FY12 Adopted Operating Budget & Capital Improvement Budget

FY12 Adopted Operating Budget & Capital Improvement Budget

FY12 Adopted Operating Budget & Capital Improvement Budget

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

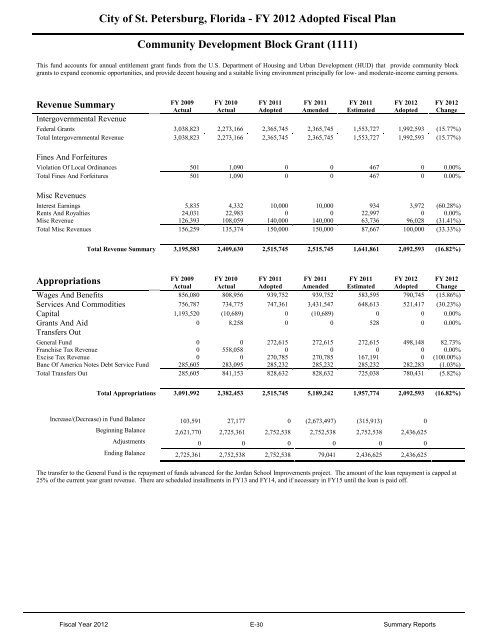

City of St. Petersburg, Florida - FY 2012 <strong>Adopted</strong> Fiscal Plan<br />

Community Development Block Grant (1111)<br />

This fund accounts for annual entitlement grant funds from the U.S. Department of Housing and Urban Development (HUD) that provide community block<br />

grants to expand economic opportunities, and provide decent housing and a suitable living environment principally for low- and moderate-income earning persons.<br />

Revenue Summary<br />

FY 2009<br />

Actual<br />

FY 2010<br />

Actual<br />

FY 2011<br />

<strong>Adopted</strong><br />

FY 2011<br />

Amended<br />

FY 2011<br />

Estimated<br />

FY 2012<br />

<strong>Adopted</strong><br />

FY 2012<br />

Change<br />

Intergovernmental Revenue<br />

Federal Grants 3,038,823 2,273,166 2,365,745 2,365,745 1,553,727 1,992,593 (15.77%)<br />

Total Intergovernmental Revenue 3,038,823 2,273,166 2,365,745 2,365,745 1,553,727 1,992,593 (15.77%)<br />

Fines And Forfeitures<br />

Violation Of Local Ordinances 501 1,090 0 0 467 0 0.00%<br />

Total Fines And Forfeitures 501 1,090 0 0 467 0 0.00%<br />

Misc Revenues<br />

Interest Earnings 5,835 4,332 10,000 10,000 934 3,972 (60.28%)<br />

Rents And Royalties 24,031 22,983 0 0 22,997 0 0.00%<br />

Misc Revenue 126,393 108,059 140,000 140,000 63,736 96,028 (31.41%)<br />

Total Misc Revenues 156,259 135,374 150,000 150,000 87,667 100,000 (33.33%)<br />

Total Revenue Summary 3,195,583 2,409,630 2,515,745 2,515,745 1,641,861 2,092,593 (16.82%)<br />

Appropriations<br />

FY 2009<br />

Actual<br />

FY 2010<br />

Actual<br />

FY 2011<br />

<strong>Adopted</strong><br />

FY 2011<br />

Amended<br />

FY 2011<br />

Estimated<br />

FY 2012<br />

<strong>Adopted</strong><br />

FY 2012<br />

Change<br />

Wages And Benefits 856,080 808,956 939,752 939,752 583,595 790,745 (15.86%)<br />

Services And Commodities 756,787 734,775 747,361 3,431,547 648,613 521,417 (30.23%)<br />

<strong>Capital</strong> 1,193,520 (10,689) 0 (10,689) 0 0 0.00%<br />

Grants And Aid 0 8,258 0 0 528 0 0.00%<br />

Transfers Out<br />

General Fund 0 0 272,615 272,615 272,615 498,148 82.73%<br />

Franchise Tax Revenue 0 558,058 0 0 0 0 0.00%<br />

Excise Tax Revenue 0 0 270,785 270,785 167,191 0 (100.00%)<br />

Banc Of America Notes Debt Service Fund 285,605 283,095 285,232 285,232 285,232 282,283 (1.03%)<br />

Total Transfers Out 285,605 841,153 828,632 828,632 725,038 780,431 (5.82%)<br />

Total Appropriations 3,091,992 2,382,453 2,515,745 5,189,242 1,957,774 2,092,593 (16.82%)<br />

Increase/(Decrease) in Fund Balance 103,591 27,177 0 (2,673,497) (315,913) 0<br />

Beginning Balance 2,621,770 2,725,361 2,752,538 2,752,538 2,752,538 2,436,625<br />

Adjustments 0 0 0 0 0 0<br />

Ending Balance 2,725,361 2,752,538 2,752,538 79,041 2,436,625 2,436,625<br />

The transfer to the General Fund is the repayment of funds advanced for the Jordan School <strong>Improvement</strong>s project. The amount of the loan repayment is capped at<br />

25% of the current year grant revenue. There are scheduled installments in FY13 and FY14, and if necessary in FY15 until the loan is paid off.<br />

Fiscal Year 2012 E-30 Summary Reports