- Page 1 and 2: The Proceedings of the 6th Internat

- Page 3 and 4: Contents Paper Title Author(s) Page

- Page 5 and 6: Preface These Proceedings are the w

- Page 7 and 8: Biographies of contributing authors

- Page 9 and 10: Department of Computer Science, IQR

- Page 11 and 12: Using the Longest Common Substring

- Page 13 and 14: Jaime Acosta Some techniques that u

- Page 15 and 16: Jaime Acosta assigned by an anti-vi

- Page 17 and 18: Jaime Acosta Cormen, T.H., Leiserso

- Page 19 and 20: Hind Al Falasi and Liren Zhang tran

- Page 21 and 22: Hind Al Falasi and Liren Zhang ther

- Page 23 and 24: Hind Al Falasi and Liren Zhang the

- Page 25 and 26: Edwin Leigh Armistead and Thomas Mu

- Page 27: Deception Operations Security (OPS

- Page 31 and 32: Edwin Leigh Armistead and Thomas Mu

- Page 33 and 34: The Uses and Limits of Game Theory

- Page 35 and 36: 3. Limits to using game theory 3.1

- Page 37 and 38: Merritt Baer Effective cyberintrusi

- Page 39 and 40: Merritt Baer 1.5), there seems to b

- Page 41 and 42: Merritt Baer Report of the Defense

- Page 43 and 44: Ivan Burke and Renier van Heerden F

- Page 45 and 46: Ivan Burke and Renier van Heerden a

- Page 47 and 48: Ivan Burke and Renier van Heerden F

- Page 49 and 50: Ivan Burke and Renier van Heerden F

- Page 51 and 52: Ivan Burke and Renier van Heerden F

- Page 53 and 54: Marco Carvalho et al. systems start

- Page 55 and 56: Marco Carvalho et al. Benatallah, 2

- Page 57 and 58: Marco Carvalho et al. management la

- Page 59 and 60: Marco Carvalho et al. Figure 4: Sta

- Page 61 and 62: Marco Carvalho et al. Sorrels, D.,

- Page 63 and 64: Manoj Cherukuri and Srinivas Mukkam

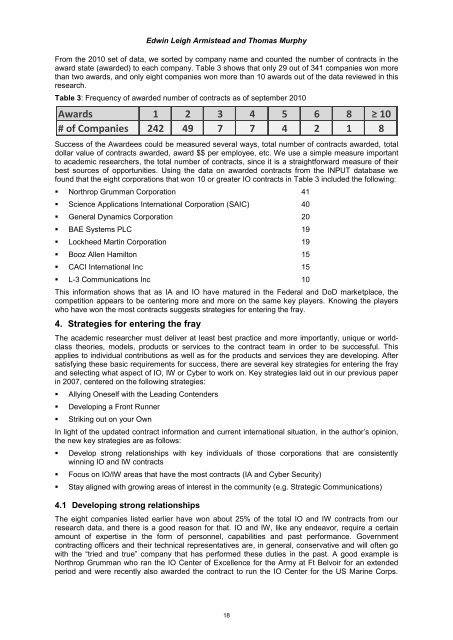

- Page 65 and 66: Manoj Cherukuri and Srinivas Mukkam

- Page 67 and 68: Manoj Cherukuri and Srinivas Mukkam

- Page 69 and 70: Manoj Cherukuri and Srinivas Mukkam

- Page 71 and 72: Manoj Cherukuri and Srinivas Mukkam

- Page 73 and 74: Manoj Cherukuri and Srinivas Mukkam

- Page 75 and 76: Manoj Cherukuri and Srinivas Mukkam

- Page 77 and 78: Manoj Cherukuri and Srinivas Mukkam

- Page 79 and 80:

Mecealus Cronkrite et al. to see bo

- Page 81 and 82:

Mecealus Cronkrite et al. trivial.

