IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

IRR310313.pdf - Banco Itaú

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Analysis of Net Income<br />

Points of Service<br />

At the end of the first quarter of 2013, our network comprised<br />

4,957 branches and client service branches (CSB), including Brazil<br />

and abroad.<br />

Branches and Client Service Branches (CSB) | Brazil and Abroad<br />

4,907 4,920 4,961 4,949 4,970 4,977 4,983 4,957<br />

Tax Expenses for ISS, PIS, Cofins and Other<br />

Tax expenses amounted to R$1,041 million in the first quarter of<br />

2013, a decrease of 7.8% from the previous quarter.<br />

Income Tax and Social Contribution on Net Income<br />

In the first quarter of 2013, Income Tax and Social Contribution<br />

on Net Income (CSLL) expenses totaled R$1,295 million, a R$164<br />

million decrease from the previous period.<br />

3,970 3,983 4,049 4,056 4,075 4,081 4,083 4,075<br />

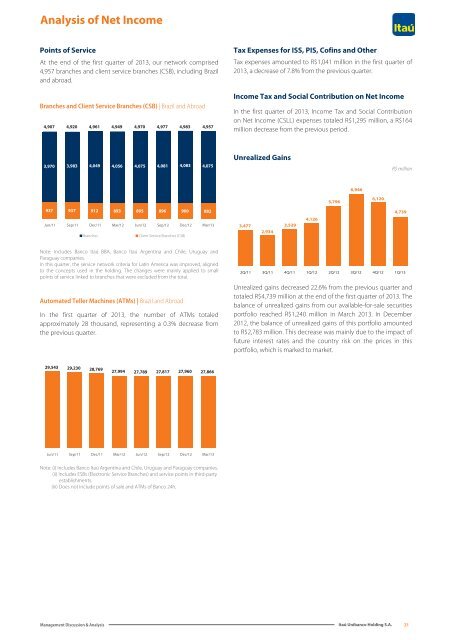

Unrealized Gains<br />

R$ million<br />

6,946<br />

5,796<br />

6,120<br />

937 937 912 893 895 896 900 882<br />

Jun/11 Sep/11 Dec/11 Mar/12 Jun/12 Sep/12 Dec/12 Mar/13<br />

Branches<br />

Client Service Branches (CSB)<br />

3,477<br />

2,934<br />

3,529<br />

4,126<br />

4,739<br />

Note: Includes <strong>Banco</strong> <strong>Itaú</strong> BBA, <strong>Banco</strong> <strong>Itaú</strong> Argentina and Chile, Uruguay and<br />

Paraguay companies.<br />

In this quarter, the service network criteria for Latin America was improved, aligned<br />

to the concepts used in the holding. The changes were mainly applied to small<br />

points of service linked to branches that were excluded from the total.<br />

Automated Teller Machines (ATMs) | Brazil and Abroad<br />

In the first quarter of 2013, the number of ATMs totaled<br />

approximately 28 thousand, representing a 0.3% decrease from<br />

the previous quarter.<br />

2Q/11 3Q/11 4Q/11 1Q/12 2Q/12 3Q/12 4Q/12 1Q/13<br />

Unrealized gains decreased 22.6% from the previous quarter and<br />

totaled R$4,739 million at the end of the first quarter of 2013. The<br />

balance of unrealized gains from our available-for-sale securities<br />

portfolio reached R$1,240 million in March 2013. In December<br />

2012, the balance of unrealized gains of this portfolio amounted<br />

to R$2,783 million. This decrease was mainly due to the impact of<br />

future interest rates and the country risk on the prices in this<br />

portfolio, which is marked to market.<br />

29,543<br />

29,230 28,769<br />

27,994 27,789 27,817 27,960 27,866<br />

Jun/11 Sep/11 Dec/11 Mar/12 Jun/12 Sep/12 Dec/12 Mar/13<br />

Note: (i) Includes <strong>Banco</strong> <strong>Itaú</strong> Argentina and Chile, Uruguay and Paraguay companies.<br />

(ii) Includes ESBs (Electronic Service Branches) and service points in third-party<br />

establishments.<br />

(iii) Does not include points of sale and ATMs of <strong>Banco</strong> 24h.<br />

Management Discussion & Analysis<br />

<strong>Itaú</strong> Unibanco Holding S.A.<br />

25