IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Executive Summary<br />

Net Income<br />

R$ million<br />

Managerial Financial Margin<br />

R$ million<br />

1Q13<br />

597<br />

10,929<br />

11,526<br />

3,603<br />

3,317<br />

3,940 3,746<br />

3,807<br />

3,681<br />

3,544<br />

3,426<br />

3,585<br />

3,304<br />

3,412 3,502 3,512<br />

3,372<br />

3,492 3,472<br />

4Q12<br />

3Q12<br />

875<br />

849<br />

11,732<br />

11,963<br />

12,608<br />

12,811<br />

2Q12<br />

1,128<br />

12,393<br />

13,521<br />

2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13<br />

31.1<br />

20.4<br />

42.7<br />

23.5<br />

Recurring Net Income<br />

Recurring Net Income for the first quarter of 2013 reached<br />

R$3,512 million, representing a slight increase in relation to the<br />

previous quarter. We highlight the 14.0% improvement in our<br />

Expenses for Allowance for Loan and Lease Losses when<br />

compared to the previous quarter. The 12.1% decrease in Loan<br />

and Retained Claim Losses, net of recoveries, and the 2.5%<br />

decrease in our Non-Interest Expenses offset the reduction in our<br />

managerial financial margin with clients and with the market. Our<br />

Income from Insurance and Banking Service Fees remained<br />

practically flat compared to the fourth quarter of 2012, despite of<br />

the typical seasonality for the last quarter of the year.<br />

Annualized Return on Average Equity<br />

49.9<br />

21.8<br />

42.9<br />

20.0<br />

2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13<br />

ROE Annualized Return on Average Equity<br />

38.1<br />

19.4<br />

34.4<br />

18.5<br />

Net Income<br />

39.3<br />

19.3<br />

36.6<br />

19.1<br />

ROE from Insurance, Pension Plan and Capitalization<br />

The annualized recurring return on equity reached 19.1% in the<br />

first quarter of 2013, and also for the last 12 months. On March 31,<br />

2013, stockholders’ equity totaled R$74.4 billion, an increase of<br />

2.7% when compared to the same period of the previous year.<br />

The recurring return of our insurance, pension plan and<br />

capitalization operations reached 36.6% in the first quarter of<br />

2013, considering the recurring net income in relation to the<br />

economic allocated capital of this operation.<br />

%<br />

1Q12<br />

4Q11<br />

3Q11<br />

2Q11<br />

958<br />

1,039<br />

1,142<br />

700<br />

Financial Margin with Clients<br />

Financial Margin with Market<br />

12,259<br />

11,795<br />

11,697<br />

11,288<br />

11,987<br />

13,217<br />

12,834<br />

12,839<br />

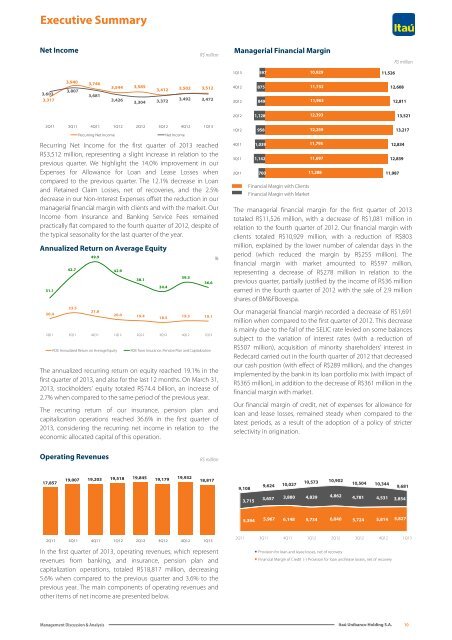

The managerial financial margin for the first quarter of 2013<br />

totaled R$11,526 million, with a decrease of R$1,081 million in<br />

relation to the fourth quarter of 2012. Our financial margin with<br />

clients totaled R$10,929 million, with a reduction of R$803<br />

million, explained by the lower number of calendar days in the<br />

period (which reduced the margin by R$255 million). The<br />

financial margin with market amounted to R$597 million,<br />

representing a decrease of R$278 million in relation to the<br />

previous quarter, partially justified by the income of R$36 million<br />

earned in the fourth quarter of 2012 with the sale of 2.9 million<br />

shares of BM&FBovespa.<br />

Our managerial financial margin recorded a decrease of R$1,691<br />

million when compared to the first quarter of 2012. This decrease<br />

is mainly due to the fall of the SELIC rate levied on some balances<br />

subject to the variation of interest rates (with a reduction of<br />

R$507 million), acquisition of minority shareholders’ interest in<br />

Redecard carried out in the fourth quarter of 2012 that decreased<br />

our cash position (with effect of R$289 million), and the changes<br />

implemented by the bank in its loan portfolio mix (with impact of<br />

R$365 million), in addition to the decrease of R$361 million in the<br />

financial margin with market.<br />

Our financial margin of credit, net of expenses for allowance for<br />

loan and lease losses, remained steady when compared to the<br />

latest periods, as a result of the adoption of a policy of stricter<br />

selectivity in origination.<br />

Operating Revenues<br />

R$ million<br />

17,857<br />

19,007 19,203 19,518 19,845 19,179<br />

19,932<br />

18,817<br />

9,108<br />

3,715<br />

9,624<br />

3,657<br />

10,027<br />

3,880<br />

10,573<br />

10,902<br />

4,839 4,862<br />

10,504 10,344<br />

9,681<br />

4,781 4,531 3,854<br />

5,394 5,967 6,148 5,734 6,040 5,724 5,814 5,827<br />

2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13<br />

In the first quarter of 2013, operating revenues, which represent<br />

revenues from banking, and insurance, pension plan and<br />

capitalization operations, totaled R$18,817 million, decreasing<br />

5.6% when compared to the previous quarter and 3.6% to the<br />

previous year. The main components of operating revenues and<br />

other items of net income are presented below.<br />

2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13<br />

Provision for loan and lease losses, net of recovery<br />

Financial Margin of Credit (-) Provision for loan and lease losses, net of recovery<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

10