- Page 83 and 84:

Mecealus Cronkrite et al. socially

- Page 85 and 86:

Mecealus Cronkrite et al. The views

- Page 87 and 88:

Vincent Garramone and Daniel Likari

- Page 89 and 90:

Vincent Garramone and Daniel Likari

- Page 91 and 92:

Vincent Garramone and Daniel Likari

- Page 93 and 94:

Vincent Garramone and Daniel Likari

- Page 95 and 96:

Stephen Groat et al. Sections 4 and

- Page 97 and 98:

Stephen Groat et al. probability fo

- Page 99 and 100:

Stephen Groat et al. host. In this

- Page 101 and 102:

Stephen Groat et al. changing addre

- Page 103 and 104:

Marthie Grobler et al. leadership,

- Page 105 and 106:

Marthie Grobler et al. apply to sta

- Page 107 and 108:

Marthie Grobler et al. 6. Working t

- Page 109 and 110:

Cyber Strategy and the Law of Armed

- Page 111 and 112:

Ulf Haeussler Alliance and Allies r

- Page 113 and 114:

Ulf Haeussler following the invocat

- Page 115 and 116:

Ulf Haeussler NCSA (2009) NCSA Supp

- Page 117 and 118:

Karim Hamza and Van Dalen of respon

- Page 119 and 120:

Karim Hamza and Van Dalen From a mi

- Page 121 and 122:

Karim Hamza and Van Dalen productiv

- Page 123 and 124:

Intelligence-Driven Computer Networ

- Page 125 and 126:

Eric Hutchins et al. of defensive a

- Page 127 and 128:

Eric Hutchins et al. Defenders can

- Page 129 and 130:

Eric Hutchins et al. Equally as imp

- Page 131 and 132:

Eric Hutchins et al. X-Mailer: Yaho

- Page 133 and 134:

Eric Hutchins et al. Received: (qma

- Page 135 and 136:

Eric Hutchins et al. U.S.-China Eco

- Page 137 and 138:

Saara Jantunen and Aki-Mauri Huhtin

- Page 139 and 140:

Saara Jantunen and Aki-Mauri Huhtin

- Page 141 and 142:

Saara Jantunen and Aki-Mauri Huhtin

- Page 143 and 144:

Saara Jantunen and Aki-Mauri Huhtin

- Page 145 and 146:

Brian Jewell and Justin Beaver In t

- Page 147 and 148:

Brian Jewell and Justin Beaver Figu

- Page 149 and 150:

4. Evaluation Brian Jewell and Just

- Page 151 and 152:

Brian Jewell and Justin Beaver othe

- Page 153 and 154:

Detection of YASS Using Calibration

- Page 155 and 156:

Kesav Kancherla and Srinivas Mukkam

- Page 157 and 158:

M M M Su−2 Sv ∑∑ u= 1 v= 1 h(

- Page 159 and 160:

5.2 ROC curves Kesav Kancherla and

- Page 161 and 162:

Developing a Knowledge System for I

- Page 163 and 164:

Louise Leenen et al. We distinction

- Page 165 and 166:

Louise Leenen et al. There is growi

- Page 167 and 168:

3.1 Needs analysis Louise Leenen et

- Page 169 and 170:

Louise Leenen et al. Kroenke, D.M.

- Page 171 and 172:

Jose Mas y Rubi et al. As we can se

- Page 173 and 174:

Figure 2: CALEA forensic model (Pel

- Page 175 and 176:

Jose Mas y Rubi et al. Table 2: Com

- Page 177 and 178:

Jose Mas y Rubi et al. Another pend

- Page 179 and 180:

Tree of Objectives Acknowledgements

- Page 181 and 182:

Secure Proactive Recovery - a Hardw

- Page 183 and 184:

Ruchika Mehresh et al. implementing

- Page 185 and 186:

Ruchika Mehresh et al. The coordina

- Page 187 and 188:

Ruchika Mehresh et al. multiplicati

- Page 189 and 190:

Ruchika Mehresh et al. Table 2: App

- Page 191 and 192:

2. Network infiltration detection D

- Page 193 and 194:

David Merritt and Barry Mullins on

- Page 195 and 196:

David Merritt and Barry Mullins Ess

- Page 197 and 198:

David Merritt and Barry Mullins Dev

- Page 199 and 200:

Muhammad Naveed Pakistan Computer E

- Page 201 and 202:

Muhammad Naveed response could also

- Page 203 and 204:

Muhammad Naveed Table 10: Aggressiv

- Page 205 and 206:

Muhammad Naveed 2006 Tcp Open Mysql

- Page 207 and 208:

Muhammad Naveed 8009 Tcp Open Ajp13

- Page 209 and 210:

Muhammad Naveed Austalian Taxation

- Page 211 and 212:

Alexandru Nitu world and bring it i

- Page 213 and 214:

Alexandru Nitu Article 51 restricts

- Page 215 and 216:

