“Quicklook” Assessment of Greater Adelaide's Assets & Challenges ...

“Quicklook” Assessment of Greater Adelaide's Assets & Challenges ...

“Quicklook” Assessment of Greater Adelaide's Assets & Challenges ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Business Oriented Processes and Entrepreneurial Approaches<br />

• A "First Tuesday" network (100 to 180 people that meet monthly) bridges funding<br />

from angels to VCs, but there is no VC presence in these monthly networking<br />

meetings.<br />

• A VC summit is planned in August. Also, Business Vision 2010 is planning a VC<br />

Forum at some point in the future.<br />

• Playford Centre, a seed capital investment company that is 100% owned by<br />

Government, whose scoring <strong>of</strong> applicants is based on people, market, and product,<br />

report a good deal flow.<br />

• Invest SA is a government program to encourage foreign direct investment. One<br />

<strong>of</strong> their major areas <strong>of</strong> emphasis is the Information and Communications Technology<br />

(ICT) sector. They take a marketing approach and do research working collectively<br />

with other agencies locally. They are mandated to work on a statewide basis for<br />

investment opportunities that are good for the region as a whole.<br />

Physical Infrastructure and Resources<br />

• A few VC funds have local representatives in Adelaide employed on an agency<br />

basis who receive commissions based on the success <strong>of</strong> the companies.<br />

• There is a national group <strong>of</strong> wealthy Australian angels that occasionally invest in<br />

Adelaide start-ups, but the concept <strong>of</strong> "out <strong>of</strong> site, out <strong>of</strong> mind" seemed to prevail<br />

since most investment capital originates in Sydney or Melbourne.<br />

• The PricewaterhouseCoopers’ benchmarking study <strong>of</strong>fers encourage in regard to<br />

venture capital investment, at least for Australia as a whole. Australian venture capital<br />

investment grew rapidly between 1998 and 1999 and early stage investment grew<br />

faster than overall investment in this sector.<br />

Barriers/Obstacles<br />

• It is felt that there is not always a collective approach with regards to all <strong>of</strong> the<br />

Government activities. Poor communications was cited as a problem at times.<br />

• The fear <strong>of</strong> failure and its accompanying social stigma is seen as a limiting factor.<br />

• There is an acknowledged "Valley <strong>of</strong> Death" in the $200k to $1M range in<br />

Adelaide between funding from friends/family and funding from VCs. The problem<br />

appears to be insufficient angel capital to develop good ideas to the VC stage.<br />

• Many times, wealthy individuals in Adelaide prefer to invest in vines, beans, and<br />

other agricultural schemes where they receive tax deduction up front, rather than<br />

waiting 5 years to see if the I/T investment will pay <strong>of</strong>f. VCs tend to be interested in<br />

the tax benefits.<br />

• The tax system, in general, has not been right to stimulate angel investment. For<br />

example, the tax code encouraged dividend investment, rather than capital<br />

investment.<br />

• The ‘one hour rule’ – VCs tend to invest in opportunities that are located not more<br />

than one hour away from their location.<br />

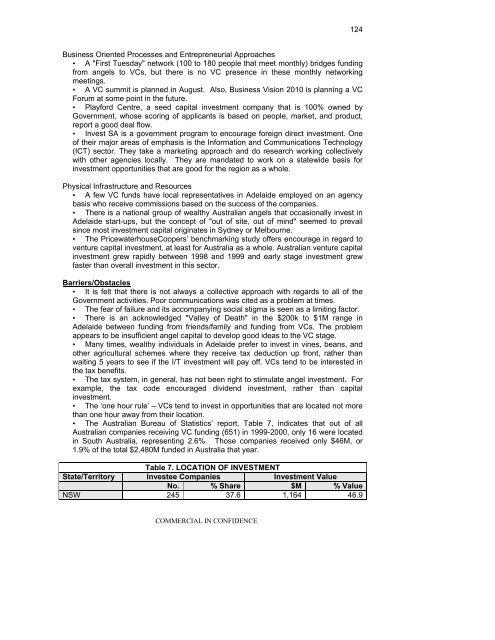

• The Australian Bureau <strong>of</strong> Statistics’ report, Table 7, indicates that out <strong>of</strong> all<br />

Australian companies receiving VC funding (651) in 1999-2000, only 16 were located<br />

in South Australia, representing 2.6%. Those companies received only $46M, or<br />

1.9% <strong>of</strong> the total $2,480M funded in Australia that year.<br />

Table 7. LOCATION OF INVESTMENT<br />

State/Territory Investee Companies Investment Value<br />

No. % Share $M % Value<br />

NSW 245 37.6 1,164 46.9<br />

COMMERCIAL IN CONFIDENCE<br />

124