FY12 Adopted Operating Budget & Capital Improvement Budget

FY12 Adopted Operating Budget & Capital Improvement Budget

FY12 Adopted Operating Budget & Capital Improvement Budget

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

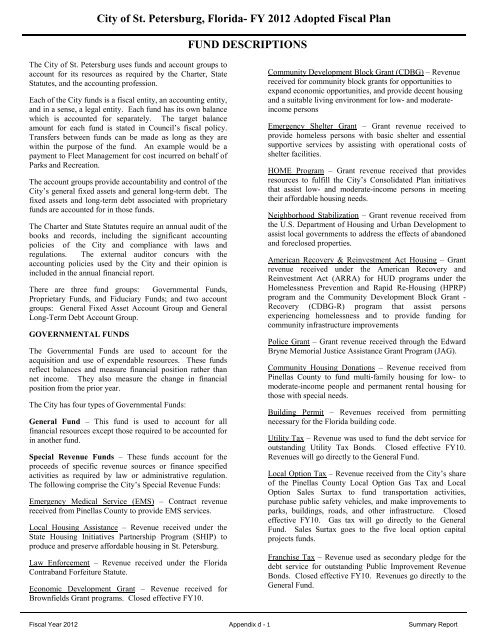

City of St. Petersburg, Florida- FY 2012 <strong>Adopted</strong> Fiscal Plan<br />

FUND DESCRIPTIONS<br />

The City of St. Petersburg uses funds and account groups to<br />

account for its resources as required by the Charter, State<br />

Statutes, and the accounting profession.<br />

Each of the City funds is a fiscal entity, an accounting entity,<br />

and in a sense, a legal entity. Each fund has its own balance<br />

which is accounted for separately. The target balance<br />

amount for each fund is stated in Council’s fiscal policy.<br />

Transfers between funds can be made as long as they are<br />

within the purpose of the fund. An example would be a<br />

payment to Fleet Management for cost incurred on behalf of<br />

Parks and Recreation.<br />

The account groups provide accountability and control of the<br />

City’s general fixed assets and general long-term debt. The<br />

fixed assets and long-term debt associated with proprietary<br />

funds are accounted for in those funds.<br />

The Charter and State Statutes require an annual audit of the<br />

books and records, including the significant accounting<br />

policies of the City and compliance with laws and<br />

regulations. The external auditor concurs with the<br />

accounting policies used by the City and their opinion is<br />

included in the annual financial report.<br />

There are three fund groups: Governmental Funds,<br />

Proprietary Funds, and Fiduciary Funds; and two account<br />

groups: General Fixed Asset Account Group and General<br />

Long-Term Debt Account Group.<br />

GOVERNMENTAL FUNDS<br />

The Governmental Funds are used to account for the<br />

acquisition and use of expendable resources. These funds<br />

reflect balances and measure financial position rather than<br />

net income. They also measure the change in financial<br />

position from the prior year.<br />

The City has four types of Governmental Funds:<br />

General Fund – This fund is used to account for all<br />

financial resources except those required to be accounted for<br />

in another fund.<br />

Special Revenue Funds – These funds account for the<br />

proceeds of specific revenue sources or finance specified<br />

activities as required by law or administrative regulation.<br />

The following comprise the City’s Special Revenue Funds:<br />

Emergency Medical Service (EMS) – Contract revenue<br />

received from Pinellas County to provide EMS services.<br />

Local Housing Assistance – Revenue received under the<br />

State Housing Initiatives Partnership Program (SHIP) to<br />

produce and preserve affordable housing in St. Petersburg.<br />

Law Enforcement – Revenue received under the Florida<br />

Contraband Forfeiture Statute.<br />

Economic Development Grant – Revenue received for<br />

Brownfields Grant programs. Closed effective FY10.<br />

Community Development Block Grant (CDBG) – Revenue<br />

received for community block grants for opportunities to<br />

expand economic opportunities, and provide decent housing<br />

and a suitable living environment for low- and moderateincome<br />

persons<br />

Emergency Shelter Grant – Grant revenue received to<br />

provide homeless persons with basic shelter and essential<br />

supportive services by assisting with operational costs of<br />

shelter facilities.<br />

HOME Program – Grant revenue received that provides<br />

resources to fulfill the City’s Consolidated Plan initiatives<br />

that assist low- and moderate-income persons in meeting<br />

their affordable housing needs.<br />

Neighborhood Stabilization – Grant revenue received from<br />

the U.S. Department of Housing and Urban Development to<br />

assist local governments to address the effects of abandoned<br />

and foreclosed properties.<br />

American Recovery & Reinvestment Act Housing – Grant<br />

revenue received under the American Recovery and<br />

Reinvestment Act (ARRA) for HUD programs under the<br />

Homelessness Prevention and Rapid Re-Housing (HPRP)<br />

program and the Community Development Block Grant -<br />

Recovery (CDBG-R) program that assist persons<br />

experiencing homelessness and to provide funding for<br />

community infrastructure improvements<br />

Police Grant – Grant revenue received through the Edward<br />

Bryne Memorial Justice Assistance Grant Program (JAG).<br />

Community Housing Donations – Revenue received from<br />

Pinellas County to fund multi-family housing for low- to<br />

moderate-income people and permanent rental housing for<br />

those with special needs.<br />

Building Permit – Revenues received from permitting<br />

necessary for the Florida building code.<br />

Utility Tax – Revenue was used to fund the debt service for<br />

outstanding Utility Tax Bonds. Closed effective FY10.<br />

Revenues will go directly to the General Fund.<br />

Local Option Tax – Revenue received from the City’s share<br />

of the Pinellas County Local Option Gas Tax and Local<br />

Option Sales Surtax to fund transportation activities,<br />

purchase public safety vehicles, and make improvements to<br />

parks, buildings, roads, and other infrastructure. Closed<br />

effective FY10. Gas tax will go directly to the General<br />

Fund. Sales Surtax goes to the five local option capital<br />

projects funds.<br />

Franchise Tax – Revenue used as secondary pledge for the<br />

debt service for outstanding Public <strong>Improvement</strong> Revenue<br />

Bonds. Closed effective FY10. Revenues go directly to the<br />

General Fund.<br />

Fiscal Year 2012 Appendix d - 1 Summary Report