- Page 5 and 6:

Edited by Michael Miklaucic and Jac

- Page 7 and 8:

Contents Foreword vii James G. Stav

- Page 9 and 10:

Foreword Admiral James G. Stavridis

- Page 11 and 12:

Foreword find themselves in. The Re

- Page 13 and 14:

Acknowledgments E very published bo

- Page 15 and 16:

Introduction Michael Miklaucic and

- Page 17 and 18:

Introduction networks will operate

- Page 19 and 20:

Introduction and distribution opera

- Page 21 and 22:

Introduction bureaucracies remain h

- Page 23:

Introduction Just looking at Mexico

- Page 27 and 28:

Chapter 1 Deviant Globalization Nil

- Page 29 and 30:

Deviant Globalization lots of choic

- Page 31 and 32:

Deviant Globalization of (at least

- Page 33 and 34:

Deviant Globalization tale. Today

- Page 35 and 36:

Deviant Globalization What Is to Be

- Page 37:

Deviant Globalization 3 Philip Capu

- Page 40 and 41:

Williams Some commentators wholehea

- Page 42 and 43:

Williams In this connection, not on

- Page 44 and 45:

Williams 20 With a single ship able

- Page 46 and 47:

Williams rates. . . . In 2050, appr

- Page 48 and 49:

Williams of no-go zone and slums an

- Page 50 and 51:

Williams Water would also be at ris

- Page 52 and 53:

Williams is simply the prize of pol

- Page 54 and 55:

Williams era of state budgetary ret

- Page 56 and 57:

Williams The corollary is that alth

- Page 58 and 59:

Williams would not be prudent to re

- Page 60 and 61:

Williams 56 “Global Water Securit

- Page 62 and 63:

Picard information on black markets

- Page 64 and 65:

Picard harms. The economic value of

- Page 66 and 67:

Picard not particularly relevant as

- Page 68 and 69:

Picard The Government Accountabilit

- Page 70 and 71:

Picard The study was based on a var

- Page 72 and 73:

Picard In considering whether the d

- Page 74 and 75:

Picard 50 Table 3. Comparison of Pr

- Page 76 and 77:

Picard Connecting Illicit Market Si

- Page 78 and 79:

Picard have died because they have

- Page 80 and 81:

Picard 56 10 percent = $14.95 billi

- Page 82 and 83:

Picard prohibited, taxed, or regula

- Page 84 and 85:

Picard 32 “The Illegal Shipment o

- Page 87 and 88:

Chapter 4 The Illicit Supply Chain

- Page 89 and 90: The Illicit Supply Chain business (

- Page 91 and 92: The Illicit Supply Chain For cash c

- Page 93 and 94: The Illicit Supply Chain routes (bo

- Page 95 and 96: The Illicit Supply Chain increase i

- Page 97 and 98: The Illicit Supply Chain 6 In 2010,

- Page 99 and 100: Chapter 5 Fixers, Super Fixers, and

- Page 101 and 102: Fixers, Super Fixers, and Shadow Fa

- Page 103 and 104: Fixers, Super Fixers, and Shadow Fa

- Page 105 and 106: Fixers, Super Fixers, and Shadow Fa

- Page 107 and 108: Fixers, Super Fixers, and Shadow Fa

- Page 109 and 110: Fixers, Super Fixers, and Shadow Fa

- Page 111 and 112: Fixers, Super Fixers, and Shadow Fa

- Page 113 and 114: Fixers, Super Fixers, and Shadow Fa

- Page 115 and 116: Fixers, Super Fixers, and Shadow Fa

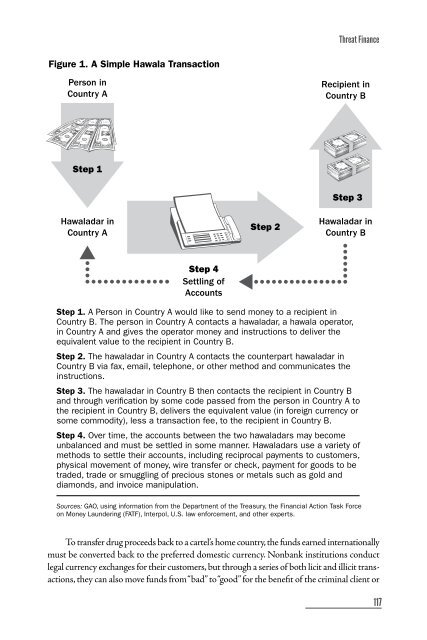

- Page 117 and 118: Fixers, Super Fixers, and Shadow Fa

- Page 119: Fixers, Super Fixers, and Shadow Fa

- Page 122 and 123: Keefe If, as Phil Williams contends

- Page 124 and 125: Keefe For those seeking to study or

- Page 126 and 127: Keefe Partial State Degradation Fro

- Page 128 and 129: Keefe A more recent study hypothesi

- Page 130 and 131: Keefe An Informal Economy Of course

- Page 132 and 133: Keefe Notes 1 William Langewiesche,

- Page 135 and 136: Chapter 7 Threat Finance: A Critica

- Page 137 and 138: Threat Finance ultimately threatens

- Page 139: Threat Finance donations that were

- Page 143 and 144: Threat Finance benefits offered by

- Page 145 and 146: Threat Finance Since the start of t

- Page 147 and 148: Threat Finance played a key role in

- Page 149 and 150: Threat Finance international standa

- Page 151 and 152: Threat Finance Directive 5205.14 ch

- Page 153 and 154: Threat Finance 18 Per 2009 statisti

- Page 155 and 156: Chapter 8 Money Laundering into Rea

- Page 157 and 158: Money Laundering into Real Estate p

- Page 159 and 160: Money Laundering into Real Estate a

- Page 161 and 162: Money Laundering into Real Estate Y

- Page 163 and 164: Money Laundering into Real Estate f

- Page 165 and 166: Money Laundering into Real Estate c

- Page 167 and 168: Money Laundering into Real Estate S

- Page 169 and 170: Money Laundering into Real Estate 3

- Page 171: Part III. The Attack on Sovereignty

- Page 174 and 175: Miklaucic and Naím linkages to ext

- Page 176 and 177: Miklaucic and Naím magnitude of il

- Page 178 and 179: Miklaucic and Naím are groups and

- Page 180 and 181: Miklaucic and Naím 156 or as defin

- Page 182 and 183: Miklaucic and Naím While disturbin

- Page 184 and 185: Miklaucic and Naím now exceeds US$

- Page 186 and 187: Miklaucic and Naím However, under

- Page 188 and 189: Miklaucic and Naím that would bene

- Page 190 and 191:

Miklaucic and Naím An Existential

- Page 192 and 193:

Miklaucic and Naím 15 Transparency

- Page 195 and 196:

Chapter 10 How Illicit Networks Imp

- Page 197 and 198:

How Illicit Networks Impact Soverei

- Page 199 and 200:

How Illicit Networks Impact Soverei

- Page 201 and 202:

• usurping state fiscal roles (st

- Page 203 and 204:

How Illicit Networks Impact Soverei

- Page 205 and 206:

How Illicit Networks Impact Soverei

- Page 207 and 208:

How Illicit Networks Impact Soverei

- Page 209 and 210:

How Illicit Networks Impact Soverei

- Page 211:

How Illicit Networks Impact Soverei

- Page 214 and 215:

Felbab-Brown the 2010 U.S. military

- Page 216 and 217:

Felbab-Brown poorest farmers, who a

- Page 218 and 219:

Felbab-Brown the strategic distinct

- Page 220 and 221:

Felbab-Brown system. Intolerable to

- Page 222 and 223:

Felbab-Brown Poppy cultivation did

- Page 224 and 225:

Felbab-Brown Should a civil war be

- Page 226 and 227:

Felbab-Brown Moreover, the positive

- Page 228 and 229:

Felbab-Brown During conflict situat

- Page 230 and 231:

Felbab-Brown 2 Adam Pain, “Opium

- Page 232 and 233:

Felbab-Brown 39 For details, see Fe

- Page 235:

Part IV. Fighting Back

- Page 238 and 239:

Luna domestic product. The wide ava

- Page 240 and 241:

Luna renewed multilateral diplomacy

- Page 242 and 243:

Luna organizations or facilitators

- Page 244 and 245:

Luna build on regional and interreg

- Page 246 and 247:

Luna subregional, and bilateral lev

- Page 248 and 249:

Luna 224 • drain the illicit econ

- Page 250 and 251:

Luna to combat the assets of the cr

- Page 252 and 253:

Luna The following represent exampl

- Page 254 and 255:

Luna rests in private hands. Privat

- Page 256 and 257:

Luna Author’s Note In honor and m

- Page 258 and 259:

Wechsler and Barnabo The drug-traff

- Page 260 and 261:

Wechsler and Barnabo threat to nati

- Page 262 and 263:

Wechsler and Barnabo the state. Col

- Page 264 and 265:

Wechsler and Barnabo enemies in Afg

- Page 266 and 267:

Wechsler and Barnabo Notes 1 Statem

- Page 268 and 269:

Realuyo 244 • Promote collaborati

- Page 270 and 271:

Realuyo a result of globalization,

- Page 272 and 273:

Realuyo 248 • reduce the demand f

- Page 274 and 275:

Realuyo 250 • Organized crime and

- Page 276 and 277:

Realuyo around the world, and their

- Page 278 and 279:

Realuyo For more than 10 years, the

- Page 280 and 281:

Realuyo power and corruption by the

- Page 282 and 283:

Realuyo handled 141 investigative l

- Page 284 and 285:

Realuyo is in support of those law

- Page 286 and 287:

Realuyo 262 • Know your partners.

- Page 288 and 289:

Realuyo Table 1. Critical Elements

- Page 290 and 291:

Realuyo 18 Ibid. 19 UNODC, “UNODC

- Page 293 and 294:

About the Contributors Michael Mikl

- Page 295 and 296:

About the Contributors Nils Gilman

- Page 297 and 298:

About the Contributors feiting, art

- Page 299:

About the Contributors campaign pla