF 6.125% 23/02/2015 5,000,000 CM CIC HOME LOAN SFH 1.875% 14/06/2013 350,000 CNP ASSURANCES VAR PERP 600,000 CNP ASSURANCES VAR 30/09/2041 5,000,000 COMP<strong>AG</strong>NIE DE FINANCEMENT FONCIER 2.25% 07/03/2014 4,000,000 COMP<strong>AG</strong>NIE DE FINANCEMENT FONCIER 4.75% 25/06/2015 500,000 COMP<strong>AG</strong>NIE DE SAINT GOBAIN 8.25% 28/07/2014 200,000 CREDIT <strong>AG</strong>RICOLE SA VAR PERP 700,000 CREDIT <strong>AG</strong>RICOLE SA 2.625% 21/01/2014 1,000,000 CREDIT LOGEMENT FRN PERP 500,000 CREDIT LOGEMENT VAR PERP 100,000 ELECTRICITE DE FRANKREICH 4.5% 12/11/2040 400,000 FEDERAL BANK CREDIT MUTUEL 3.75% 26/01/2018 4,500,000 FRANKREICH EMPRUNT D’ETAT OAT 3.5% 25/04/2026 150,000 FRANKREICH EMPRUNT D’ETAT OAT 4% 25/04/2055 5,000,000 FRANKREICH EMPRUNT D’ETAT OAT 4.5% 25/04/2041 7,000,000 FRANKREICH EMPRUNT D’ETAT OAT 5.75% 25/10/2032 350,000 GALERIE LAFAYETTE 4.5% 28/04/2017 4,150,000 GCE COV.BONDS 2.25% 04/02/2013 300,000 GECINA 4.25% 03/02/2016 100,000 GECINA 4.50% 19/09/2014 700,000 KLEPIERRE 4% 13/04/2017 250,000 RCI BANQUE SA 3.4% 11/04/2014 100,000 RCI BANQUE SA 4% 16/03/2016 100,000 RCI BANQUE SA 4.375% 27/01/2015 200,000 RESEAU FERRE DE FRANKREICH 6% 12/10/2020 300,000 SCOR SE FRN 06/07/2020 500,000 SOCIETE AUTOROUTE PARIS-RHIN-RHONE 5% 12/01/2017 300,000 SOCIETE GENERALE VAR PERP 800,000 SOCIETE GENERALE 4% 20/04/2016 400,000 SOCIETE GENERALE 5.2% 15/04/2021 700,000 SOCIETE GENERALE 6.625% 27/04/2015 300,000 UNIBAIL RODAMCO SE 3.875% 05/11/2020 500,000 VALEO 4.875% 11/05/2018 200,000 VAUBAN MOBILISATIONS GARANTIES 6% 28/10/2011 300,000 VEOLIA ENVIRONNEMENT 5.25% 24/04/2014 100,000 VEOLIA ENVIRONNEMENT 5.875% 01/02/2012 150,000 VIVENDI 3.875% 15/02/2012 297,513 4,879,350 5,824,884 158,213 Marktwert 339,174 319,278 105,796 442,668 4,955,300 278,191 598,710 3,489,844 4,248,000 575,615 170,282 484,455 819,760 407,695 87,364 391,024 4,312,665 143,115 5,260,500 8,617,349 346,612 4,149,170 297,258 101,326 696,346 175,442 97,715 100,846 237,518 288,000 513,065 254,163 801,576 269,233 758,464 294,741 500,290 202,668 318,888 102,220 151,608 % des NIW 0.29 0.10 0.05 0.10 1.62 1.92 0.05 0.11 0.11 0.04 0.15 1.65 0.09 0.20 1.16 1.41 0.19 0.06 0.16 0.27 0.14 0.03 0.13 1.43 0.05 1.75 2.85 0.12 1.38 0.10 0.03 0.23 0.06 0.03 0.03 0.08 0.10 0.17 0.08 0.27 0.09 0.25 0.10 0.17 0.07 0.11 0.03 0.05

