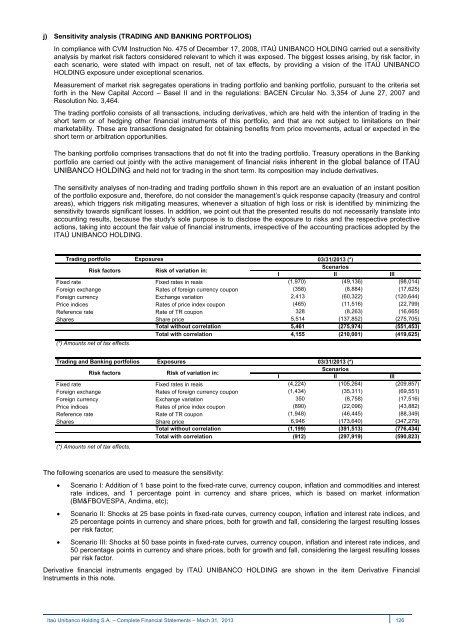

j) Sensitivity analysis (TRADING AND BANKING PORTFOLIOS) In compliance with CVM Instruction No. 475 of December 17, 2008, ITAÚ UNIBANCO HOLDING carried out a sensitivity analysis by market risk factors considered relevant to which it was exposed. The biggest losses arising, by risk factor, in each scenario, were stated with impact on result, net of tax effects, by providing a vision of the ITAÚ UNIBANCO HOLDING exposure under exceptional scenarios. Measurement of market risk segregates operations in trading portfolio and banking portfolio, pursuant to the criteria set forth in the New Capital Accord – Basel II and in the regulations: BACEN Circular No. 3,354 of June 27, 2007 and Resolution No. 3,464. The trading portfolio consists of all transactions, including derivatives, which are held with the intention of trading in the short term or of hedging other financial instruments of this portfolio, and that are not subject to limitations on their marketability. These are transactions designated for obtaining benefits from price movements, actual or expected in the short term or arbitration opportunities. The banking portfolio comprises transactions that do not fit into the trading portfolio. Treasury operations in the Banking portfolio are carried out jointly with the active management of financial risks inherent in the global balance of ITAÚ UNIBANCO HOLDING and held not for trading in the short term. Its composition may include derivatives. The sensitivity analyses of non-trading and trading portfolio shown in this report are an evaluation of an instant position of the portfolio exposure and, therefore, do not consider the management’s quick response capacity (treasury and control areas), which triggers risk mitigating measures, whenever a situation of high loss or risk is identified by minimizing the sensitivity towards significant losses. In addition, we point out that the presented results do not necessarily translate into accounting results, because the study's sole purpose is to disclose the exposure to risks and the respective protective actions, taking into account the fair value of financial instruments, irrespective of the accounting practices adopted by the ITAÚ UNIBANCO HOLDING. Trading portfolio Exposures 03/31/2013 (*) Risk factors Risk of variation in: Scenarios I II III Fixed rate Fixed rates in reais (1,970) (49,136) (98,014) Foreign exchange Rates of foreign currency coupon (358) (8,884) (17,625) Foreign currency Exchange variation 2,413 (60,322) (120,644) Price indices Rates of price index coupon (465) (11,516) (22,799) Reference rate Rate of TR coupon 328 (8,263) (16,665) Shares Share price 5,514 (137,852) (275,705) Total without correlation 5,461 (275,974) (551,453) Total with correlation 4,155 (210,001) (419,625) (*) Amounts net of tax effects. Trading and Banking portfolios Risk factors Exposures Risk of variation in: 03/31/2013 (*) Scenarios I II III Fixed rate Fixed rates in reais (4,224) (105,264) (209,857) Foreign exchange Rates of foreign currency coupon (1,434) (35,311) (69,551) Foreign currency Exchange variation 350 (8,758) (17,516) Price indices Rates of price index coupon (890) (22,096) (43,882) Reference rate Rate of TR coupon (1,948) (46,445) (88,349) Shares Share price 6,946 (173,640) (347,279) Total without correlation (1,199) (391,513) (776,434) Total with correlation (912) (297,919) (590,823) (*) Amounts net of tax effects. The following scenarios are used to measure the sensitivity: Scenario I: Addition of 1 base point to the fixed-rate curve, currency coupon, inflation and commodities and interest rate indices, and 1 percentage point in currency and share prices, which is based on market information (BM&FBOVESPA, Andima, etc); Scenario II: Shocks at 25 base points in fixed-rate curves, currency coupon, inflation and interest rate indices, and 25 percentage points in currency and share prices, both for growth and fall, considering the largest resulting losses per risk factor; Scenario III: Shocks at 50 base points in fixed-rate curves, currency coupon, inflation and interest rate indices, and 50 percentage points in currency and share prices, both for growth and fall, considering the largest resulting losses per risk factor. Derivative financial instruments engaged by ITAÚ UNIBANCO HOLDING are shown in the item Derivative Financial Instruments in this note. <strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 126

