6th European Conference - Academic Conferences

6th European Conference - Academic Conferences

6th European Conference - Academic Conferences

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Mecealus Cronkrite et al.<br />

The “industry knows best” approach for cyber-security is inefficient and a market failure. (Assante,<br />

2010) The public’s level demand for cyber-security is higher than most firms’ individual demand. This<br />

is because the private costs resulting from a cyber-incident are often less than the public’s cost. As an<br />

example, when electronically stored customer credit card information is stolen from a store the financial<br />

institutions are often responsible for the loss not the store that had badly configured security.<br />

4.1 Vulnerability: Cyber incident data is inconsistent<br />

Most industries have no mandatory cyber incident reporting which makes estimating the true impact<br />

of cyber crime difficult to measure. Regular studies performed by the FBI (CSI, 2009), Secret Service,<br />

Verizon (Baker et. al, 2010) and Microsoft (Microsoft SIR, 2010) all use voluntary surveys and data<br />

gathering. However, there are differences in the change in malware rates. The FBI, Microsoft and<br />

Verizon security reports agree that malware attacks are on the risk. However, according to Microsoft’s<br />

SIR report, “Software vulnerabilities…have been on the decline since the second half of 2006,” The<br />

report ascribed this progress to better development quality practices (Microsoft, SIR, 2010) This disparity<br />

is the result of two vastly different data sets that Microsoft and Verizon have used the voluntary<br />

nature of cyber incident responses contributes to these differences. However, all three reports agree<br />

that data is inconsistent due to the lack of a mandatory reporting system.<br />

4.2 Mitigation: Mandate cyber incident reporting<br />

According to a Computer Security Institute survey only a small fraction of organizations that experience<br />

a cyber attack, report it to law enforcement. (CSI, 2009) Firms generally do not favour expanded<br />

mandatory reporting because they do not want bad press, or the public to have a negative perception.<br />

The reluctance is even greater when the firm does not suffer any immediate financial loss. Reporting<br />

these intrusions (crimes) is in the greater interest of society because authorities stand a better chance<br />

of stopping them if they have more information about the threat in general and can learn from emerging<br />

patterns.<br />

To address privacy concerns a reporting system that is similar to U.S. Treasury FINCEN Suspicious<br />

Activity Report (SAR) could be used. Currently, most financial institutions are mandated to report certain<br />

types of suspicious activity using SARs. SARs are kept secret and have tight dissemination standards<br />

and an effective tool in fighting financial crime. A similar reporting system for cyber-attacks<br />

would be equally beneficial. “Disclosure laws” could force software publishers and their customers<br />

that support critical infrastructure to report cyber-attacks and data breaches to DHS. (DHS NIAC,<br />

2009). By mandating reporting, there will be a more accurate picture regarding cyber threats. (Goertzel<br />

et. al.2007) This will help researchers identify weakness, and aid in the apprehension of attackers.<br />

The data collected will help inform actuary tables for insurance firms, and to develop risk analyses.<br />

Cyber crime incident reporting should be required by all CI industries first to gain better knowledge<br />

about the threat malware poses and educate business owners and managers about the financial<br />

and legal implications of improper software assurance processes.<br />

4.3 Vulnerability: Demand for cyber security<br />

Rational firms should use IT risk management to manage cyber security, but, firms often lack the<br />

knowledge and expertise to implement and it is difficult for firms to measure the effectiveness of investments<br />

into cyber security. (Mead, et. al, 2009) This makes it hard to justify expenditures and results<br />

in the general lack of secure programming investment. The public is left with the costs of a cyber-security<br />

incident such as firms that were the target of the cyber incident as well as its clients,<br />

banks or others who feel its negative effects, and include taxpayers if the government responds.<br />

Since the overall damage of a cyber-incident is generally higher for the public, they would rationally<br />

choose to have a higher investment in cyber-security. Unfortunately, the public has little say in what<br />

investment an individual firm decides to make in cyber-security leading to underinvestment in the<br />

eyes of the public. In economic terms, the aggregate private firm’s demand for cyber security is less<br />

than the public’s demand. This is a market failure, which invites regulation or some form of market<br />

correction to rectify this externality.<br />

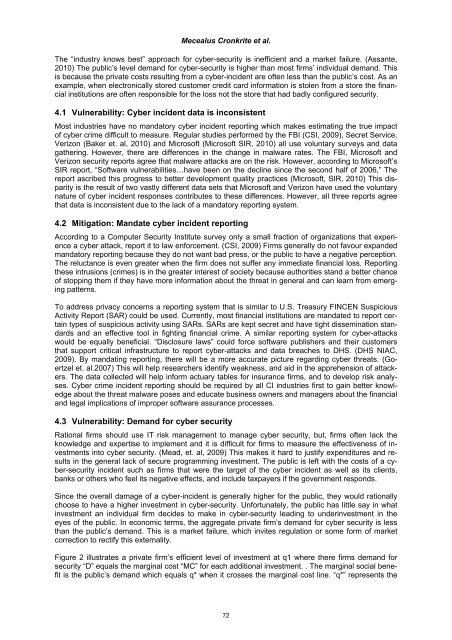

Figure 2 illustrates a private firm’s efficient level of investment at q1 where there firms demand for<br />

security “D” equals the marginal cost “MC” for each additional investment. . The marginal social benefit<br />

is the public’s demand which equals q* when it crosses the marginal cost line. “q*” represents the<br />

72