- Page 1:

Center for Transportation Analysis

- Page 5 and 6:

TABLE OF CONTENTS FOREWORD ........

- Page 7 and 8:

Table 3.5 Table 3.6 Table 3.7 Table

- Page 9 and 10:

Table 5.5 Table 5.6 Table 5.7 Table

- Page 11 and 12:

TABLE OF CONTENTS (Continued) Table

- Page 13 and 14:

TABLE OF CONTENTS (Continued) Table

- Page 15:

of them. FOREWORD This edition has

- Page 19:

ABSTRACT The Transportation Energy

- Page 23 and 24:

Source Table 1.2 Table 1.3 Chapter

- Page 25 and 26:

Table 1.2 World Crude Oil Productio

- Page 27 and 28:

I The UnitedStates has increased it

- Page 29 and 30:

I The share ofpetroleum imported to

- Page 31 and 32:

100 90 80 70 60 50 40 30 20 IO 0 No

- Page 33 and 34:

I When crude oil and other hydrocar

- Page 35 and 36:

TRANSPORTATIONENERGYDATABOOK: EDITI

- Page 37:

Table 1.11 Transportation of Petrol

- Page 40 and 41:

1989 World total 134.66 136.35 135.

- Page 42 and 43:

2-4 I Total energy use in the U.S.

- Page 44 and 45:

2-6 I As duta about alternative jil

- Page 46 and 47:

The Federal Highway Administration

- Page 48 and 49:

Q) k s e b Y u IOO- 90 - 80 - 70 -

- Page 50 and 51:

2-12 Table 2.10 U.S. Production and

- Page 52 and 53:

Great care should be taken when com

- Page 54 and 55:

I Great care should be taken when c

- Page 57 and 58:

Source Chapter 3 Greenhouse Gas Emi

- Page 59 and 60:

1990 (million metric tonnes) Austra

- Page 61 and 62:

Table 3.4 Estimated U.S. Emissions

- Page 63 and 64:

Fuel Motor gasoline LPG” Jet fuel

- Page 65 and 66:

The Greenhouse Gases, Regulated Emi

- Page 67 and 68:

Table 3.8 NEAR-TERM Technology Cfor

- Page 69 and 70:

Table 3.9 (continued) LONG-TERM Tec

- Page 71 and 72:

Table 3.9 (continued) LONG-TERM Tec

- Page 73 and 74:

Table 3.9 (continued) LONG-TERM Tec

- Page 75 and 76: Source Chapter 4 Criteria Pollutant

- Page 77 and 78: I The transportation sector account

- Page 79 and 80: I The transportation sector account

- Page 81 and 82: I The transportation sector account

- Page 83 and 84: I The transportation sector account

- Page 85 and 86: The transportation sector accounted

- Page 87 and 88: I Historically the transportation s

- Page 89 and 90: The Greenhouse Gases, Regulated Emi

- Page 91 and 92: Table 4.14 NEAR-TERM Technology Cfo

- Page 93 and 94: Table 4.15 LONG-TERM Technology Gfo

- Page 95 and 96: Table 4.15 (continued) LONG-TERM Te

- Page 97 and 98: Table 4.15 (continued) LONG-TERM Te

- Page 99 and 100: Table 4.15 (continued) LONG-TERM Te

- Page 101 and 102: Table 4.15 (continued) LONG-TERM Te

- Page 103 and 104: Table 4.15 (continued) LONG-TERM Te

- Page 105 and 106: Table 4.15 (continued) LONG-TERM Te

- Page 107 and 108: Table 4.18 Federal Exhaust Emission

- Page 109 and 110: Table 4.20 Federal Exhaust Emission

- Page 111 and 112: 2 2 % 0” z Table 4.22 Federal Exh

- Page 113 and 114: Gasoline Hydrocarbons (HC) Nitrogen

- Page 115 and 116: I Califknia’s Low-Emission Vehicl

- Page 117 and 118: Source Figure 5.1 Table 5.4 Table 5

- Page 119 and 120: Figure 5.1. Gasoline Prices for Sel

- Page 121 and 122: - I . I . I . I I Figure 5.2. Diese

- Page 123 and 124: Year Current Diesel fuel a Constant

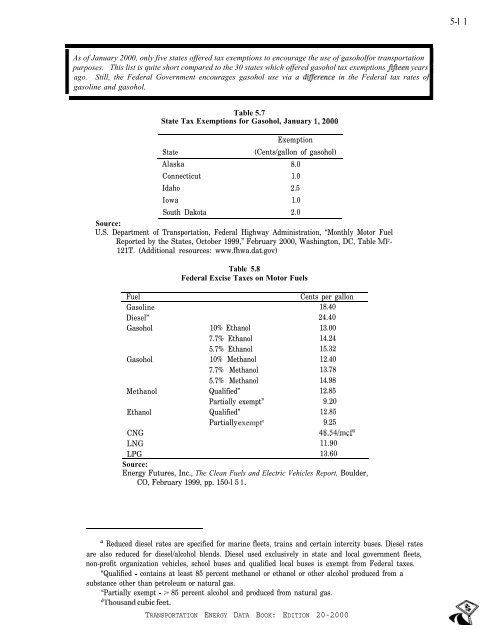

- Page 125: Table 5.6 State Taxes on Motor Fuel

- Page 129 and 130: I In current dollars, import cars,

- Page 131 and 132: I The total cost of operating an au

- Page 133 and 134: Year 1970 1980 1990 1997 1998 1970

- Page 135 and 136: Employees of motor vehicle and rela

- Page 137 and 138: Source Table 6.1 Table 6.2 Table 6.

- Page 139 and 140: Year China India Japan France 1950

- Page 141 and 142: 1970 1971 1972 E 1973 2 1974 4 1975

- Page 143 and 144: Table 6.5 Highway Vehicle Miles Tra

- Page 145 and 146: Table 6.7 Trucks in Operation and V

- Page 147 and 148: I Using current registration data a

- Page 149 and 150: I Using current registration data a

- Page 151 and 152: Source Chapter 7 Light Vehicles and

- Page 153 and 154: The Federal Highway Administration

- Page 155 and 156: Table 7.4 New Retail Sales of Truck

- Page 157 and 158: Table 7.6 Period Sales, Market Shar

- Page 159 and 160: Table 7.8 Sales-Weighted Engine Siz

- Page 161 and 162: Sales period” 1976 1977 1978 1979

- Page 163 and 164: 0.8 F 0 0.6 u' 2 s = 0.4 0.2 Figure

- Page 165 and 166: I The average auto lost over 300pou

- Page 167 and 168: I The number of conventional refuel

- Page 169 and 170: Table 7.17 Corporate Average Fuel E

- Page 171 and 172: Fuel Economy by Vehicle Speed ORNL

- Page 173 and 174: I The two earlier studies by the Fe

- Page 175 and 176: Speed (mph) 1988 1993 Chevrolet Sub

- Page 177 and 178:

I The New York Test Cycle was devel

- Page 179 and 180:

Table 7.23 Occupant Fatalities by V

- Page 181 and 182:

B0 P I In 1998, nearly 40% of all p

- Page 183 and 184:

Source Table 8.1 Table 8.1 Table 8.

- Page 185 and 186:

Table 8.2 New Retail Truck Sales by

- Page 187 and 188:

I These tables illustrate the diffe

- Page 189 and 190:

Trucks Trucks (%) Miles per truck T

- Page 191 and 192:

I Nearly 1 GO% of all truckfleets u

- Page 193 and 194:

Commodity Flow Survey The Commodity

- Page 195 and 196:

Some,freight activities, such as pi

- Page 197 and 198:

Chapter 9 Alternative Fuel Vehicles

- Page 199 and 200:

I There are more LPG vehicles in us

- Page 201 and 202:

Table 9.3 Estimates of Heavy Altern

- Page 203 and 204:

This list includes public and priva

- Page 205 and 206:

Figure 9.1 Map of Clean Cities as o

- Page 207:

The Partnership for a New Generatio

- Page 210 and 211:

. mm . . . SigniJicant changes have

- Page 212 and 213:

1 o-4 ama . . . .I . I TheseJleet d

- Page 214 and 215:

1 O-G @Ea6Ll I VW . . I Department

- Page 216 and 217:

10-8 I The Energy Policy Act of 199

- Page 218 and 219:

. D. Year 1950 1955 1960 1965 1970

- Page 220 and 221:

11-4 I Household vehicle ownership

- Page 222 and 223:

1 l-6 e. . The 1995 NPTS data shoul

- Page 224 and 225:

11-8 El . . TRANSPORTATIONENERGYDAT

- Page 226 and 227:

oooz-02 NOI.I>Ia~ :>I008 VLVa A!X%N

- Page 228 and 229:

11-12 I As households owned more ve

- Page 230 and 231:

11-14 a. . I In 1995 the average jo

- Page 232 and 233:

11-16 I3 . . Table 11.14 National a

- Page 234 and 235:

. D. Principal means of transportat

- Page 236 and 237:

. D. 90- IO- O- Figure 11.5. Shares

- Page 238 and 239:

Table 12.1 Summary Statistics for U

- Page 240 and 241:

124 In the early seventies, domesti

- Page 242 and 243:

Fifty-six percent of all domestic m

- Page 244 and 245:

Table 12.7 Summary’Statistics for

- Page 246 and 247:

12-10 The number of trailers and co

- Page 248 and 249:

Table 12.11 Summary Statistics for

- Page 250 and 251:

A-2 AAMA APTA Amtrak Btu DOC DOE DO

- Page 252 and 253:

A-4 Trucks Off-Highway Nonhighwav A

- Page 254 and 255:

A-6 Rail Total: Sum of freight and

- Page 256 and 257:

A-8 Buses Trucks Sum of transit, in

- Page 258 and 259:

A-10 Pipeline Rail Recreational Boa

- Page 260 and 261:

A-12 Highway Automobiles Personal T

- Page 262 and 263:

A-14 Nonhighway Air Recreational Bo

- Page 264 and 265:

A-16 Pipeline Rail Natural Gas: Ton

- Page 266 and 267:

A-18 Light Trucks Buses Vmt - DOT,

- Page 268 and 269:

A-20 Highway Table 2.14 Energy Inte

- Page 270 and 271:

A-22 Trucks Stock - Vehicles in use

- Page 272 and 273:

A-24 Energy Use Transit buses: Amer

- Page 274 and 275:

B-2 Automotive gasoline Diesel moto

- Page 276 and 277:

B-4 Table B.3 Energy Unit Conversio

- Page 278 and 279:

B-6 Table B.7 Volume and Flow Rate

- Page 280 and 281:

FROM Pound Kilogram Pound 1 0.4536

- Page 282 and 283:

B-10 One million million millionth

- Page 284 and 285:

B-12 Conversion of Constant Dollar

- Page 286 and 287:

Table B.14 Gross National Product (

- Page 288 and 289:

c-2 Table C.l Census Divisions and

- Page 291 and 292:

GLOSSARY Acceleration power - Measu

- Page 293 and 294:

Bunker - A storage tank. Bunkering

- Page 295 and 296:

separating facilities. Crude oil pr

- Page 297 and 298:

General aviation - That portion of

- Page 299 and 300:

Lease Condensate - A liquid recover

- Page 301 and 302:

Oil Stocks - Oil stocks include cru

- Page 303 and 304:

Petroleum inventories: The amounts

- Page 305 and 306:

Single unit truck - Includes two-ax

- Page 307 and 308:

TITLE INDEX TRANSPORTATION ENERGY D

- Page 309 and 310:

Alternative (continued) NEAR-TERM T

- Page 311 and 312:

Aviation Axle Barrel Summary Statis

- Page 313 and 314:

Certification (continued) Cities Ci

- Page 315 and 316:

Corporate Corporate Average Fuel Ec

- Page 317 and 318:

Dioxide International Man-Made Emis

- Page 319 and 320:

Emission (continued) LONG-TERM Tech

- Page 321 and 322:

Engine Sales-Weighted Engine Size o

- Page 323 and 324:

Fleet Fleet Vehicles in Service as

- Page 325 and 326:

Fuels (continued) Gallon Gas Gases

- Page 327 and 328:

Heavy (continued) Federal Exhaust E

- Page 329 and 330:

International Summary Statistics fo

- Page 331 and 332:

Material Matter Average Material Co

- Page 333 and 334:

Nitrogen Total National Emissions o

- Page 335 and 336:

Percentage (continued) Periods Pers

- Page 337 and 338:

Prices CrudeOilPrices,1870-98 . . .

- Page 339 and 340:

Retail (continued) New Retail Sales

- Page 341 and 342:

Shares Shares of Long-Distance Pers

- Page 343 and 344:

s toc1< s toc1

- Page 345 and 346:

Time Tire Ton Average Length of Tim

- Page 347 and 348:

Trucks (continued) Unit Federal Exh

- Page 349 and 350:

Vehicle (continued) Employees of Mo

- Page 351:

Work World Journey-to-Work Statisti