City of St. Petersburg, Florida - FY 2012 <strong>Adopted</strong> Fiscal Plan Marina <strong>Operating</strong> (4041) The Marina <strong>Operating</strong> Fund, like all other Enterprise Funds, is used to account for costs that are funded substantially by external (non-City department) user fees and charges. The fund is required to cover all expenses of the operation (salaries, benefits, services, commodities, and capital outlay) and allocation of general and administrative costs and payment-in-lieu-of-taxes, as well as any transfers to capital project funds, debt service funds, or return on investment/equity. Revenue Summary FY 2009 Actual FY 2010 Actual FY 2011 <strong>Adopted</strong> FY 2011 Amended FY 2011 Estimated FY 2012 <strong>Adopted</strong> FY 2012 Change Charges For Services Culture And Recreation Charges 2,763,957 2,782,018 2,954,287 2,954,287 3,275,607 3,222,903 9.09% Total Charges For Services 2,763,957 2,782,018 2,954,287 2,954,287 3,275,607 3,222,903 9.09% Fines And Forfeitures Traffic And Parking 980 340 0 0 80 0 0.00% Total Fines And Forfeitures 980 340 0 0 80 0 0.00% Misc Revenues Interest Earnings 9,843 300 3,000 3,000 113 1,192 (60.27%) Misc Revenue 681 (12,113) 1,500 1,500 (19,455) 1,500 0.00% Total Misc Revenues 10,524 (11,813) 4,500 4,500 (19,342) 2,692 (40.18%) Transfer In Utility Tax Revenue 0 286,930 0 0 0 0 0.00% Total Transfer In 0 286,930 0 0 0 0 0.00% Internal Charges Other Charges (55) (678) 0 0 (49) 0 0.00% Total Internal Charges (55) (678) 0 0 (49) 0 0.00% Total Revenue Summary 2,775,406 3,056,797 2,958,787 2,958,787 3,256,296 3,225,595 9.02% Appropriations FY 2009 Actual FY 2010 Actual FY 2011 <strong>Adopted</strong> FY 2011 Amended FY 2011 Estimated FY 2012 <strong>Adopted</strong> FY 2012 Change Wages And Benefits 860,984 895,237 910,395 910,395 948,757 983,496 8.03% Services And Commodities 767,801 866,270 915,336 1,400,302 1,347,742 1,156,135 26.31% <strong>Capital</strong> 5,968 3,000 0 0 0 0 0.00% Debt 672,794 673,725 670,971 670,971 673,647 670,771 (0.03%) Transfers Out General Fund 300,000 300,000 300,000 300,000 300,000 310,000 3.33% Marina <strong>Capital</strong> <strong>Improvement</strong> 350,004 350,004 105,000 105,000 105,000 105,000 0.00% Total Transfers Out 650,004 650,004 405,000 405,000 405,000 415,000 2.47% Total Appropriations 2,957,551 3,088,236 2,901,702 3,386,668 3,375,146 3,225,402 11.16% Increase/(Decrease) in Fund Balance (182,145) (31,439) 57,085 (427,881) (118,850) 193 Beginning Balance 469,220 284,888 225,059 225,059 225,059 139,176 Adjustments (2,187) (28,390) 0 32,967 32,967 0 Ending Balance 284,888 225,059 282,144 (169,855) 139,176 139,369 A rent increase is not budgeted for <strong>FY12</strong>. There was also no increase in FY10 and FY11. The debt service associated with the construction at the Marina for the fifth pier and the renovations is $670,771. In <strong>FY12</strong>, the fund's revenues are projected to increase by 9.02% and it's expenses by 11.16%. Both increases are associated with the Marina Ship Store, which the City took over operations of in FY11. In <strong>FY12</strong>, two temporary positions at the Marina, a full-time Account Clerk II and a part-time Marina Assistant, will be added for the Marina Ship Store. Fiscal Year 2012 E-60 Summary Reports

