Chapter 1 - San Diego Housing Commission

Chapter 1 - San Diego Housing Commission

Chapter 1 - San Diego Housing Commission

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

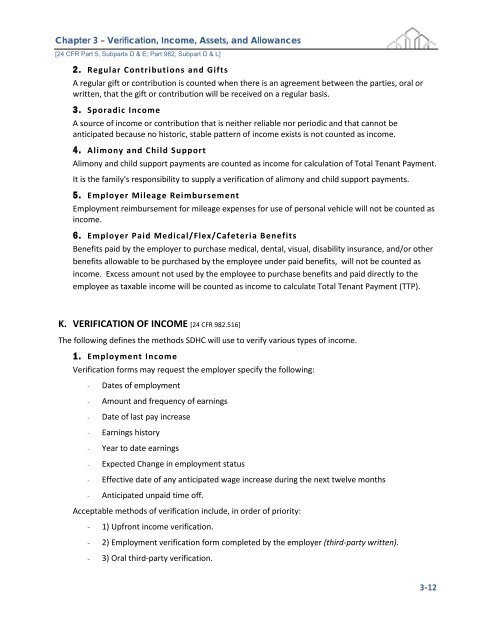

<strong>Chapter</strong> 3 – Verification, Income, Assets, and Allowances<br />

[24 CFR Part 5, Subparts D & E; Part 982, Subpart D & L]<br />

2. Regular Contributions and Gifts<br />

A regular gift or contribution is counted when there is an agreement between the parties, oral or<br />

written, that the gift or contribution will be received on a regular basis.<br />

3. Sporadic Income<br />

A source of income or contribution that is neither reliable nor periodic and that cannot be<br />

anticipated because no historic, stable pattern of income exists is not counted as income.<br />

4. Alimony and Child Support<br />

Alimony and child support payments are counted as income for calculation of Total Tenant Payment.<br />

It is the family's responsibility to supply a verification of alimony and child support payments.<br />

5. Employer Mileage Reimbursement<br />

Employment reimbursement for mileage expenses for use of personal vehicle will not be counted as<br />

income.<br />

6. Employer Paid Medical/Flex/Cafeteria Benefits<br />

Benefits paid by the employer to purchase medical, dental, visual, disability insurance, and/or other<br />

benefits allowable to be purchased by the employee under paid benefits, will not be counted as<br />

income. Excess amount not used by the employee to purchase benefits and paid directly to the<br />

employee as taxable income will be counted as income to calculate Total Tenant Payment (TTP).<br />

K. VERIFICATION OF INCOME [24 CFR 982.516]<br />

The following defines the methods SDHC will use to verify various types of income.<br />

1. Employment Income<br />

Verification forms may request the employer specify the following:<br />

- Dates of employment<br />

- Amount and frequency of earnings<br />

- Date of last pay increase<br />

- Earnings history<br />

- Year to date earnings<br />

- Expected Change in employment status<br />

- Effective date of any anticipated wage increase during the next twelve months<br />

- Anticipated unpaid time off.<br />

Acceptable methods of verification include, in order of priority:<br />

- 1) Upfront income verification.<br />

- 2) Employment verification form completed by the employer (third-party written).<br />

- 3) Oral third-party verification.<br />

3-12