NOTE 8 - LOAN, LEASE AND OTHER CREDIT OPERATIONS a) Composition of the portfolio with credit granting characteristics I – By type of operations and risk level Risk levels 03/31/2013 AA A B C D E F G H Total Total 03/31/2012 Loan operations 124,885,502 95,818,337 32,525,426 22,560,829 9,029,395 3,118,005 2,830,876 2,638,877 10,634,340 304,041,587 280,044,935 Loans and discounted trade receivables 47,612,645 48,968,901 22,118,867 17,011,354 7,492,513 2,208,602 2,228,830 2,197,083 8,648,688 158,487,483 150,387,729 Financing 48,103,328 38,629,871 8,549,013 4,902,618 1,393,833 792,539 566,211 412,398 1,924,609 105,274,420 98,906,221 Farming and agribusiness financing 5,414,400 885,426 604,620 241,677 33,416 57,568 1,949 2,015 22,117 7,263,188 5,447,694 Real estate financing 23,755,129 7,334,139 1,252,926 405,180 109,633 59,296 33,886 27,381 38,926 33,016,496 25,303,291 Lease operations 3,870,506 5,775,241 2,374,830 1,013,058 631,824 287,364 211,475 167,769 655,557 14,987,624 24,128,476 Credit card operations - 35,400,747 2,002,610 1,293,440 741,410 399,457 342,915 321,417 2,823,051 43,325,047 37,801,820 Advance on exchange contracts (1) 3,197,465 866,087 240,996 566,417 20,838 6,925 3,147 20,855 5,689 4,928,419 4,604,701 Other sundry receivables (2) Total operations with credit granting characteristics Endorsements and sureties (3) Total with endorsements and sureties 13,015 3,931,438 7,031 17,940 9,439 3,488 1,130 5,366 76,492 4,065,339 788,866 131,966,488 141,791,850 37,150,893 25,451,684 10,432,906 3,815,239 3,389,543 3,154,284 14,195,129 371,348,016 347,368,798 62,890,752 53,150,011 131,966,488 141,791,850 37,150,893 25,451,684 10,432,906 3,815,239 3,389,543 3,154,284 14,195,129 434,238,768 400,518,809 TOTAL – 03/31/2012 112,194,384 140,077,527 35,198,660 21,633,247 15,473,785 3,713,168 3,404,165 2,818,657 12,855,205 347,368,798 (1) Includes Advances on Exchange Contracts and Income Receivable from Advances Granted, reclassified from Liabilities – Foreign Exchange Portfolio/Other Receivables (Note 2a); (2) Includes Securities and Credits Receivable, Debtors for Purchase of Assets and Endorsements and Sureties paid; (3) Recorded in Memorandum Accounts. <strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 127

- Page 1 and 2:

financial report March 31, 2013 Ita

- Page 3 and 4:

management discussion analysis Ita

- Page 5 and 6:

Executive Summary Information and f

- Page 7 and 8:

Executive Summary Effects of the Re

- Page 9 and 10:

Executive Summary We present below

- Page 11 and 12:

Executive Summary Banking Services

- Page 13 and 14:

Executive Summary Credit Portfolio

- Page 15 and 16:

analysis of net income Itaú Uniban

- Page 17 and 18:

Analysis of Net Income Managerial F

- Page 19 and 20:

Analysis of Net Income Banking Serv

- Page 21 and 22:

Analysis of Net Income Result from

- Page 23 and 24:

Analysis of Net Income Non-interest

- Page 25 and 26:

Analysis of Net Income Points of Se

- Page 27 and 28:

alance sheet, balance sheet by curr

- Page 29 and 30:

Balance Sheet Short-term Interbank

- Page 31 and 32:

Balance Sheet Funding Mar 31, 13 De

- Page 33 and 34:

Balance Sheet by Currency We adopt

- Page 35 and 36:

Capital Ratios (BIS) Solvency Ratio

- Page 37 and 38:

Ownership Structure The management

- Page 39 and 40:

Annual and Extraordinary Stockholde

- Page 41 and 42:

analysis of segments, products and

- Page 43 and 44:

Analysis of Segments Pro Forma Adju

- Page 45 and 46:

Analysis of Segments The pro forma

- Page 47 and 48:

Analysis of Segments Wholesale Bank

- Page 49 and 50:

Products and Services Cards Through

- Page 51 and 52:

anking operations & insurance opera

- Page 53 and 54:

Banking Operations & Insurance Oper

- Page 55 and 56:

Insurance, Life and Pension Plan &

- Page 57 and 58:

Insurance The figures presented in

- Page 59 and 60:

Life and Pension Plan Pro Forma Rec

- Page 61 and 62:

activities abroad Itaú Unibanco Ho

- Page 63 and 64:

Activities abroad Main Operations i

- Page 65 and 66:

Activities abroad Latin America - B

- Page 67 and 68:

Activities abroad Itaú BBA Interna

- Page 70 and 71:

(This page was left in blank intent

- Page 72 and 73:

Itaú Unibanco Holding S.A. - Compl

- Page 74 and 75:

Banco Itaú BMG Consignado S.A. - i

- Page 76 and 77: 3.2) Income R$ billion Statement of

- Page 78 and 79: Default At March 31, 2013, total de

- Page 80 and 81: Custody Services - In the custody m

- Page 82 and 83: In the January-March 2013 period, t

- Page 84 and 85: ITAÚ UNIBANCO S.A. Chief Executive

- Page 86 and 87: ITAÚ UNIBANCO HOLDING S.A. Consoli

- Page 88 and 89: ITAÚ UNIBANCO HOLDING S.A. Consoli

- Page 90 and 91: ITAÚ UNIBANCO HOLDING S.A. Consoli

- Page 92 and 93: ITAÚ UNIBANCO HOLDING S.A. Stateme

- Page 94 and 95: Itaú Unibanco Holding S.A. Stateme

- Page 96 and 97: ITAÚ UNIBANCO HOLDING S.A. NOTES T

- Page 98 and 99: In ITAÚ UNIBANCO HOLDING CONSOLIDA

- Page 100 and 101: NOTE 3 - REQUIREMENTS OF CAPITAL AN

- Page 102 and 103: During this period, the effects of

- Page 104 and 105: Cash Flow Hedge - the effective amo

- Page 106 and 107: Mathematical provisions for benefit

- Page 108 and 109: NOTE 5 - CASH AND CASH EQUIVALENTS

- Page 110 and 111: NOTE 7 - SECURITIES AND DERIVATIVE

- Page 112 and 113: c) Trading securities See below the

- Page 114 and 115: e) Held-to-maturity securities See

- Page 116 and 117: I - Derivatives by index Memorandum

- Page 118 and 119: II - Derivatives by counterparty Se

- Page 120 and 121: III - Derivatives by notional amoun

- Page 122 and 123: V - Accounting hedge a) The effecti

- Page 124 and 125: VI - Realized and unrealized gain o

- Page 128 and 129: II - By maturity and risk level 03/

- Page 130 and 131: ) Credit concentration Loan, lease

- Page 132 and 133: e) Restricted operations on assets

- Page 134 and 135: NOTE 9 - FOREIGN EXCHANGE PORTFOLIO

- Page 136 and 137: c) Deposits received under securiti

- Page 138 and 139: e) Borrowings and onlending BORROWI

- Page 140 and 141: Description Name of security / Curr

- Page 142 and 143: ) Assets Guaranteeing Technical Pro

- Page 144 and 145: NOTE 12 - CONTINGENT ASSETS AND LIA

- Page 146 and 147: - Tax and social security lawsuits

- Page 148 and 149: The main discussions related to Leg

- Page 150 and 151: c) Receivables - Reimbursement of c

- Page 152 and 153: ) Prepaid expenses Commissions 03/3

- Page 154 and 155: d) Banking service fees 01/01 to 03

- Page 156 and 157: f) Personnel expenses Compensation

- Page 158 and 159: NOTE 14 - TAXES a) Composition of e

- Page 160 and 161: ) Deferred taxes I - The deferred t

- Page 162 and 163: III - The estimate of realization a

- Page 164 and 165: d) Taxes paid or provided for and w

- Page 166 and 167: II - Composition of investments 03/

- Page 168 and 169: II) Goodwill CHANGES Amortization p

- Page 170 and 171: NOTE 16 - STOCKHOLDERS’ EQUITY a)

- Page 172 and 173: c) Capital and revenue reserves 03/

- Page 174 and 175: f) Stock Option Plan I - Purpose an

- Page 176 and 177:

Summary of Changes in the Share-Bas

- Page 178 and 179:

NOTE 17 - RELATED PARTIES a) Transa

- Page 180 and 181:

) Compensation of Management Key Pe

- Page 182 and 183:

To obtain the market values for the

- Page 184 and 185:

c) Defined benefit plan I - Main as

- Page 186 and 187:

V- Change in the net amount recogni

- Page 188 and 189:

NOTE 20 - INFORMATION ON FOREIGN SU

- Page 190 and 191:

I - Market Risk Market risk is the

- Page 192 and 193:

II - Credit Risk Credit risk is the

- Page 194 and 195:

NOTE 22 -SUPPLEMENTARY INFORMATION

- Page 196 and 197:

Report on Review To the Directors a

- Page 198:

ITAÚ UNIBANCO HOLDING S.A. CNPJ. 6