Alexandru Nitu As IW strategy and t

- Page 217 and 218:

Cyberwarfare and Anonymity Christop

- Page 219 and 220:

Christopher Perr attacks again help

- Page 221 and 222:

Christopher Perr about the current

- Page 223 and 224:

Catch me if you can: Cyber Anonymit

- Page 225 and 226:

David Rohret and Michael Kraft reve

- Page 227 and 228:

David Rohret and Michael Kraft sary

- Page 229 and 230:

Data (Evidence) Removal Shield Davi

- Page 231 and 232:

Neutrality in the Context of Cyberw

- Page 233 and 234:

Julie Ryan and Daniel Ryan 18th cen

- Page 235 and 236:

Julie Ryan and Daniel Ryan “Decla

- Page 237 and 238:

Julie Ryan and Daniel Ryan von Glah

- Page 239 and 240:

Harm Schotanus et al. In the remain

- Page 241 and 242:

Harm Schotanus et al. 2.3.1 Secure

- Page 243 and 244:

Harm Schotanus et al. In this setup

- Page 245 and 246:

Harm Schotanus et al. the label (by

- Page 247 and 248:

Harm Schotanus et al. these aspects

- Page 249 and 250:

Maria Semmelrock-Picej et al. they

- Page 251 and 252:

Maria Semmelrock-Picej et al. User

- Page 253 and 254:

Maria Semmelrock-Picej et al. SPIKE

- Page 255 and 256:

Maria Semmelrock-Picej et al. A cl

- Page 257 and 258:

Maria Semmelrock-Picej et al. in co

- Page 259 and 260:

Maria Semmelrock-Picej et al. In th

- Page 261 and 262:

Maria Semmelrock-Picej et al. Fuchs

- Page 263 and 264:

Madhu Shankarapani and Srinivas Muk

- Page 265 and 266:

Figure 1: UPX packed Trojan Figure

- Page 267 and 268:

Trojan.Zb ot- 1342.mal Trojan.Sp y.

- Page 269 and 270:

Madhu Shankarapani and Srinivas Muk

- Page 271 and 272:

Namosha Veerasamy and Marthie Grobl

- Page 273 and 274:

Namosha Veerasamy and Marthie Grobl

- Page 275 and 276:

Namosha Veerasamy and Marthie Grobl

- Page 277 and 278:

4. Conclusion Namosha Veerasamy and

- Page 279 and 280:

Tanya Zlateva et al. Computer Infor

- Page 281 and 282:

Tanya Zlateva et al. security and v

- Page 283 and 284:

Tanya Zlateva et al. court opinions

- Page 285 and 286:

Tanya Zlateva et al. 5. Pedagogy, e

- Page 287 and 288:

PhD Research Papers 277

- Page 289 and 290:

Shada Alsalamah et al. Level 3 all

- Page 291 and 292:

Shada Alsalamah et al. assure the a

- Page 293 and 294:

Shada Alsalamah et al. for Health I

- Page 295 and 296:

3. Hematology Laboratory System Who

- Page 297 and 298:

Shada Alsalamah et al. Pirnejad, H.

- Page 299 and 300:

Michael Bilzor a diverse base of U.

- Page 301 and 302:

Michael Bilzor In our current exper

- Page 303 and 304:

5. Execution monitor theory Michael

- Page 305 and 306:

Michael Bilzor design was run in si

- Page 307 and 308:

Michael Bilzor over testbench metho

- Page 309 and 310:

Evan Dembskey and Elmarie Biermann

- Page 311 and 312:

Evan Dembskey and Elmarie Biermann

- Page 313 and 314:

Evan Dembskey and Elmarie Biermann

- Page 315 and 316:

Evan Dembskey and Elmarie Biermann

- Page 317 and 318:

Theoretical Offensive Cyber Militia

- Page 319 and 320:

Rain Ottis Last, but not least, it

- Page 321 and 322:

Rain Ottis an infantry battalion, w

- Page 323 and 324:

Rain Ottis Ottis, R. (2008) “Anal

- Page 325 and 326:

Work in Progress Papers 315

- Page 327 and 328:

Large-Scale Analysis of Continuous

- Page 329 and 330:

References William Acosta Abadi, D.

- Page 331 and 332:

Natarajan Vijayarangan top box unit

- Page 333 and 334:

Natarajan Vijayarangan The proposed