Anzahl nennwert Großbritannien 950,000 ABBEY NATIONAL TREASURY SERVICES FRN 04/10/2012 5,000,000 ABBEY NATIONAL TREASURY SERVICES 2.50% 18/03/2013 5,000,000 ABBEY NATIONAL TREASURY SERVICES 3.375% 08/06/2015 450,000 ABBEY NATIONAL TREASURY SERVICES 3.375% 20/10/2015 500,000 ANGLO AMERICAN CAPITAL PLC 4.375% 02/12/2016 300,000 AVIVA PLC REGS VAR 14/11/2021 300,000 AVIVA PLC VAR PERP 250,000 BARCLAYS BANK PLC VAR PERP 450,000 BARCLAYS BANK PLC 4.125% 15/03/2016 500,000 BARCLAYS BANK PLC 5.25% 27/05/2014 450,000 BP CAPITAL MARKETS PLC 3.10% 07/10/2014 900,000 BP CAPITAL MARKETS PLC 3.472% 01/06/2016 250,000 BP CAPITAL MARKETS PLC 3.83% 06/10/2017 1,000,000 CARNIVAL PLC 4.25% 27/11/2013 500,000 CREDIT <strong>AG</strong>RICOLE SA LONDON BR 5.125% 18/04/2023 500,000 CREDIT <strong>AG</strong>RICOLE SA LONDON BR 5.50% 17/12/2021 150,000 HBOS PLC VAR 30/10/2019 500,000 HSBC BANK PLC FRN 30/09/2020 1,100,000 HSBC HOLDING PLC 3.875% 16/03/2016 300,000 IMPERIAL TOBACCO FINANCE PLC 4.375% 22/11/2013 1,000,000 LLOYDS TSB BANK PLC 4.5% 15/09/2014 500,000 LLOYDS TSB BANK PLC 5.875% 08/07/2014 150,000 LLOYDS TSB BANK PLC 6.5% 24/03/2020 200,000 OLD MUTUAL PLC 4.5% 18/01/2017 150,000 OTE PLC 4.625% 20/05/2016 200,000 ROYAL BANK OF SCOTLAND PLC 4.75% 18/05/2016 400,000 ROYAL BANK OF SCOTLAND PLC 5.25% 15/05/2013 550,000 ROYAL BANK OF SCOTLAND PLC 6% 10/05/2013 1,000,000 SL FINANCE PLC VAR 12/07/2022 100,000 STANDARD CHARTERED BANK VAR 03/02/2017 Guernsey 500,000 CREDIT SUISSE GROUP FINANCE FRN 23/01/2018 Irland 400,000 CATERPILLAR INTERNATIONAL FINANCE PLC 2.75% 06/06/2014 550,000 FGA CAPITAL IRELAND PLC 4% 28/03/2013 350,000 GE CAPITAL EUROPEAN FUNDING 2.875% 17/09/2015 1,050,000 GE CAPITAL EUROPEAN FUNDING 3.75% 04/04/2016 Italien 200,000 ATLANTIA SPA 3.375% 18/09/2017 200,000 BANCA CARIGE 3.75% 25/11/2016 100,000 BANCA MONTE DEI PASCHI DI SIENA 4.125% 11/11/2013 Die beiliegenden Erläuterungen sind integraler Bestandteil dieses Berichtes Marktwert 23,559,248 951,672 4,991,849 4,961,749 432,068 509,740 301,125 263,583 178,658 451,499 525,775 451,940 900,684 250,580 1,027,070 501,200 553,358 136,638 469,675 1,114,585 309,159 1,009,390 511,410 142,670 199,996 125,343 199,944 412,056 566,341 1,009,740 99,751 494,865 494,865 2,352,602 401,752 551,645 345,426 1,053,779 44,698,938 192,408 193,216 100,279 % des NIW Anzahl nennwert Bond Euro Aggregate Wertpapierbestand zum 30/06/11 EUR EUR 7.83 0.32 1.65 1.64 0.14 0.17 0.10 0.09 0.06 0.15 0.17 0.15 0.30 0.08 0.34 0.17 0.18 0.05 0.16 0.37 0.10 0.34 0.17 0.05 0.07 0.04 0.07 0.14 0.19 0.34 0.03 0.16 0.16 0.78 0.13 0.18 0.11 0.36 14.85 0.06 0.06 0.03 100,000 