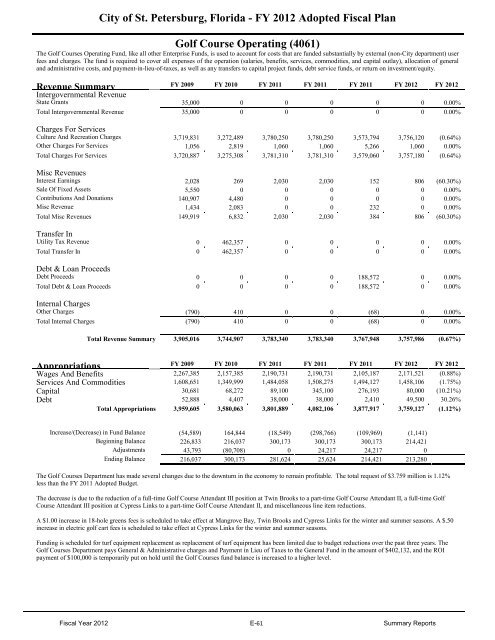

City of St. Petersburg, Florida - FY 2012 <strong>Adopted</strong> Fiscal Plan Golf Course <strong>Operating</strong> (4061) The Golf Courses <strong>Operating</strong> Fund, like all other Enterprise Funds, is used to account for costs that are funded substantially by external (non-City department) user fees and charges. The fund is required to cover all expenses of the operation (salaries, benefits, services, commodities, and capital outlay), allocation of general and administrative costs, and payment-in-lieu-of-taxes, as well as any transfers to capital project funds, debt service funds, or return on investment/equity. Revenue Summary FY 2009 FY 2010 FY 2011 FY 2011 FY 2011 FY 2012 FY 2012 Intergovernmental Revenue State Grants 35,000 0 0 0 0 0 0.00% Total Intergovernmental Revenue 35,000 0 0 0 0 0 0.00% Charges For Services Culture And Recreation Charges 3,719,831 3,272,489 3,780,250 3,780,250 3,573,794 3,756,120 (0.64%) Other Charges For Services 1,056 2,819 1,060 1,060 5,266 1,060 0.00% Total Charges For Services 3,720,887 3,275,308 3,781,310 3,781,310 3,579,060 3,757,180 (0.64%) Misc Revenues Interest Earnings 2,028 269 2,030 2,030 152 806 (60.30%) Sale Of Fixed Assets 5,550 0 0 0 0 0 0.00% Contributions And Donations 140,907 4,480 0 0 0 0 0.00% Misc Revenue 1,434 2,083 0 0 232 0 0.00% Total Misc Revenues 149,919 6,832 2,030 2,030 384 806 (60.30%) Transfer In Utility Tax Revenue 0 462,357 0 0 0 0 0.00% Total Transfer In 0 462,357 0 0 0 0 0.00% Debt & Loan Proceeds Debt Proceeds 0 0 0 0 188,572 0 0.00% Total Debt & Loan Proceeds 0 0 0 0 188,572 0 0.00% Internal Charges Other Charges (790) 410 0 0 (68) 0 0.00% Total Internal Charges (790) 410 0 0 (68) 0 0.00% Total Revenue Summary 3,905,016 3,744,907 3,783,340 3,783,340 3,767,948 3,757,986 (0.67%) Appropriations FY 2009 FY 2010 FY 2011 FY 2011 FY 2011 FY 2012 FY 2012 Wages And Benefits 2,267,385 2,157,385 2,190,731 2,190,731 2,105,187 2,171,521 (0.88%) Services And Commodities 1,608,651 1,349,999 1,484,058 1,508,275 1,494,127 1,458,106 (1.75%) <strong>Capital</strong> 30,681 68,272 89,100 345,100 276,193 80,000 (10.21%) Debt 52,888 4,407 38,000 38,000 2,410 49,500 30.26% Total Appropriations 3,959,605 3,580,063 3,801,889 4,082,106 3,877,917 3,759,127 (1.12%) Increase/(Decrease) in Fund Balance (54,589) 164,844 (18,549) (298,766) (109,969) (1,141) Beginning Balance 226,833 216,037 300,173 300,173 300,173 214,421 Adjustments 43,793 (80,708) 0 24,217 24,217 0 Ending Balance 216,037 300,173 281,624 25,624 214,421 213,280 The Golf Courses Department has made several changes due to the downturn in the economy to remain profitable. The total request of $3.759 million is 1.12% less than the FY 2011 <strong>Adopted</strong> <strong>Budget</strong>. The decrease is due to the reduction of a full-time Golf Course Attendant III position at Twin Brooks to a part-time Golf Course Attendant II, a full-time Golf Course Attendant III position at Cypress Links to a part-time Golf Course Attendant II, and miscellaneous line item reductions. A $1.00 increase in 18-hole greens fees is scheduled to take effect at Mangrove Bay, Twin Brooks and Cypress Links for the winter and summer seasons. A $.50 increase in electric golf cart fees is scheduled to take effect at Cypress Links for the winter and summer seasons. Funding is scheduled for turf equipment replacement as replacement of turf equipment has been limited due to budget reductions over the past three years. The Golf Courses Department pays General & Administrative charges and Payment in Lieu of Taxes to the General Fund in the amount of $402,132, and the ROI payment of $100,000 is temporarily put on hold until the Golf Courses fund balance is increased to a higher level. Fiscal Year 2012 E-61 Summary Reports

