- Page 1 and 2: Undergraduate Bulletin 2006-2007

- Page 3 and 4: University Phone Numbers Westcheste

- Page 5 and 6: ACADEMIC CALENDAR / 5 Feb 9 F Last

- Page 7 and 8: The University History The names

- Page 9 and 10: Goals Loyola Marymount University p

- Page 11 and 12: Membership Loyola Marymount Univers

- Page 13 and 14: University Facilities Academic A co

- Page 15 and 16: Student-Managed Social and Recreati

- Page 17 and 18: University Services Campus Ministry

- Page 19 and 20: Computer Labs and Villages The Univ

- Page 21 and 22: Alumni Association The Loyola Marym

- Page 23 and 24: Student Affairs The Division of Stu

- Page 25 and 26: The award-winning Burns Recreation

- Page 27 and 28: By the end of the first year at LMU

- Page 29 and 30: KXLU/KLMU As one of the only opport

- Page 31 and 32: Admission Loyola Marymount Universi

- Page 33 and 34: Credit for work completed at instit

- Page 35 and 36: AP Exam Minimum AP Score Required N

- Page 37: If a student repeats a course, the

- Page 41 and 42: Nanette Salamunovich Goodman Schola

- Page 43 and 44: Rev. Alfred J. Kilp, S.J., Alumni S

- Page 45 and 46: Orientation Fee (non-refundable man

- Page 47 and 48: The University strives to meet the

- Page 49 and 50: University Core Curriculum Goals an

- Page 51 and 52: Students in the College of Communic

- Page 53 and 54: Academic Degrees and Programs Under

- Page 55 and 56: M.A. ..............Pastoral Theolog

- Page 57 and 58: Academic Probation Academic probati

- Page 59 and 60: D. Intentional Violation: If the In

- Page 61 and 62: Arrangements to undertake an Indepe

- Page 63 and 64: A grade of A may be modified by a m

- Page 65 and 66: 6. A minor may be earned only while

- Page 67 and 68: After the deadline, and before the

- Page 69 and 70: The student’s program is then for

- Page 71 and 72: The program costs (comparable to th

- Page 73 and 74: Thomas and Dorothy Leavey Center fo

- Page 75 and 76: ACADEMIC AWARDS AND COMMENCEMENT HO

- Page 77 and 78: University Academic Awards For stud

- Page 79 and 80: Sr. Raymunde McKay, R.S.H.M., Servi

- Page 81 and 82: University Honors Program All Unive

- Page 83 and 84: HNRS 497 Honors Thesis 1-2 Semester

- Page 85 and 86: Bellarmine College of Liberal Arts

- Page 87 and 88: Critical and Creative Arts 6 Semest

- Page 89 and 90:

African American Studies Faculty Ac

- Page 91 and 92:

Sophomore Year Fall Semester S.H. o

- Page 93 and 94:

AFAM 485 African American Social Th

- Page 95 and 96:

AMCS 300 Advanced Survey of America

- Page 97 and 98:

Asian and Pacific Studies Model Fou

- Page 99 and 100:

ASPA 490 Asian Women Writers 3 Seme

- Page 101 and 102:

APAM 435 Asian Pacific American Wom

- Page 103 and 104:

Catholic Studies Director: José Ig

- Page 105 and 106:

Chicana/o Studies Faculty Chairpers

- Page 107 and 108:

CHST 298 Special Studies 1-3 Semest

- Page 109 and 110:

Classics and Archaeology Faculty Ch

- Page 111 and 112:

Upper Division Requirements: GREK 3

- Page 113 and 114:

Classical Civilizations Model Four-

- Page 115 and 116:

Senior Year Fall Semester S.H. GREK

- Page 117 and 118:

CLCV 304 Art and Architecture of An

- Page 119 and 120:

GREK 398 Special Studies 1-3 Semest

- Page 121 and 122:

LATN 498 Special Studies 1-3 Semest

- Page 123 and 124:

Modern Greek Objectives The Modern

- Page 125 and 126:

Economics Faculty Chairperson: Jame

- Page 127 and 128:

Spring Semester S.H. or or or or EC

- Page 129 and 130:

ECON 330 Regression Analysis 3 Seme

- Page 131 and 132:

ECON 414 Game Theory 3 Semester Hou

- Page 133 and 134:

English Faculty Chairperson: David

- Page 135 and 136:

Pre-Journalism Curriculum Although

- Page 137 and 138:

Spring Semester S.H. or or ENGL 371

- Page 139 and 140:

ENGL 301 Writing for Journalism I:

- Page 141 and 142:

ENGL 371 American Literature I 3 Se

- Page 143 and 144:

ENGL 502 The Arthurian Romance 3 Se

- Page 145 and 146:

ENGL 553 American Realism and Natur

- Page 147 and 148:

ENGL 584 The Black Aesthetic 3 Seme

- Page 149 and 150:

European Studies Director Petra Lie

- Page 151 and 152:

Spring Semester S.H. or PHIL 160 Ph

- Page 153 and 154:

Geography Director Peter Hoffman Ob

- Page 155 and 156:

History Faculty Chairperson: John H

- Page 157 and 158:

Spring Semester S.H. HIST ___ HIST

- Page 159 and 160:

HIST 418 From Viking to Crusader 3

- Page 161 and 162:

HIST 462 Founding Fathers 3 Semeste

- Page 163 and 164:

HIST 491 South Africa 3 Semester Ho

- Page 165 and 166:

6 semester hours in either an ancie

- Page 167 and 168:

Irish Studies Director John Menagha

- Page 169 and 170:

Note: Courses offered in other depa

- Page 171 and 172:

LIBA 299 Independent Studies 1-3 Se

- Page 173 and 174:

HIST 366: History of California (3

- Page 175 and 176:

Spring Semester S.H. EDUC 410 Direc

- Page 177 and 178:

CHIN 203 Intermediate Chinese I 3 S

- Page 179 and 180:

Foreign Literature in English Trans

- Page 181 and 182:

Spring Semester S.H. or or FREN 204

- Page 183 and 184:

FREN 431 French/Francophone Film 3

- Page 185 and 186:

GRMN 203 Intermediate German I 3 Se

- Page 187 and 188:

ITAL 102 Elementary Italian II 3 Se

- Page 189 and 190:

JAPN 203 Intermediate Japanese I 3

- Page 191 and 192:

Major Requirements Lower Division R

- Page 193 and 194:

Spring Semester S.H. SPAN 500 Senio

- Page 195 and 196:

SPAN 204 Intermediate Spanish II 3

- Page 197 and 198:

SPAN 443 Latin American Women Write

- Page 199 and 200:

Peace Studies Director Daniel L. Sm

- Page 201 and 202:

Honors in Philosophy To graduate wi

- Page 203 and 204:

PHIL 321 Bioethics 3 Semester Hours

- Page 205 and 206:

PHIL 366 Philosophy of Religion 3 S

- Page 207 and 208:

Political Science Faculty Chairpers

- Page 209 and 210:

Senior Year Fall Semester S.H. POLS

- Page 211 and 212:

POLS 520 Modes of Political Inquiry

- Page 213 and 214:

POLS 353 Politics in the Middle Eas

- Page 215 and 216:

POLS 571 The Law and Presidential P

- Page 217 and 218:

Psychology Student Learning Outcome

- Page 219 and 220:

Freshman Year Fall Semester S.H. EN

- Page 221 and 222:

Students may take no more than ten

- Page 223 and 224:

PSYC 330 Forensic Psychology 3 Seme

- Page 225 and 226:

PSYC 442 Psychological Assessment 3

- Page 227 and 228:

PSYC 598 Special Studies 1-3 Semest

- Page 229 and 230:

Freshman Year Fall Semester S.H. or

- Page 231 and 232:

SOCL 422 Criminal Justice 3 Semeste

- Page 233 and 234:

SOCL 454 Religion, Culture, and Soc

- Page 235 and 236:

One additional upper division THST

- Page 237 and 238:

THST 110 Introduction to the New Te

- Page 239 and 240:

THST 415 New Testament Theology 3 S

- Page 241 and 242:

Area C: Faith, Culture, and Ministr

- Page 243 and 244:

Urban Studies Director Peter R. Hof

- Page 245 and 246:

Freshman Year Fall Semester S.H. or

- Page 247 and 248:

Women’s Studies Faculty Chairpers

- Page 249 and 250:

Senior Year Fall Semester S.H. WNST

- Page 251 and 252:

WNST 366 The American Family (See H

- Page 253 and 254:

College of Business Administration

- Page 255 and 256:

Philosophy 6 Semester Hours Course

- Page 257 and 258:

Finance ENTR 461 Technology Venture

- Page 259 and 260:

Upper division business courses may

- Page 261 and 262:

Accounting Faculty Chairperson: Mah

- Page 263 and 264:

Finance, Computer Information Syste

- Page 265 and 266:

Computer Information Systems and Op

- Page 267 and 268:

Management, Entrepreneurship, and I

- Page 269 and 270:

MGMT 451 Business Practices in a Gl

- Page 271 and 272:

INBA 445 International Marketing (S

- Page 273 and 274:

BLAW 408 Real Estate Law 3 Semester

- Page 275 and 276:

MRKT 465 Marketing Promotional Stra

- Page 277 and 278:

Travel and Tourism Director Alan K.

