IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

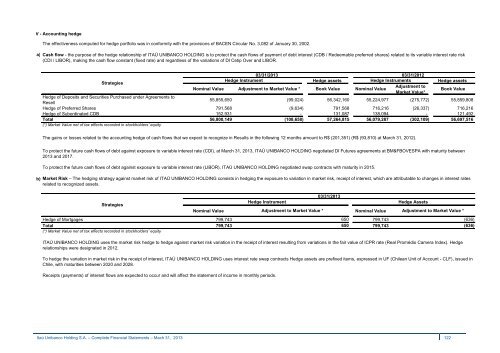

V - Accounting hedge<br />

a)<br />

The effectiveness computed for hedge portfolio was in conformity with the provisions of BACEN Circular No. 3,082 of January 30, 2002.<br />

Cash flow - the purpose of the hedge relationship of ITAÚ UNIBANCO HOLDING is to protect the cash flows of payment of debt interest (CDB / Redeemable preferred shares) related to its variable interest rate risk<br />

(CDI / LIBOR), making the cash flow constant (fixed rate) and regardless of the variations of DI Cetip Over and LIBOR.<br />

03/31/2013 03/31/2012<br />

Hedge Instrument<br />

Hedge assets<br />

Hedge Instruments<br />

Hedge assets<br />

Strategies<br />

Adjustment to<br />

Nominal Value Adjustment to Market Value * Book Value Nominal Value<br />

Book Value<br />

Market Value*<br />

Hedge of Deposits and Securities Purchased under Agreements to<br />

55,855,650 (99,024) 56,342,160 55,224,977 (275,772) 55,859,808<br />

Resell<br />

Hedge of Preferred Shares 791,568 (9,634) 791,568 716,216 (26,337) 716,216<br />

Hedge of Subordinated CDB 152,931 - 131,087 138,094 - 121,492<br />

Total 56,800,149 (108,658) 57,264,815 56,079,287 (302,109) 56,697,516<br />

(*) Market Value net of tax effects recorded in stockholders’ equity<br />

The gains or losses related to the accounting hedge of cash flows that we expect to recognize in Results in the following 12 months amount to R$ (201,351) (R$ (93,810) at March 31, 2012).<br />

b)<br />

To protect the future cash flows of debt against exposure to variable interest rate (CDI), at March 31, 2013, ITAÚ UNIBANCO HOLDING negotiated DI Futures agreements at BM&FBOVESPA with maturity between<br />

2013 and 2017.<br />

To protect the future cash flows of debt against exposure to variable interest rate (LIBOR), ITAÚ UNIBANCO HOLDING negotiated swap contracts with maturity in 2015.<br />

Market Risk – The hedging strategy against market risk of ITAÚ UNIBANCO HOLDING consists in hedging the exposure to variation in market risk, receipt of interest, which are attributable to changes in interest rates<br />

related to recognized assets.<br />

03/31/2013<br />

Strategies<br />

Hedge Instrument<br />

Nominal Value<br />

Adjustment to Market Value *<br />

Nominal Value<br />

Hedge of Mortgages 799,743 650<br />

799,743<br />

Total 799,743 650<br />

799,743<br />

(*) Market Value net of tax effects recorded in stockholders’ equity<br />

Hedge Assets<br />

Adjustment to Market Value *<br />

(636)<br />

(636)<br />

ITAÚ UNIBANCO HOLDING uses the market risk hedge to hedge against market risk variation in the receipt of interest resulting from variations in the fair value of ICPR rate (Real Promédio Camera Index). Hedge<br />

relationships were designated in 2012.<br />

To hedge the variation in market risk in the receipt of interest, ITAÚ UNIBANCO HOLDING uses interest rate swap contracts Hedge assets are prefixed items, expressed in UF (Chilean Unit of Account - CLF), issued in<br />

Chile, with maturities between 2020 and 2028.<br />

Receipts (payments) of interest flows are expected to occur and will affect the statement of income in monthly periods.<br />

<strong>Itaú</strong> Unibanco Holding S.A. – Complete Financial Statements – Mach 31, 2013 122