- Page 1 and 2:

CITY OF ST. PETERSBURG FLORIDA Adop

- Page 3 and 4:

CITY OF ST. PETERSBURG OPERATING BU

- Page 5 and 6:

USING THIS ONLINE VERSION: THROUGHO

- Page 7 and 8:

City of St. Petersburg, Florida- FY

- Page 9 and 10:

City of St. Petersburg, Florida- FY

- Page 11 and 12:

Section A EXECUTIVE SUMMARY

- Page 13 and 14:

City of St. Petersburg, Florida - F

- Page 15 and 16:

City of St. Petersburg, Florida - F

- Page 17 and 18:

City of St. Petersburg, Florida - F

- Page 19 and 20:

City of St. Petersburg, Florida - F

- Page 21 and 22:

City of St. Petersburg, Florida - F

- Page 23 and 24:

City of St. Petersburg, Florida - F

- Page 25 and 26:

City of St. Petersburg, Florida - F

- Page 27 and 28:

City of St. Petersburg, Florida - F

- Page 29 and 30:

City of St. Petersburg, Florida - F

- Page 31 and 32:

City of St. Petersburg, Florida - F

- Page 33 and 34:

City of St. Petersburg, Florida - F

- Page 35 and 36:

City of St. Petersburg, Florida - F

- Page 37 and 38:

City of St. Petersburg, Florida - F

- Page 39 and 40:

City of St. Petersburg, Florida - F

- Page 41 and 42:

City of St. Petersburg, Florida - F

- Page 43 and 44:

City of St. Petersburg, Florida - F

- Page 45 and 46:

City of St. Petersburg, Florida - F

- Page 47 and 48:

City of St. Petersburg, Florida - F

- Page 49 and 50:

City of St. Petersburg, Florida - F

- Page 51 and 52:

City of St. Petersburg, Florida - F

- Page 53 and 54:

City of St. Petersburg, Florida - F

- Page 55 and 56:

Section B FISCAL POLICIES

- Page 57 and 58:

City of St. Petersburg, Florida - F

- Page 59 and 60:

City of St. Petersburg, Florida - F

- Page 61 and 62:

City of St. Petersburg, Florida - F

- Page 63 and 64:

City of St. Petersburg, Florida - F

- Page 65 and 66:

City of St. Petersburg, Florida - F

- Page 67 and 68:

City of St. Petersburg, Florida - F

- Page 69 and 70:

City of St. Petersburg, Florida - F

- Page 71 and 72:

City of St. Petersburg, Florida - F

- Page 73 and 74:

City of St. Petersburg, Florida - F

- Page 75 and 76:

City of St. Petersburg, Florida - F

- Page 77 and 78:

Section D REVENUE HIGHLIGHTS

- Page 79 and 80:

City of St. Petersburg, Florida - F

- Page 81 and 82:

Utility Taxes: City of St. Petersbu

- Page 83 and 84:

City of St. Petersburg, Florida - F

- Page 85 and 86:

City of St. Petersburg, Florida - F

- Page 87 and 88:

City of St. Petersburg, Florida - F

- Page 89 and 90:

City of St. Petersburg, Florida - F

- Page 91 and 92:

City of St. Petersburg, Florida - F

- Page 93 and 94:

City of St. Petersburg, Florida - F

- Page 95 and 96:

City of St. Petersburg, Florida - F

- Page 97 and 98: City of St. Petersburg, Florida - F

- Page 99 and 100: City of St. Petersburg, Florida - F

- Page 101 and 102: City of St. Petersburg, Florida - F

- Page 103 and 104: City of St. Petersburg, Florida - F

- Page 105 and 106: City of St. Petersburg, Florida - F

- Page 107 and 108: City of St. Petersburg, Florida - F

- Page 109 and 110: City of St. Petersburg, Florida - F

- Page 111 and 112: City of St. Petersburg, Florida - F

- Page 113 and 114: City of St. Petersburg, Florida - F

- Page 115 and 116: City of St. Petersburg, Florida - F

- Page 117 and 118: City of St. Petersburg, Florida - F

- Page 119 and 120: City of St. Petersburg, Florida - F

- Page 121 and 122: City of St. Petersburg, Florida - F

- Page 123 and 124: City of St. Petersburg, Florida - F

- Page 125 and 126: City of St. Petersburg, Florida - F

- Page 127 and 128: City of St. Petersburg, Florida - F

- Page 129 and 130: City of St. Petersburg, Florida - F

- Page 131 and 132: City of St. Petersburg, Florida - F

- Page 133 and 134: City of St. Petersburg, Florida - F

- Page 135 and 136: City of St. Petersburg, Florida - F

- Page 137 and 138: City of St. Petersburg, Florida - F

- Page 139 and 140: City of St. Petersburg, Florida - F

- Page 141 and 142: City of St. Petersburg, Florida - F

- Page 143 and 144: City of St. Petersburg, Florida - F

- Page 145 and 146: City of St. Petersburg, Florida - F

- Page 147: City of St. Petersburg, Florida - F

- Page 151 and 152: City of St. Petersburg, Florida - F

- Page 153 and 154: City of St. Petersburg, Florida - F

- Page 155 and 156: City of St. Petersburg, Florida - F

- Page 157 and 158: City of St. Petersburg, Florida - F

- Page 159 and 160: City of St. Petersburg, Florida - F

- Page 161 and 162: City of St. Petersburg, Florida - F

- Page 163 and 164: City of St. Petersburg, Florida - F

- Page 165 and 166: City of St. Petersburg, Florida - F

- Page 167 and 168: City of St. Petersburg, Florida - F

- Page 169 and 170: Section F DEBT SERVICE

- Page 171 and 172: City of St. Petersburg, Florida - F

- Page 173 and 174: Section G CITY DEVELOPMENT

- Page 175 and 176: City of St. Petersburg, Florida - F

- Page 177 and 178: City of St. Petersburg, Florida - F

- Page 179 and 180: City of St. Petersburg, Florida - F

- Page 181 and 182: City of St. Petersburg, Florida - F

- Page 183 and 184: City of St. Petersburg, Florida - F

- Page 185 and 186: City of St. Petersburg, Florida - F

- Page 187 and 188: City of St. Petersburg, Florida - F

- Page 189 and 190: Department Mission Statement City o

- Page 191 and 192: City of St. Petersburg, Florida - F

- Page 193 and 194: Department Mission Statement City o

- Page 195 and 196: Department Mission Statement City o

- Page 197 and 198: Section H GENERAL GOVERNMENT

- Page 199 and 200:

City of St. Petersburg, Florida - F

- Page 201 and 202:

City of St. Petersburg, Florida - F

- Page 203 and 204:

City of St. Petersburg, Florida - F

- Page 205 and 206:

Department Mission Statement City o

- Page 207 and 208:

Department Mission Statement City o

- Page 209 and 210:

Department Mission Statement City o

- Page 211 and 212:

Department Mission Statement City o

- Page 213 and 214:

City of St. Petersburg, Florida - F

- Page 215 and 216:

City of St. Petersburg, Florida - F

- Page 217 and 218:

City of St. Petersburg, Florida - F

- Page 219 and 220:

City of St. Petersburg, Florida - F

- Page 221 and 222:

City of St. Petersburg, Florida - F

- Page 223 and 224:

City of St. Petersburg, Florida - F

- Page 225 and 226:

City of St. Petersburg, Florida - F

- Page 227 and 228:

City of St. Petersburg, Florida - F

- Page 229 and 230:

City of St. Petersburg, Florida - F

- Page 231 and 232:

City of St. Petersburg, Florida - F

- Page 233 and 234:

City of St. Petersburg, Florida - F

- Page 235 and 236:

City of St. Petersburg, Florida - F

- Page 237 and 238:

City of St. Petersburg, Florida - F

- Page 239 and 240:

City of St. Petersburg, Florida - F

- Page 241 and 242:

City of St. Petersburg, Florida - F

- Page 243 and 244:

City of St. Petersburg, Florida - F

- Page 245 and 246:

City of St. Petersburg, Florida - F

- Page 247 and 248:

City of St. Petersburg, Florida - F

- Page 249 and 250:

City of St. Petersburg, Florida - F

- Page 251 and 252:

City of St. Petersburg, Florida - F

- Page 253 and 254:

Section J PUBLIC SAFETY

- Page 255 and 256:

City of St. Petersburg, Florida - F

- Page 257 and 258:

City of St. Petersburg, Florida - F

- Page 259 and 260:

City of St. Petersburg, Florida - F

- Page 261 and 262:

City of St. Petersburg, Florida - F

- Page 263 and 264:

City of St. Petersburg, Florida - F

- Page 265 and 266:

Section K PUBLIC WORKS

- Page 267 and 268:

City of St. Petersburg, Florida - F

- Page 269 and 270:

City of St. Petersburg, Florida - F

- Page 271 and 272:

City of St. Petersburg, Florida - F

- Page 273 and 274:

Department Mission Statement City o

- Page 275 and 276:

Department Mission Statement City o

- Page 277 and 278:

City of St. Petersburg, Florida - F

- Page 279 and 280:

Department Mission Statement City o

- Page 281 and 282:

Objective and Performance Measure C

- Page 283 and 284:

City of St. Petersburg, Florida - F

- Page 285 and 286:

City of St. Petersburg, Florida - F

- Page 287 and 288:

City of St. Petersburg, Florida - F

- Page 289 and 290:

Section L Capital Improvement Progr

- Page 291 and 292:

City of St. Petersburg, Florida - F

- Page 293 and 294:

Section M Capital Improvement Progr

- Page 295 and 296:

City of St. Petersburg, Florida - F

- Page 297 and 298:

City of St. Petersburg, Florida - F

- Page 299 and 300:

City of St. Petersburg, Florida - F

- Page 301 and 302:

City of St. Petersburg, Florida - F

- Page 303 and 304:

City of St. Petersburg, Florida - F

- Page 305 and 306:

City of St. Petersburg, Florida - F

- Page 307 and 308:

City of St. Petersburg, Florida - F

- Page 309 and 310:

City of St. Petersburg, Florida - F

- Page 311 and 312:

City of St. Petersburg, Florida - F

- Page 313 and 314:

City of St. Petersburg, Florida - F

- Page 315 and 316:

City of St. Petersburg, Florida - F

- Page 317 and 318:

City of St. Petersburg, Florida - F

- Page 319 and 320:

City of St. Petersburg, Florida - F

- Page 321 and 322:

Project Descriptions City of St. Pe

- Page 323 and 324:

City of St. Petersburg, Florida - F

- Page 325 and 326:

City of St. Petersburg, Florida - F

- Page 327 and 328:

City of St. Petersburg, Florida - F

- Page 329 and 330:

City of St. Petersburg, Florida - F

- Page 331 and 332:

City of St. Petersburg, Florida - F

- Page 333 and 334:

City of St. Petersburg, Florida - F

- Page 335 and 336:

City of St. Petersburg, Florida - F

- Page 337 and 338:

City of St. Petersburg, Florida - F

- Page 339 and 340:

City of St. Petersburg, Florida - F

- Page 341 and 342:

City of St. Petersburg, Florida - F

- Page 343 and 344:

City of St. Petersburg, Florida - F

- Page 345 and 346:

City of St. Petersburg, Florida - F

- Page 347 and 348:

City of St. Petersburg, Florida - F

- Page 349 and 350:

City of St. Petersburg, Florida - F

- Page 351 and 352:

City of St. Petersburg, Florida - F

- Page 353 and 354:

Section Q Capital Improvement Progr

- Page 355 and 356:

City of St. Petersburg, Florida - F

- Page 357 and 358:

City of St. Petersburg, Florida - F

- Page 359 and 360:

City of St. Petersburg, Florida - F

- Page 361:

APPENDICES

- Page 371 and 372:

City of St. Petersburg, Florida - F

- Page 373 and 374:

City of St. Petersburg, Florida - F

- Page 375 and 376:

City of St. Petersburg, Florida - F

- Page 377 and 378:

City of St. Petersburg, Florida- FY

- Page 379:

Look At What We Can Accomplish! ST.