- Page 279 and 280:

TOUR 496 Travel and Tourism Informa

- Page 281 and 282:

COMMUNICATION AND FINE ARTS / 281 C

- Page 283 and 284:

Social Sciences 6 Semester Hours St

- Page 285 and 286:

Art and Art History Faculty Chairpe

- Page 287 and 288:

Art History ARHS 100 Art and Its Hi

- Page 289 and 290:

ARHS 449 Junior/Senior Seminar in A

- Page 291 and 292:

Junior Year Fall Semester S.H. ART

- Page 293 and 294:

Spring Semester S.H. ART 154 Drawin

- Page 295 and 296:

Spring Semester S.H. ART 360 Graphi

- Page 297 and 298:

Spring Semester S.H. ART 494 Multim

- Page 299 and 300:

ART 301 Figure Workshop II 1 Semest

- Page 301 and 302:

ART 372 Jewelry I 3 Semester Hours

- Page 303 and 304:

ART 468 Typography II 3 Semester Ho

- Page 305 and 306:

Spring Semester S.H. CMST 351 Conte

- Page 307 and 308:

CMST 301 Theories of Human Communic

- Page 309 and 310:

CMST 490 Communication Practicum I

- Page 311 and 312:

Lower Division Requirements: A mini

- Page 313 and 314:

Sophomore Year Fall Semester S.H. D

- Page 315 and 316:

DANC 220 Ballet II 0-2 Semester Hou

- Page 317 and 318:

DANC 378 Service Project 0-1 Semest

- Page 319 and 320:

DANC 480 Kinesiology for Dancers I

- Page 321 and 322:

Music Faculty Chairperson: Mary Cat

- Page 323 and 324:

Music Minor Curriculum 21 Semester

- Page 325 and 326:

Spring Semester S.H. MUSC 318 Music

- Page 327 and 328:

MUSC 181 Guitar, Percussion, Piano,

- Page 329 and 330:

MUSC 331 Score Reading II 2 Semeste

- Page 331 and 332:

MUSC 413 Music of the Baroque 3 Sem

- Page 333 and 334:

MUSC 492 Chamber Music Ensembles 0-

- Page 335 and 336:

Spring Semester S.H. THEA 245 Weste

- Page 337 and 338:

THEA 252 Workshop: Playwrights and

- Page 339 and 340:

THEA 422 Advanced Costume Design 3

- Page 341 and 342:

Frank R. Seaver College of Science

- Page 343 and 344:

Teacher Preparation Programs The Co

- Page 345 and 346:

International/Global Studies Studen

- Page 347 and 348:

Critical/Creative Arts 6 Semester H

- Page 349 and 350:

Biology Faculty Chairperson: Martin

- Page 351 and 352:

Senior Year Fall Semester S.H. BIOL

- Page 353 and 354:

BIOL 201 Cell Function 3 Semester H

- Page 355 and 356:

BIOL 319 Ecology Laboratory 1 Semes

- Page 357 and 358:

BIOL 376 Genetics Laboratory 1 Seme

- Page 359 and 360:

BIOL 490 Biological Teaching 1-2 Se

- Page 361 and 362:

Chemistry and Biochemistry Faculty

- Page 363 and 364:

Spring Semester S.H. CHEM 490 Chemi

- Page 365 and 366:

Senior Year Fall Semester S.H. BIOL

- Page 367 and 368:

CHEM 298 Special Studies: Chemistry

- Page 369 and 370:

CHEM 470 Biochemistry I 3 Semester

- Page 371 and 372:

Civil Engineering and Environmental

- Page 373 and 374:

Spring Semester S.H. CIVL 302 Seism

- Page 375 and 376:

Civil Engineering CIVL 200 Mechanic

- Page 377 and 378:

CIVL 498 Special Studies 1-4 Semest

- Page 379 and 380:

ENVS 513 Solid Wastes Engineering 2

- Page 381 and 382:

Electrical Engineering Curriculum (

- Page 383 and 384:

Junior Year Fall Semester S.H. CMSI

- Page 385 and 386:

ELEC 383 Introduction to Microproce

- Page 387 and 388:

ELEC 567 Introduction to Digtial VL

- Page 389 and 390:

Senior Year Fall Semester S.H. CMSI

- Page 391 and 392:

CMSI 371 Computer Graphics 3 Semest

- Page 393 and 394:

General Engineering A General Engin

- Page 395 and 396:

Mathematics Faculty Acting Chairper

- Page 397 and 398:

Minor in Secondary Education Mathem

- Page 399 and 400:

Spring Semester S.H. MATH 322** Rea

- Page 401 and 402:

MATH 106 Mathematics for Elementary

- Page 403 and 404:

MATH 301 Mathematical Ideas for Fut

- Page 405 and 406:

MATH 495 Mathematical Modeling 3 Se

- Page 407 and 408:

Mechanical Engineering Faculty Chai

- Page 409 and 410:

Senior Year Fall Semester S.H. MECH

- Page 411 and 412:

MECH 340 Engineering Systems II 3 S

- Page 413 and 414:

MECH 527 Finite Elements Methods 3

- Page 415 and 416:

B.S. Degree in Natural Science Gene

- Page 417 and 418:

Junior Year Fall Semester S.H. ____

- Page 419 and 420:

B.S. Degree in Natural Science Seco

- Page 421 and 422:

B.S. Degree in Athletic Training (1

- Page 423 and 424:

Spring Semester S.H. BIOL 102 Gener

- Page 425 and 426:

NTLS 250 The Blue Planet: Introduct

- Page 427 and 428:

NTLS 320 Science, Theology, and the

- Page 429 and 430:

NTLS 396 Occupational Therapy Inter

- Page 431 and 432:

NTLS 510 Chemistry for Environmenta

- Page 433 and 434:

Physics Curriculum (125 S.H.) Fresh

- Page 435 and 436:

PHYS 101 Introduction to Mechanics

- Page 437 and 438:

PHYS 298 Special Studies 1-4 Semest

- Page 439 and 440:

School of Education EDUCATION / 439

- Page 441 and 442:

• Collaborate and share leadershi

- Page 443 and 444:

• Subject Matter Plan of Action c

- Page 445 and 446:

• Complete the following methods

- Page 447 and 448:

• Subject Matter Plan of Action C

- Page 449 and 450:

Minor in Education Students may dec

- Page 451 and 452:

EDUC 414 Theories of Second Languag

- Page 453 and 454:

EDUC 456 Directed Teaching with Cul

- Page 455 and 456:

EDUC 8000 Health Education 1 Extens

- Page 457 and 458:

School of Film and Television Admin

- Page 459 and 460:

Philosophy 6 Semester Hours Course

- Page 461 and 462:

Animation Major Requirements Lower

- Page 463 and 464:

ANIM 199 Independent Studies 1-3 Se

- Page 465 and 466:

Production—Film and Television Ob

- Page 467 and 468:

Film and Television Studies FTVS 10

- Page 469 and 470:

FTVS 516 Working with Actors 3 Seme

- Page 471 and 472:

PROD 450 Production IV (non-fi ctio

- Page 473 and 474:

Recording Arts Lower Division Requi

- Page 475 and 476:

RECA 367 Production Sound 3 Semeste

- Page 477 and 478:

Spring Semester S.H. SCWR 321 Compl

- Page 479 and 480:

Department of Aerospace Studies AER

- Page 481 and 482:

AERO 100 The Foundation of the Unit

- Page 483 and 484:

Campus Maps CAMPUS MAPS / 483

- Page 485 and 486:

University Administration UNIVERSIT

- Page 487 and 488:

Regents of the University William D

- Page 489 and 490:

Academic Administration Marcia L. A

- Page 491 and 492:

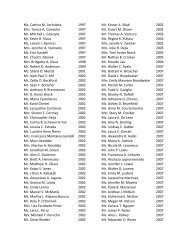

University Faculty UNIVERSITY FACUL

- Page 493 and 494:

SUSAN TORREY BARBER (1991) Associat

- Page 495 and 496:

S.W. TINA CHOE (1996) Associate Pro

- Page 497 and 498:

ELLEN A. ENSHER (1997) Associate Pr

- Page 499 and 500:

FERNANDO J. GUERRA (1987) Associate

- Page 501 and 502:

LILY KHADJAVI (1999) Associate Prof

- Page 503 and 504:

DAVID MARCHESE (2005) Adjunct Profe

- Page 505 and 506:

JENNIFER P. OFFENBERG (2005) Assist

- Page 507 and 508:

THOMAS P. RAUSCH, S.J. (1967-69; 19

- Page 509 and 510:

JEFFREY S. SIKER (1987) Professor o

- Page 511 and 512:

KEVIN J. WETMORE, JR. (2005) Assist

- Page 513 and 514:

Faculty Emeriti BERNARD V. ABBENE C

- Page 515 and 516:

Index A Academic Advising .........

- Page 517 and 518:

Liberal Arts Courses ..............

- Page 520:

Updates to the Undergraduate Bullet