ENI SPA 3.5% 29/01/2018 100,000 ENI SPA 4% 29/06/2020 500,000 ENI SPA 5% 28/01/2016 500,000 INTESA SANPAOLO SPA FRN 24/02/2014 700,000 INTESA SANPAOLO SPA FRN 28/05/2018 150,000 INTESA SANPAOLO SPA VAR PERP 800,000 INTESA SANPAOLO SPA 3.25% 01/02/2013 100,000 INTESA SANPAOLO SPA 3.5% 27/11/2013 700,000 INTESA SANPAOLO SPA 4.125% 14/01/2016 100,000 INTESA SANPAOLO SPA 4.375% 16/08/2016 100,000 ITALIEN BTP 4% 01/02/2017 5,000,000 ITALIEN BTP 4.25% 15/10/2012 6,500,000 ITALIEN BTP 4.75% 01/09/2021 17,400,000 ITALIEN BTP 5% 01/03/2025 1,000,000 ITALIEN BTP 5% 01/08/2039 7,500,000 ITALIEN BTP 5% 01/09/2040 700,000 ITALIEN BTP 5.25% 01/08/2011 100,000 PIRELLI E C SPA 5.125% 22/02/2016 550,000 TELECOM ITALIA SPA 5.125% 25/01/2016 500,000 TELECOM ITALIA SPA 8.25% 21/03/2016 100,000 TELECOM ITALIA 6.25% 01/02/2012 650,000 TERNA SPA 4.75% 15/03/2021 100,000 UNICREDITO SUB VAR 22/09/2019 600,000 UNIONE DI BANCHE ITALIANE 4.125% 21/10/2013 417,000 UNIPOL GRUPPO FINANZIA 5% 11/01/2017 Jersey 100,000 UBS <strong>AG</strong> JERSEY BRANCH VAR 25/09/2018 Kaimaninseln 200,000 HUTCHISON WHAMPOA INTERNATIONAL LTD 4.75% 14/11/2016 Luxemburg 350,000 ARCELORMITTAL SA 8.25% 03/06/2013 300,000 EUROPEAN INVESTMENT BANK 4.5% 15/10/2025 300,000 EUROPEAN INVESTMENT BANK 5.50% 15/02/2018 2,103,000 EUROPEAN UNION 3.25% 04/04/2018 Mexiko 300,000 AMERICA MOVIL SAB DE CV 3.75% 28/06/2017 1,100,000 PETROLEOS MEXICANOS 5.5% 09/01/2017 Niederlande 150,000 ABN AMRO BANK NV 2.75% 29/10/2013 300,000 ABN AMRO BANK NV 4.25% 11/04/2016 400,000 ABN AMRO BANK NV 6.375% 27/04/2021 500,000 ABN AMRO FRN 08/06/2015 500,000 ALLIANZ FINANCE II BV VAR 08/07/2041 700,000 ALTADIS FINANCE BV 5.125% 02/10/2013 250,000 BK NEDL GEM.5 3,375% 5/06/2013 EMTN 100,000 BMW FINANCE 6.125% 02/04/2012 100,000 DAIMLER INTL FIN BV 7.75% 26/03/2012 350,000 DELTA LLOYD NV 4.25% 17/11/2017 300,000 FORTIS BANK NV 4% 03/02/2015 300,000 GENERALI FINANCE B.V 4.75% 12/05/2014 206,376 206,376 Marktwert 97,576 98,434 531,265 345,767 714,672 152,894 796,376 99,566 692,937 100,600 99,622 5,107,750 6,464,055 17,320,829 920,070 6,870,975 701,995 101,281 557,904 569,105 102,190 656,500 97,433 599,754 413,485 99,622 99,622 3,149,737 383,348 316,626 340,854 2,108,909 1,457,148 298,353 1,158,795 22,660,781 148,859 301,125 402,300 441,025 480,330 732,543 265,338 102,933 103,992 346,311 302,502 311,772 % des NIW 0.03 0.03 0.18 0.11 0.24 0.05 0.26 0.03 0.23 0.03 0.03 1.70 2.16 5.76 0.31 2.29 0.23 0.03 0.19 0.19 0.03 0.22 0.03 0.20 0.14 0.03 0.03 0.07 0.07 1.05 0.13 0.11 0.11 0.70 0.48 0.10 0.38 7.53 0.05 0.10 0.13 0.15 0.16 0.24 0.09 0.03 0.03 0.12 0.10 0.10 79

