IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

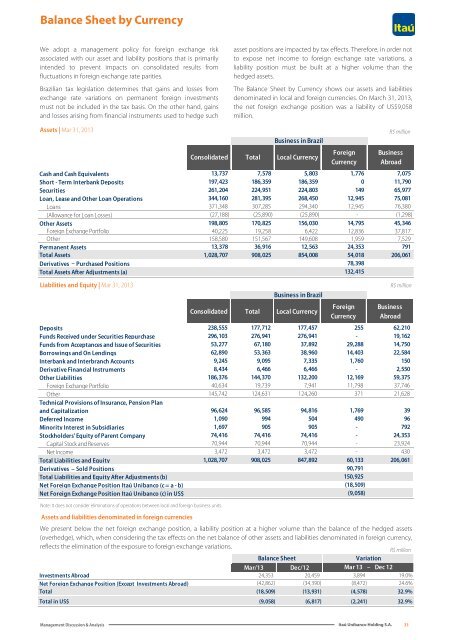

Balance Sheet by Currency<br />

We adopt a management policy for foreign exchange risk<br />

associated with our asset and liability positions that is primarily<br />

intended to prevent impacts on consolidated results from<br />

fluctuations in foreign exchange rate parities.<br />

Brazilian tax legislation determines that gains and losses from<br />

exchange rate variations on permanent foreign investments<br />

must not be included in the tax basis. On the other hand, gains<br />

and losses arising from financial instruments used to hedge such<br />

asset positions are impacted by tax effects. Therefore, in order not<br />

to expose net income to foreign exchange rate variations, a<br />

liability position must be built at a higher volume than the<br />

hedged assets.<br />

The Balance Sheet by Currency shows our assets and liabilities<br />

denominated in local and foreign currencies. On March 31, 2013,<br />

the net foreign exchange position was a liability of US$9,058<br />

million.<br />

Assets | Mar 31, 2013<br />

Liabilities and Equity | Mar 31, 2013<br />

Note: It does not consider eliminations of operations between local and foreign business units.<br />

Assets and liabilities denominated in foreign currencies<br />

Business in Brazil<br />

Consolidated Total Local Currency<br />

Foreign<br />

Currency<br />

R$ million<br />

Business<br />

Abroad<br />

Cash and Cash Equivalents 13,737 7,578 5,803 1,776 7,075<br />

Short - Term Interbank Deposits 197,423 186,359 186,359 0 11,790<br />

Securities 261,204 224,951 224,803 149 65,977<br />

Loan, Lease and Other Loan Operations 344,160 281,395 268,450 12,945 75,081<br />

Loans 371,348 307,285 294,340 12,945 76,380<br />

(Allowance for Loan Losses) (27,188) (25,890) (25,890) - (1,298)<br />

Other Assets 198,805 170,825 156,030 14,795 45,346<br />

Foreign Exchange Portfolio 40,225 19,258 6,422 12,836 37,817<br />

Other 158,580 151,567 149,608 1,959 7,529<br />

Permanent Assets 13,378 36,916 12,563 24,353 791<br />

Total Assets 1,028,707 908,025 854,008 54,018 206,061<br />

Derivatives – Purchased Positions 78,398<br />

Total Assets After Adjustments (a) 132,415<br />

Business in Brazil<br />

Consolidated Total Local Currency<br />

Foreign<br />

Currency<br />

R$ million<br />

Business<br />

Abroad<br />

Deposits 238,555 177,712 177,457 255 62,210<br />

Funds Received under Securities Repurchase 296,103 276,941 276,941 - 19,162<br />

Funds from Acceptances and Issue of Securities 53,277 67,180 37,892 29,288 14,750<br />

Borrowings and On Lendings 62,890 53,363 38,960 14,403 22,584<br />

Interbank and Interbranch Accounts 9,245 9,095 7,335 1,760 150<br />

Derivative Financial Instruments 8,434 6,466 6,466 - 2,550<br />

Other Liabilities 186,376 144,370 132,200 12,169 59,375<br />

Foreign Exchange Portfolio 40,634 19,739 7,941 11,798 37,746<br />

Other 145,742 124,631 124,260 371 21,628<br />

Technical Provisions of Insurance, Pension Plan<br />

and Capitalization 96,624 96,585 94,816 1,769 39<br />

Deferred Income 1,090 994 504 490 96<br />

Minority Interest in Subsidiaries 1,697 905 905 - 792<br />

Stockholders' Equity of Parent Company 74,416 74,416 74,416 - 24,353<br />

Capital Stock and Reserves 70,944 70,944 70,944 - 23,924<br />

Net Income 3,472 3,472 3,472 - 430<br />

Total Liabilities and Equity 1,028,707 908,025 847,892 60,133 206,061<br />

Derivatives – Sold Positions 90,791<br />

Total Liabilities and Equity After Adjustments (b) 150,925<br />

Net Foreign Exchange Position <strong>Itaú</strong> Unibanco (c = a - b) (18,509)<br />

Net Foreign Exchange Position <strong>Itaú</strong> Unibanco (c) in US$ (9,058)<br />

We present below the net foreign exchange position, a liability position at a higher volume than the balance of the hedged assets<br />

(overhedge), which, when considering the tax effects on the net balance of other assets and liabilities denominated in foreign currency,<br />

reflects the elimination of the exposure to foreign exchange variations.<br />

R$ million<br />

Balance Sheet<br />

Variation<br />

Mar/13<br />

Dec/12<br />

Mar 13 – Dec 12<br />

Investments Abroad 24,353 20,459 3,894 19.0%<br />

Net Foreign Exchange Position (Except Investments Abroad) (42,862) (34,390) (8,472) 24.6%<br />

Total (18,509) (13,931) (4,578) 32.9%<br />

Total in US$ (9,058) (6,817) (2,241) 32.9%<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

33