IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

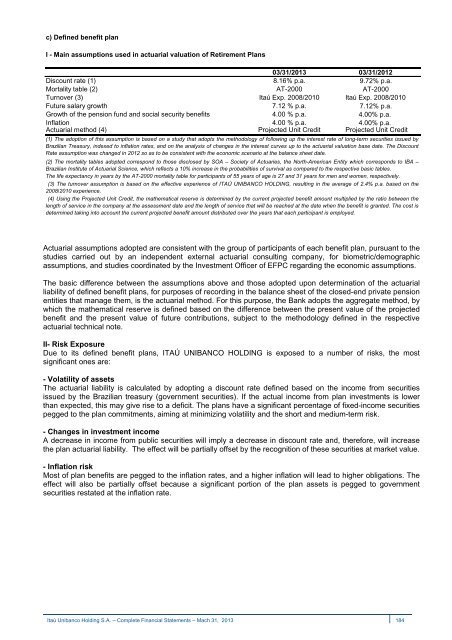

c) Defined benefit plan<br />

I - Main assumptions used in actuarial valuation of Retirement Plans<br />

03/31/2013 03/31/2012<br />

Discount rate (1) 8.16% p.a. 9.72% p.a.<br />

Mortality table (2) AT-2000 AT-2000<br />

Turnover (3) <strong>Itaú</strong> Exp. 2008/2010 <strong>Itaú</strong> Exp. 2008/2010<br />

Future salary growth 7.12 % p.a. 7.12% p.a.<br />

Growth of the pension fund and social security benefits 4.00 % p.a. 4.00% p.a.<br />

Inflation 4.00 % p.a. 4.00% p.a.<br />

Actuarial method (4) Projected Unit Credit Projected Unit Credit<br />

(1) The adoption of this assumption is based on a study that adopts the methodology of following up the interest rate of long-term securities issued by<br />

Brazilian Treasury, indexed to inflation rates, and on the analysis of changes in the interest curves up to the actuarial valuation base date. The Discount<br />

Rate assumption was changed in 2012 so as to be consistent with the economic scenario at the balance sheet date.<br />

(2) The mortality tables adopted correspond to those disclosed by SOA – Society of Actuaries, the North-American Entity which corresponds to IBA –<br />

Brazilian Institute of Actuarial Science, which reflects a 10% increase in the probabilities of survival as compared to the respective basic tables.<br />

The life expectancy in years by the AT-2000 mortality table for participants of 55 years of age is 27 and 31 years for men and women, respectively.<br />

(3) The turnover assumption is based on the effective experience of ITAÚ UNIBANCO HOLDING, resulting in the average of 2.4% p.a. based on the<br />

2008/2010 experience.<br />

(4) Using the Projected Unit Credit, the mathematical reserve is determined by the current projected benefit amount multiplied by the ratio between the<br />

length of service in the company at the assessment date and the length of service that will be reached at the date when the benefit is granted. The cost is<br />

determined taking into account the current projected benefit amount distributed over the years that each participant is employed.<br />

Actuarial assumptions adopted are consistent with the group of participants of each benefit plan, pursuant to the<br />

studies carried out by an independent external actuarial consulting company, for biometric/demographic<br />

assumptions, and studies coordinated by the Investment Officer of EFPC regarding the economic assumptions.<br />

The basic difference between the assumptions above and those adopted upon determination of the actuarial<br />

liability of defined benefit plans, for purposes of recording in the balance sheet of the closed-end private pension<br />

entities that manage them, is the actuarial method. For this purpose, the Bank adopts the aggregate method, by<br />

which the mathematical reserve is defined based on the difference between the present value of the projected<br />

benefit and the present value of future contributions, subject to the methodology defined in the respective<br />

actuarial technical note.<br />

II- Risk Exposure<br />

Due to its defined benefit plans, ITAÚ UNIBANCO HOLDING is exposed to a number of risks, the most<br />

significant ones are:<br />

- Volatility of assets<br />

The actuarial liability is calculated by adopting a discount rate defined based on the income from securities<br />

issued by the Brazilian treasury (government securities). If the actual income from plan investments is lower<br />

than expected, this may give rise to a deficit. The plans have a significant percentage of fixed-income securities<br />

pegged to the plan commitments, aiming at minimizing volatility and the short and medium-term risk.<br />

- Changes in investment income<br />

A decrease in income from public securities will imply a decrease in discount rate and, therefore, will increase<br />

the plan actuarial liability. The effect will be partially offset by the recognition of these securities at market value.<br />

- Inflation risk<br />

Most of plan benefits are pegged to the inflation rates, and a higher inflation will lead to higher obligations. The<br />

effect will also be partially offset because a significant portion of the plan assets is pegged to government<br />

securities restated at the inflation rate.<br />

<strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 184