Namibia PDNA 2009 - GFDRR

Namibia PDNA 2009 - GFDRR

Namibia PDNA 2009 - GFDRR

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

4.1<br />

Macro-economic Impact<br />

This section outlines the impact of the floods on the overall economy. Since the economy is diversified, and the wealth of the nation<br />

is concentrated mostly in the non-flooded area, the flood had a minor impact on the overall macro-economic aggregates. However,<br />

the affected persons constitute more than 60 percent of the total population. While the impact on household assets was minimal, it<br />

was higher on household living conditions. As such, a recovery strategy should consider redistribution aspects.<br />

4.1.1<br />

Pre-disaster <strong>Namibia</strong>n Economy<br />

<strong>Namibia</strong> is among the strongest performing African<br />

economies, with a GNI per capita of US$4,200 in 2008.<br />

The economy has registered strong economic growth<br />

in recent years, growing by an average of 7.3 percent<br />

during 2004-2006. The main source of growth has been<br />

the booming mining sector, but also tertiary industries,<br />

including Government services, wholesale and retail, and<br />

real estate and business services, which accounted for<br />

59 percent of GDP between 2000 and 2007.<br />

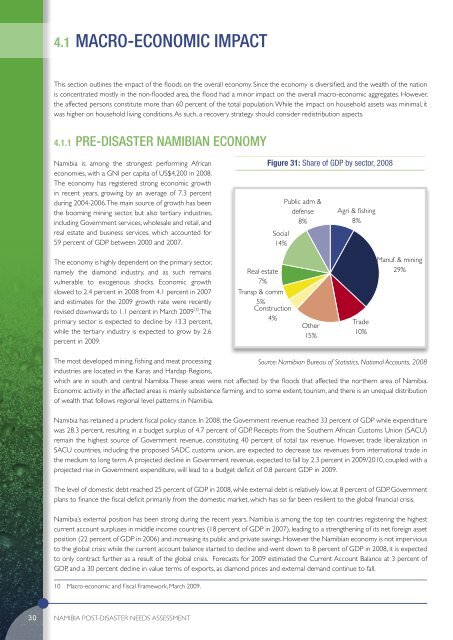

Figure 31: Share of GDP by sector, 2008<br />

Social<br />

14%<br />

Public adm &<br />

defense<br />

8%<br />

Agri & fishing<br />

8%<br />

The economy is highly dependent on the primary sector,<br />

namely the diamond industry, and as such remains<br />

vulnerable to exogenous shocks. Economic growth<br />

slowed to 2.4 percent in 2008 from 4.1 percent in 2007<br />

and estimates for the <strong>2009</strong> growth rate were recently<br />

revised downwards to 1.1 percent in March <strong>2009</strong> 10 . The<br />

primary sector is expected to decline by 13.3 percent,<br />

while the tertiary industry is expected to grow by 2.6<br />

percent in <strong>2009</strong>.<br />

Real estate<br />

7%<br />

Transp & comm<br />

5%<br />

Construction<br />

4%<br />

Other<br />

15%<br />

Trade<br />

10%<br />

Manuf. & mining<br />

29%<br />

The most developed mining, fishing and meat processing<br />

Source: <strong>Namibia</strong>n Bureau of Statistics, National Accounts, 2008<br />

industries are located in the Karas and Hardap Regions,<br />

which are in south and central <strong>Namibia</strong>. These areas were not affected by the floods that affected the northern area of <strong>Namibia</strong>.<br />

Economic activity in the affected areas is mainly subsistence farming, and to some extent, tourism, and there is an unequal distribution<br />

of wealth that follows regional level patterns in <strong>Namibia</strong>.<br />

<strong>Namibia</strong> has retained a prudent fiscal policy stance. In 2008, the Government revenue reached 33 percent of GDP while expenditure<br />

was 28.3 percent, resulting in a budget surplus of 4.7 percent of GDP. Receipts from the Southern African Customs Union (SACU)<br />

remain the highest source of Government revenue, constituting 40 percent of total tax revenue. However, trade liberalization in<br />

SACU countries, including the proposed SADC customs union, are expected to decrease tax revenues from international trade in<br />

the medium to long term. A projected decline in Government revenue, expected to fall by 2.3 percent in <strong>2009</strong>/2010, coupled with a<br />

projected rise in Government expenditure, will lead to a budget deficit of 0.8 percent GDP in <strong>2009</strong>.<br />

The level of domestic debt reached 25 percent of GDP in 2008, while external debt is relatively low, at 8 percent of GDP. Government<br />

plans to finance the fiscal deficit primarily from the domestic market, which has so far been resilient to the global financial crisis.<br />

<strong>Namibia</strong>’s external position has been strong during the recent years. <strong>Namibia</strong> is among the top ten countries registering the highest<br />

current account surpluses in middle income countries (18 percent of GDP in 2007), leading to a strengthening of its net foreign asset<br />

position (22 percent of GDP in 2006) and increasing its public and private savings. However the <strong>Namibia</strong>n economy is not impervious<br />

to the global crisis: while the current account balance started to decline and went down to 8 percent of GDP in 2008, it is expected<br />

to only contract further as a result of the global crisis. Forecasts for <strong>2009</strong> estimated the Current Account Balance at 3 percent of<br />

GDP, and a 30 percent decline in value terms of exports, as diamond prices and external demand continue to fall.<br />

10 Macro-economic and Fiscal Framework, March <strong>2009</strong>.<br />

30<br />

<strong>Namibia</strong> POST-DISASTER NEEDS ASSESSMENT