- Seite 1:

FWWP112432 AMUNDI FUNDS SICAV mit T

- Seite 5 und 6:

Seite Organisation 6 Bericht des Vo

- Seite 7 und 8:

DEPOTBANK CACEIS Bank Luxemburg S.A

- Seite 9 und 10:

BILANZ FÜR DAS 2. HALBJAHR 2010 Be

- Seite 11 und 12:

Anzahl Nennwert Positive Positionen

- Seite 13 und 14:

Anzahl nennwert Positive Positionen

- Seite 15 und 16:

Anzahl nennwert 69,700 KISSEI PHARM

- Seite 17 und 18:

Anzahl nennwert Positive Positionen

- Seite 19 und 20:

Anzahl nennwert Getränke 775 COCA-

- Seite 21 und 22:

Anzahl nennwert Positive Positionen

- Seite 23 und 24:

Anzahl nennwert Aktien/Anteile aus

- Seite 25 und 26:

Anzahl nennwert 3,450 GOOGLE INC-A

- Seite 27 und 28: Anzahl nennwert 117,000 MITSUBISHI

- Seite 29 und 30: Anzahl nennwert Aktien/Anteile aus

- Seite 31 und 32: Anzahl nennwert Positive Positionen

- Seite 33 und 34: Anzahl nennwert Positive Positionen

- Seite 35 und 36: Anzahl nennwert Positive Positionen

- Seite 37 und 38: Anzahl nennwert Positive Positionen

- Seite 39 und 40: Anzahl nennwert Positive Positionen

- Seite 41 und 42: Anzahl nennwert Taiwan 4,774,866 AD

- Seite 43 und 44: Anzahl nennwert 12,400 RANDON SA IM

- Seite 45 und 46: Anzahl nennwert 303,080,773 VTB BAN

- Seite 47 und 48: Anzahl nennwert 498,000 CHINA SHENH

- Seite 49 und 50: Anzahl nennwert Südkorea 16,162 CE

- Seite 51 und 52: Anzahl nennwert Positive Positionen

- Seite 53 und 54: Anzahl nennwert 1,137,500 TAMBANG B

- Seite 55 und 56: Anzahl nennwert 35,697 LG CORP 14,2

- Seite 57 und 58: Anzahl nennwert 45,093 SPAR GROUP L

- Seite 59 und 60: Anzahl nennwert Taiwan 797,000 ADVA

- Seite 61 und 62: Anzahl nennwert Positive Positionen

- Seite 63 und 64: Anzahl nennwert Reise und Freizeit

- Seite 65 und 66: Anzahl nennwert Positive Positionen

- Seite 67 und 68: Anzahl nennwert Chile 72,409 CAP SA

- Seite 69 und 70: Anzahl nennwert Positive Positionen

- Seite 71 und 72: Anzahl nennwert Positive Positionen

- Seite 73 und 74: Anzahl nennwert Positive Positionen

- Seite 75 und 76: Anzahl nennwert Positive Positionen

- Seite 77: Anzahl nennwert Geldmarktinstrument

- Seite 81 und 82: Anzahl nennwert 300,000 UNICREDITO

- Seite 83 und 84: Anzahl nennwert 700,000 SPAIN 3.8%

- Seite 85 und 86: Anzahl nennwert 1,750,000 HBOS PLC

- Seite 87 und 88: Anzahl nennwert Positive Positionen

- Seite 89 und 90: Anzahl nennwert Positive Positionen

- Seite 91 und 92: Anzahl nennwert Aktien/Anteile aus

- Seite 93 und 94: Anzahl nennwert Bergbau 185,000 ARC

- Seite 95 und 96: Anzahl nennwert 8,000 JEFFERIES GRO

- Seite 97 und 98: Anzahl nennwert Positive Positionen

- Seite 99 und 100: Anzahl nennwert Positive Positionen

- Seite 101 und 102: Anzahl nennwert Geldmarktinstrument

- Seite 103 und 104: Anzahl nennwert Marktwert % des NIW

- Seite 105 und 106: Anzahl nennwert Positive Positionen

- Seite 107 und 108: Anzahl nennwert Positive Positionen

- Seite 109 und 110: Anzahl nennwert Positive Positionen

- Seite 111 und 112: Anzahl nennwert Luxemburg 79,070 AR

- Seite 113 und 114: Anzahl nennwert Frankreich 11,759 A

- Seite 115 und 116: Anzahl nennwert Italien 97,568 ASSI

- Seite 117 und 118: Anzahl nennwert Positive Positionen

- Seite 119 und 120: Anzahl nennwert 63,099 BANK OF NEW

- Seite 121 und 122: Anzahl nennwert 18,580 INTERNATIONA

- Seite 123 und 124: Anzahl nennwert 125,418 SPRINT NEXT

- Seite 125 und 126: Anzahl nennwert 57,000 MTR CORP 82,

- Seite 127 und 128: Anzahl nennwert 42 NTT URBAN DEVELO

- Seite 129 und 130:

Anzahl nennwert Positive Positionen

- Seite 131 und 132:

Anzahl nennwert Positive Positionen

- Seite 133 und 134:

Anzahl nennwert Positive Positionen

- Seite 135 und 136:

Anzahl nennwert Positive Positionen

- Seite 137 und 138:

Anzahl nennwert Vereinigte Staaten

- Seite 139 und 140:

Anzahl nennwert Irland 2,250,000 CE

- Seite 141 und 142:

Anzahl nennwert Negative Positionen

- Seite 143 und 144:

Anzahl nennwert Positive Positionen

- Seite 145 und 146:

Anzahl nennwert -275 MICHELIN - 72.

- Seite 147 und 148:

Anzahl nennwert Positive Positionen

- Seite 149 und 150:

Anzahl nennwert Positive Positionen

- Seite 151 und 152:

Anzahl nennwert Positive Positionen

- Seite 154 und 155:

Nettovermögensaufstellung Deutsch

- Seite 156 und 157:

Nettovermögensaufstellung Deutsch

- Seite 158 und 159:

Nettovermögensaufstellung Deutsch

- Seite 160 und 161:

Nettovermögensaufstellung Deutsch

- Seite 162 und 163:

Nettovermögensaufstellung Deutsch

- Seite 164 und 165:

Nettovermögensaufstellung Deutsch

- Seite 166 und 167:

Nettovermögensaufstellung Deutsch

- Seite 168 und 169:

Nettovermögensaufstellung Deutsch

- Seite 170 und 171:

Nettovermögensaufstellung Deutsch

- Seite 172 und 173:

Nettovermögensaufstellung Deutsch

- Seite 174 und 175:

Nettovermögensaufstellung Deutsch

- Seite 176 und 177:

Nettovermögensaufstellung Deutsch

- Seite 178 und 179:

Nettovermögensaufstellung Deutsch

- Seite 180 und 181:

Finanzielle Einzelheiten zu den let

- Seite 182 und 183:

Finanzielle Einzelheiten zu den let

- Seite 184 und 185:

Finanzielle Einzelheiten zu den let

- Seite 186 und 187:

Finanzielle Einzelheiten zu den let

- Seite 188 und 189:

Finanzielle Einzelheiten zu den let

- Seite 190 und 191:

Finanzielle Einzelheiten zu den let

- Seite 192 und 193:

Finanzielle Einzelheiten zu den let

- Seite 194 und 195:

Finanzielle Einzelheiten zu den let

- Seite 196 und 197:

Finanzielle Einzelheiten zu den let

- Seite 198 und 199:

Finanzielle Einzelheiten zu den let

- Seite 200 und 201:

Finanzielle Einzelheiten zu den let

- Seite 202 und 203:

Finanzielle Einzelheiten zu den let

- Seite 204 und 205:

Finanzielle Einzelheiten zu den let

- Seite 206 und 207:

Finanzielle Einzelheiten zu den let

- Seite 208 und 209:

Finanzielle Einzelheiten zu den let

- Seite 210 und 211:

Finanzielle Einzelheiten zu den let

- Seite 212 und 213:

Finanzielle Einzelheiten zu den let

- Seite 214 und 215:

Finanzielle Einzelheiten zu den let

- Seite 216 und 217:

Finanzielle Einzelheiten zu den let

- Seite 218 und 219:

Finanzielle Einzelheiten zu den let

- Seite 220 und 221:

Finanzielle Einzelheiten zu den let

- Seite 222 und 223:

Finanzielle Einzelheiten zu den let

- Seite 224:

Finanzielle Einzelheiten zu den let

- Seite 227 und 228:

227 Die beiliegenden Erläuterungen

- Seite 229 und 230:

229 Die beiliegenden Erläuterungen

- Seite 231 und 232:

231 Die beiliegenden Erläuterungen

- Seite 233 und 234:

233 Die beiliegenden Erläuterungen

- Seite 235 und 236:

235 Die beiliegenden Erläuterungen

- Seite 237 und 238:

237 Die beiliegenden Erläuterungen

- Seite 239 und 240:

239 Die beiliegenden Erläuterungen

- Seite 241 und 242:

241 Die beiliegenden Erläuterungen

- Seite 243 und 244:

Bond Euro Aggregate 30/06/2011 EUR

- Seite 245 und 246:

245 Die beiliegenden Erläuterungen

- Seite 247 und 248:

247 Die beiliegenden Erläuterungen

- Seite 249 und 250:

249 Die beiliegenden Erläuterungen

- Seite 251 und 252:

251 Die beiliegenden Erläuterungen

- Seite 253 und 254:

Absolute Statistical Arbitrage 30/0

- Seite 255 und 256:

255 Die beiliegenden Erläuterungen

- Seite 257 und 258:

257 Die beiliegenden Erläuterungen

- Seite 259 und 260:

- Amundi Funds Volatility Euro Equi

- Seite 261 und 262:

Anteilklassen Diese Tabelle macht n

- Seite 263 und 264:

Rücknahme gebühr Umwandlung s geb

- Seite 265 und 266:

Rücknahme gebühr Umwandlung s geb

- Seite 267 und 268:

4 VERWALTUNGS- UND VERTRIEBSGEBÜHR

- Seite 269 und 270:

AMUNDI FUNDS Basiswährung des Teil

- Seite 271 und 272:

AMUNDI FUNDS Basiswährung des Teil

- Seite 273 und 274:

AMUNDI FUNDS Basiswährung des Teil

- Seite 275 und 276:

AMUNDI FUNDS Basiswährung des Teil

- Seite 277 und 278:

Basiswährung des AMUNDI FUNDS Teil

- Seite 279 und 280:

AMUNDI FUNDS Basiswährung des Teil

- Seite 281 und 282:

5 PERFORMANCEGEBÜHREN AKTIEN- UND

- Seite 283 und 284:

7 OFFENE POSITIONEN AUS TERMINGESCH

- Seite 285 und 286:

Amundi Funds Bond Euro Aggregate An

- Seite 287 und 288:

Amundi Funds Bond Global Anzahl der

- Seite 289 und 290:

Amundi Funds Absolute VaR 2(EUR) An

- Seite 291 und 292:

Amundi Funds Absolute Volatility Wo

- Seite 293 und 294:

Amundi Funds Bond Global Aggregate

- Seite 295 und 296:

Amundi Funds Equity US Concentrated

- Seite 297 und 298:

Amundi Funds Equity Emerging Intern

- Seite 299 und 300:

Amundi Funds Bond Euro Inflation An

- Seite 301 und 302:

Amundi Funds Bond Global Inflation

- Seite 303 und 304:

Amundi Funds Index Global Bond (EUR

- Seite 305 und 306:

Amundi Funds Absolute VaR 4(EUR) A

- Seite 307 und 308:

Amundi Funds Absolute Volatility Wo

- Seite 309 und 310:

Währung Teilfonds * Diese Teilfond

- Seite 311 und 312:

Amundi Funds Absolute Statistical A

- Seite 313 und 314:

Amundi Funds Bond Europe Anmerkunge

- Seite 315 und 316:

Anmerkungen zum Geschäftsbericht z

- Seite 317 und 318:

Amundi Funds Absolute Volatility Eu

- Seite 319 und 320:

Amundi Funds Bond Euro Corporate No

- Seite 321 und 322:

19 CONTRACTS FOR DIFFERENCE (DIFFER

- Seite 323 und 324:

Bericht des Rechnungsprüfers An di

- Seite 325 und 326:

Bekanntmachungen und Berichte Sofer

- Seite 327 und 328:

Zusätzliche Informationen (ungepr

- Seite 329 und 330:

Zusätzliche Informationen (ungepr

- Seite 331 und 332:

Zusätzliche Informationen (ungepr

- Seite 333 und 334:

Zusätzliche Informationen (ungepr

- Seite 335 und 336:

Zusätzliche Informationen (ungepr

- Seite 337 und 338:

Zusätzliche Informationen (ungepr

- Seite 339 und 340:

Zusätzliche Informationen (ungepr

- Seite 341 und 342:

Zusätzliche Informationen (ungepr

- Seite 343 und 344:

Zusätzliche Informationen (ungepr

- Seite 345 und 346:

Zusätzliche Informationen (ungepr

- Seite 347:

RECHTLICHE HINWEISE AMUNDI FUNDS In

![1O]MRsP^]LO\SMR^ # - Skandia Lebensversicherung AG](https://img.yumpu.com/15068944/1/184x260/1omrsplosmr-skandia-lebensversicherung-ag.jpg?quality=85)